Yesterday, there was only one signal for market entry. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2718 as a possible entry point. The price fell, but a false breakout was not formed. In the afternoon, an unsuccessful consolidation above 1.2735 generated a sell signal, which sent the pair down by more than 40 pips.

For long positions on GBP/USD:

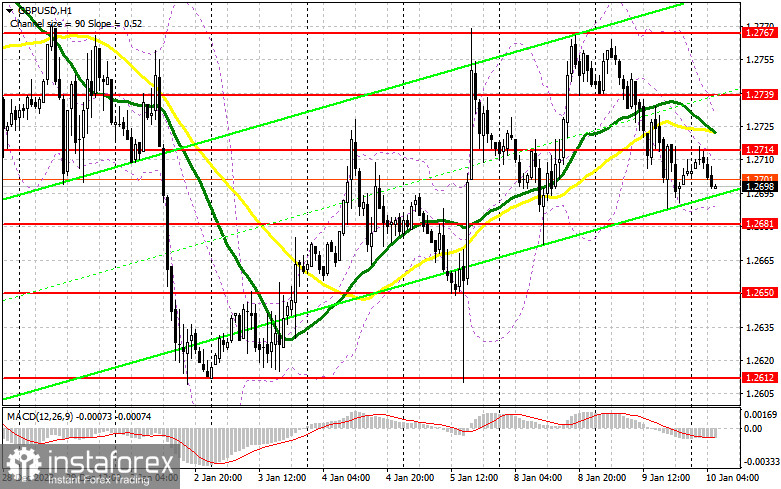

The bears continued to pressure the pound until they completely offset the previous day's gains, and this happened in the absence of economic reports. We expect today to be an equally interesting day, as Bank of England Governor Andrew Bailey speaks to the Treasury Select Committee. The pair's direction will depend on whether Bailey remains focused on fighting inflation. If GBP/USD fails, the bulls will have to be active around the support at 1.2681. A false breakout there will provide an excellent entry point for long positions in developing the bullish market, which is now under great threat. It will also help to bring GBP/USD back to the resistance area of 1.2714, established at the end of the Asian session. The moving averages are just above this level, so a breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2739. The farthest target will be the 1.2767 high, where I will take profits. If the pair falls and there is no buying activity at 1.2681 in the first half of the day, the bears may become more assertive. In this case, I will postpone buying until the test of 1.2650. Only a false breakout there will signal opening long positions. I plan to buy GBP/USD immediately on a rebound from last week's low of 1.2612, aiming for an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Despite the fact that the bears managed to do quite a lot yesterday, traders still have a chance to build a bullish market, and the pound looks much more attractive than before. If Bailey maintains a tough stance on rates and mentions its fight against stubborn inflation, demand for the pound may return. In this case, forming a false breakout near 1.2714 will make sure that there are big bears in the market, which can produce a sell signal and may push the price to the area of 1.2681. A breakout and an upward retest of this range will deal a more serious blow to the bulls' positions, leading to the removal of stop orders and opening the way to 1.2650. The furthest target will be the area of 1.2612 - last week's low, where I will take profits. If GBP/USD rises and there is no activity at 1.2714, traders will continue to develop a bullish market. In this case, I would delay short positions until a false breakout at 1.2739. If there is no downward movement there, I will sell GBP/USD immediately on a bounce right from 1.2767, considering a downward correction of 30-35 pips.

COT report:

The Commitment of Traders (COT) report for January 2 showed an increase in both long and short positions. It is clear that the pound is in demand for certain reasons. The Bank of England's recent decision to leave interest rates unchanged as it continues its fight to curb inflation, as well as statements by BoE Governor Andrew Bailey that rates will remain high for an extended period - all of this goes against the expected policy of the Federal Reserve, where the central bank plans to lower interest rates, citing good progress in addressing inflation. This divergence is exerting pressure on the dollar, and weakens the GBP/USD pair in the medium term. If the latest US inflation data pleases central bank officials, we can expect another rise in GBP/USD. The latest COT report indicates that non-commercial long positions rose by 3,044 to 61,794, while non-commercial short positions were up by 1,931 to 46,589. As a result, the spread between long and short positions decreased by 38.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower border near 1.2685 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română