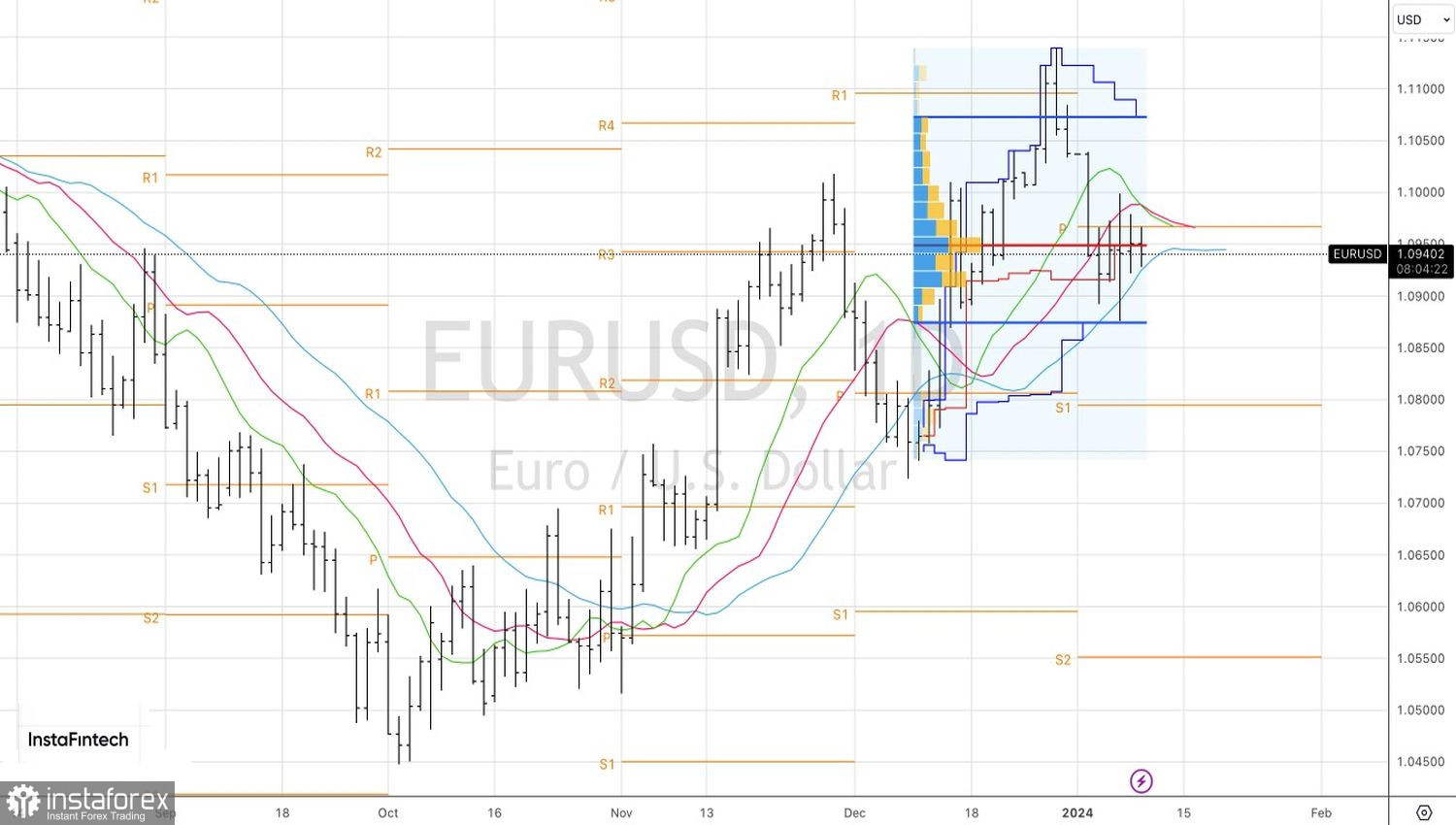

Calm before the storm. This is how the narrowing of trading ranges in the EUR/USD pair looks right now. Investors are awaiting data on American inflation and are not ready to force events by opening long or short positions on the major currency pair. Moreover, macroeconomic statistics for the Eurozone have a mixed character, making it unclear whether the region will recover or continue to sink into stagflation.

Unemployment in the currency bloc returned to a historically low level of 6.5% in November. At the same time, the number of unemployed decreased by almost 100,000. The Eurozone labor market shows no signs of cooling, which may allow the hawks of the Governing Council to stick to a policy of keeping the ECB deposit rate at 4%. In the tight labor market, the risks of wage hikes are increasing, which could ultimately result in a new peak in inflation.

Unemployment Dynamics in the Eurozone

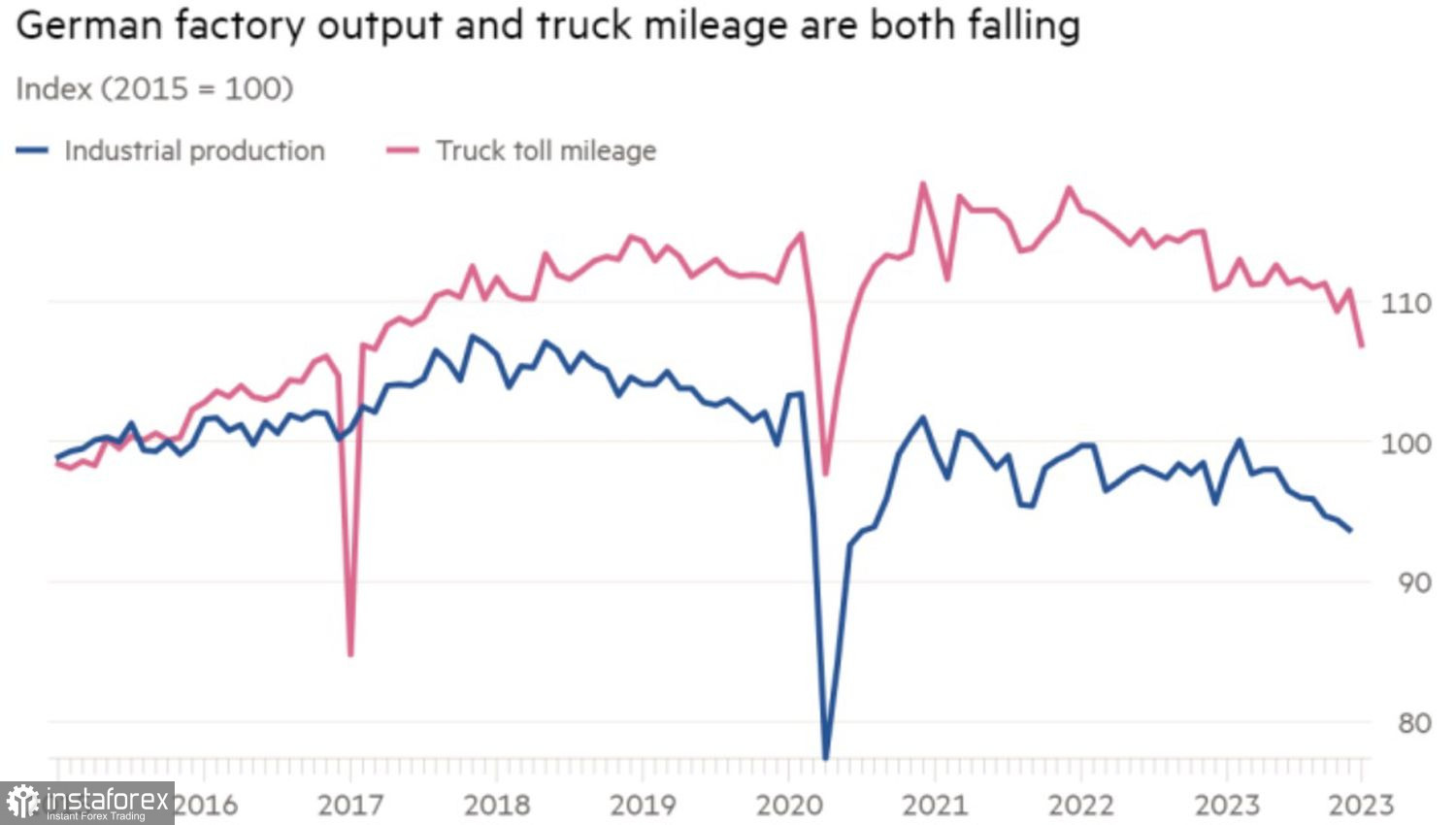

Together with the increase in the economic confidence index in the Eurozone and the 3.7% growth in German exports in November, this sets a bullish tone for EUR/USD. However, slower growth in industrial orders than forecasted by Bloomberg experts and a contraction in industrial production in Germany indicate that clouds have not yet cleared over the leading economy of the currency bloc. The country still looks like the sickest person in Europe, making euro buyers think seven times before taking action—deciding to open long positions.

It's also worth noting the reluctance of the U.S. economy to slow down. As a result, the prevailing idea of reducing the growth differential between the U.S. and Eurozone economies is starting to raise doubts, leading to a decline in EUR/USD quotes.

Germany's Industrial Orders and Production Dynamics

The euro is not benefiting from the rise in American stock indices thanks to positive news from tech giants. The stock market is starting to remember its greed from the end of 2023, but U.S. inflation data could instill fear. The expected acceleration of consumer prices from 3.1% to 3.2% and the slowdown in core inflation from 4% to 3.8% will signal that the Fed's battle against high prices is far from over. Especially in a strong economy, which, according to theory, is a favorable environment for inflationary pressure.

In my opinion, it is evident that the chances provided by derivatives for the start of the Fed's monetary policy easing process in March are overestimated. The central bank will delay it as long as possible, until it sees a serious cooling of the economy or a rapid return of PCE to the 2% target. Neither of these will be achieved quickly. And that's good news for the U.S. dollar.

Technically, on the daily chart of EUR/USD, the formation of an inside bar has been completed. Its appearance allows setting pending orders to buy the euro against the U.S. dollar from the level of 1.098 and to sell the major currency pair from 1.0925.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română