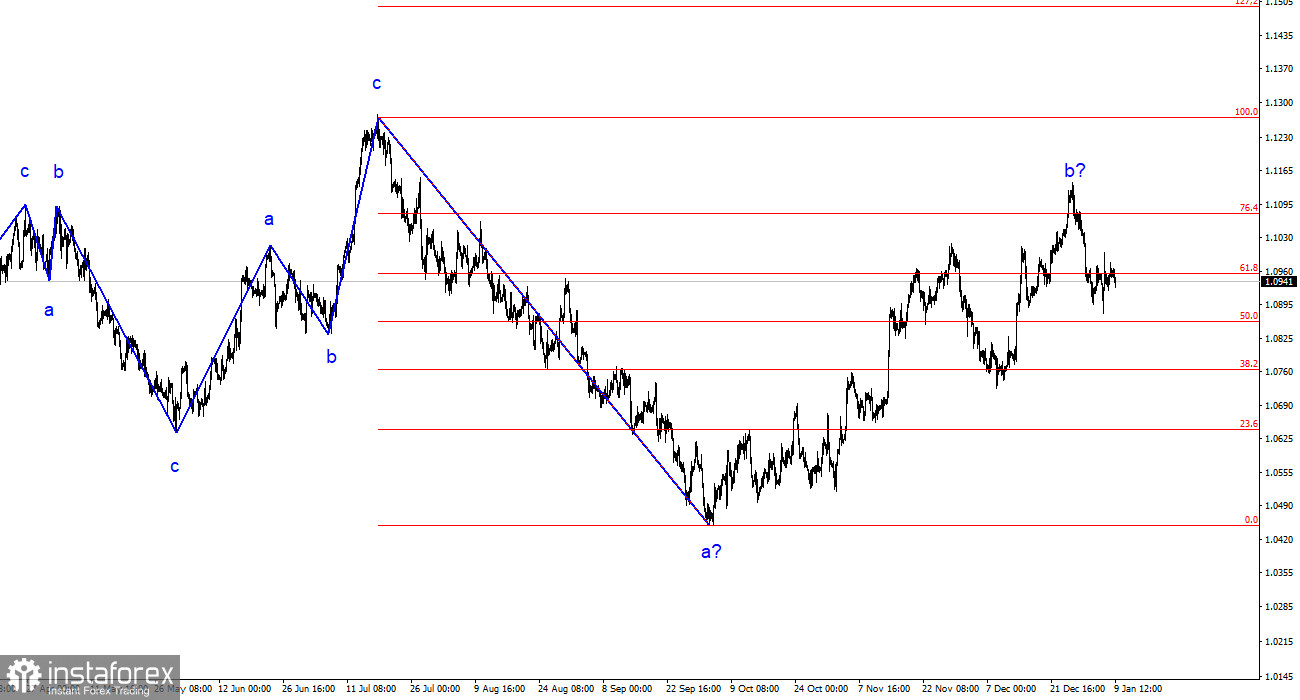

The wave analysis on the 4-hour chart for the euro/dollar pair has become more complex. Over the past year, we have seen only three wave structures that constantly alternate with each other. Another three-wave decline is underway, with the first wave presumed to be complete. However, wave 2 or b has become more complex three or four times, and there are no guarantees that it won't become more complex again.

Even though the news background cannot be considered "supportive of the European currency," the market keeps finding new reasons to increase demand for the pair. This situation is not normal. Even if the bullish trend resumes, its internal structure will become unreadable.

The internal wave structure of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is the case, wave c is currently being formed, and the entire wave 2 or b could end at any moment (or may have already ended). The current retracement from the achieved highs looks convincing, so we expect a transition to wave 3 or c construction.

Industrial production in Germany has contracted again.

The euro/dollar currency pair experienced a slight decline on Tuesday. The range of movements was again quite weak, but without any news background, it wasn't easy to expect anything else. I still cannot confidently state that the construction of wave 2 or b is complete. As often as it has taken on a more complex form when it should have ended, I would not be surprised if its internal wave structure becomes more complex again. The low of the last internal wave 2 or b has yet to be reached. This means that each subsequent low is higher than the previous one, and each subsequent peak is higher. This indicates that the uptrend is still intact.

Today, a new report on industrial production was released in Germany. Volumes declined by 0.7% in November every month, while the market expected an increase of 0.2-0.6%. This is not the first time the market has anticipated growth (based on what?), only to see the indicator decline. For the past six months, industrial production in Germany has declined. The German economy is not yet in a recession but continues to teeter on the edge.

Also today, a report on unemployment in the European Union was released, which showed a decrease of 6.4%. However, EU unemployment has never been of great interest to the markets. In general, more than these reports are needed to drive more active trading in the market. As of the time of writing, the daily trading range is less than 20 basis points.

General Conclusions:

Based on the analysis conducted, the formation of a bearish wave set is continuing. The targets around the 1.0463 mark have been ideally reached, and the unsuccessful attempt to break through this level indicates a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so I expect the formation of an impulsive downward wave 3 or c with a significant decline in the pair soon. The unsuccessful attempt to break the 1.1125 mark, corresponding to the 23.6% Fibonacci level, indicates the market's readiness for selling.

On the larger wave scale, it can be seen that the construction of the corrective wave 2 orb is still ongoing, which is already more than 61.8% of the Fibonacci retracement from the first wave. As I have already mentioned, this is not critical, and the scenario with the formation of wave 3 or c and a decline in the pair below the 1.4 figure is still valid.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română