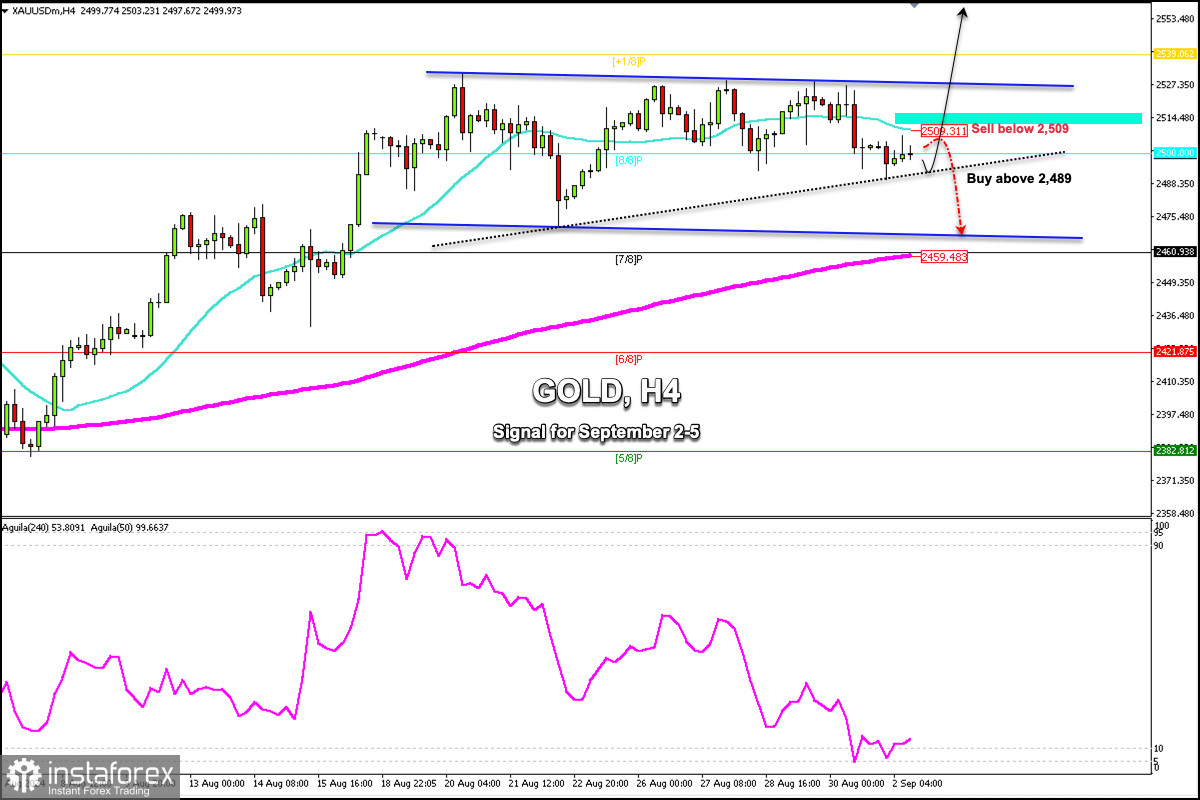

Early in the American session, gold is trading around the psychological level of $2,500 below the 21 SMA and within a bearish trend channel forming since August 17.

On the H4 chart, we can see that Gold has tried to break the strong resistance zone around 2,527 on several occasions and is now consolidating near these levels. Apparently, gold is accumulating momentum to continue rising in the coming days and could reach 2,539 and 2,573.

If the gold price consolidates above 2,500 in the next few days, the outlook could be positive and the price could challenge the resistance at 2,527 again. Finally, above this area, the bullish movement could accelerate and reach 2,573 as a final target.

On the contrary, with a drop below 2,500 or 2,490, we could expect a strong technical correction in the XAU so that the instrument could reach the bottom of the downtrend channel around 2,465. Finally, the metal could find good support around the 200 EMA at about 7/8 of Murray which could be seen as a buying opportunity in this area.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română