EUR/USD

Higher Timeframes

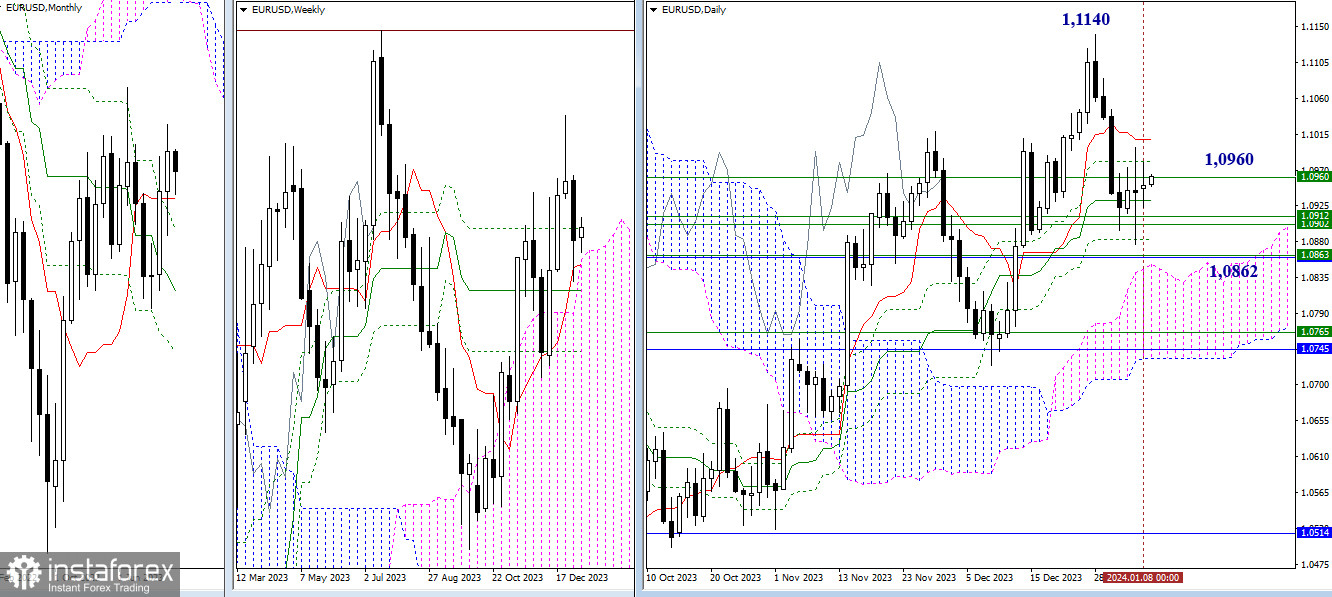

Monday did not bring significant changes. The range of daily movement was minor, and the pair preferred to consolidate rather than develop movement. The nearest attraction and influence on the current situation are still provided by the daily (1.1008 – 1.0981 – 1.0932 – 1.0883) and weekly (1.0960 – 1.0912 – 1.0902) support levels. In case of further decline, the monthly short-term trend and the weekly medium-term trend, having joined their efforts around 1.0862, will come into play. However, if bulls start to show activity, their first most important task in this section is to exit the zone of daily downward correction (1.1140).

H4 – H1

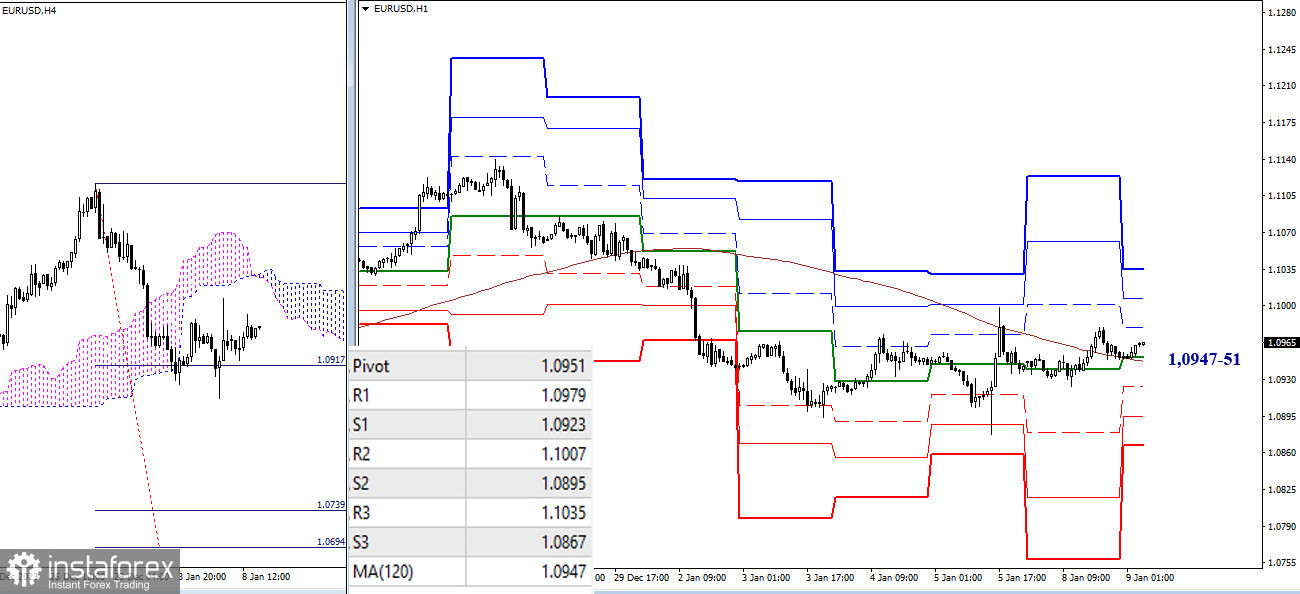

On the lower timeframes, sideways movement continues to develop, but, at the same time, the pair managed to push through key levels, settling above 1.0947-51 (weekly long-term trend + central pivot point). Other reference points for the development of movement within the day can be noted at supports (1.0923 – 1.0895 – 1.0867) and resistances (1.0979 – 1.1007 – 1.1035) of classic pivot points.

***

GBP/USD

Higher Timeframes

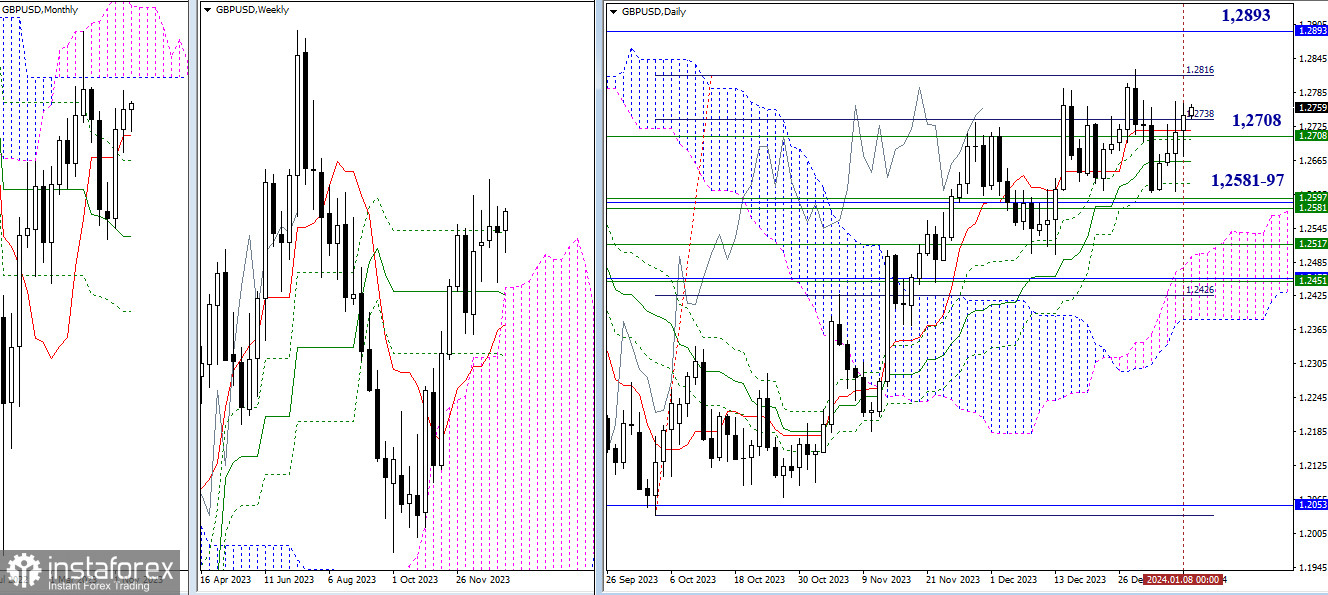

The pound does not abandon hopes of updating the December high (1.2826) and continuing the rise. The next bullish target, in this case, will be the lower boundary of the monthly cloud (1.2893). The main attraction, which currently restrains the development of the situation, is provided by the daily short-term trend (1.2717) and the final level of the weekly Ichimoku cross (1.2708). To change the situation, bears need to eliminate the daily Ichimoku cross (1.2624) and overcome the cluster of supports around 1.2581–97 (monthly short-term trend + weekly levels).

H4 – H1

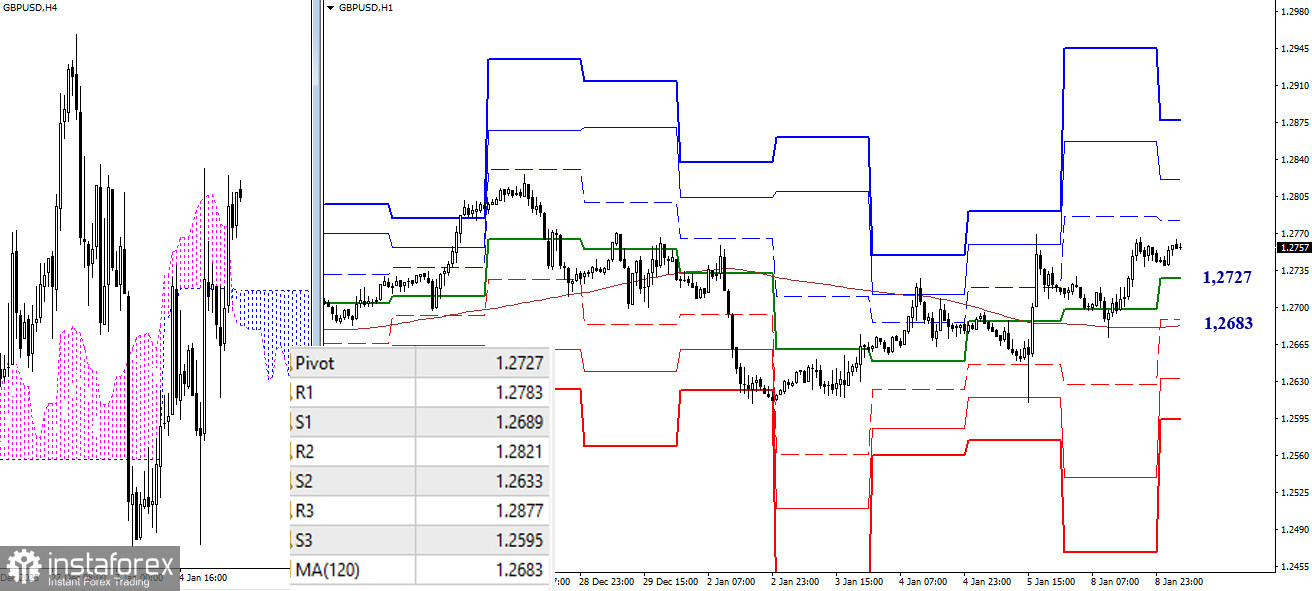

On the lower timeframes, the advantage of bullish players, who are trying to develop the rise, is now preserved. Targets for the rise within the day today are located at 1.2783 – 1.2821 – 1.2877 (resistances of classic pivot points). The key levels at the moment serve as supports, and in the event of a corrective decline, the pair will be the first to meet at the levels of 1.2727 – 1.2683 (central pivot point + weekly long-term trend). Further supports within the day today can also be provided by S2 (1.2633) and S3 (1.2595).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română