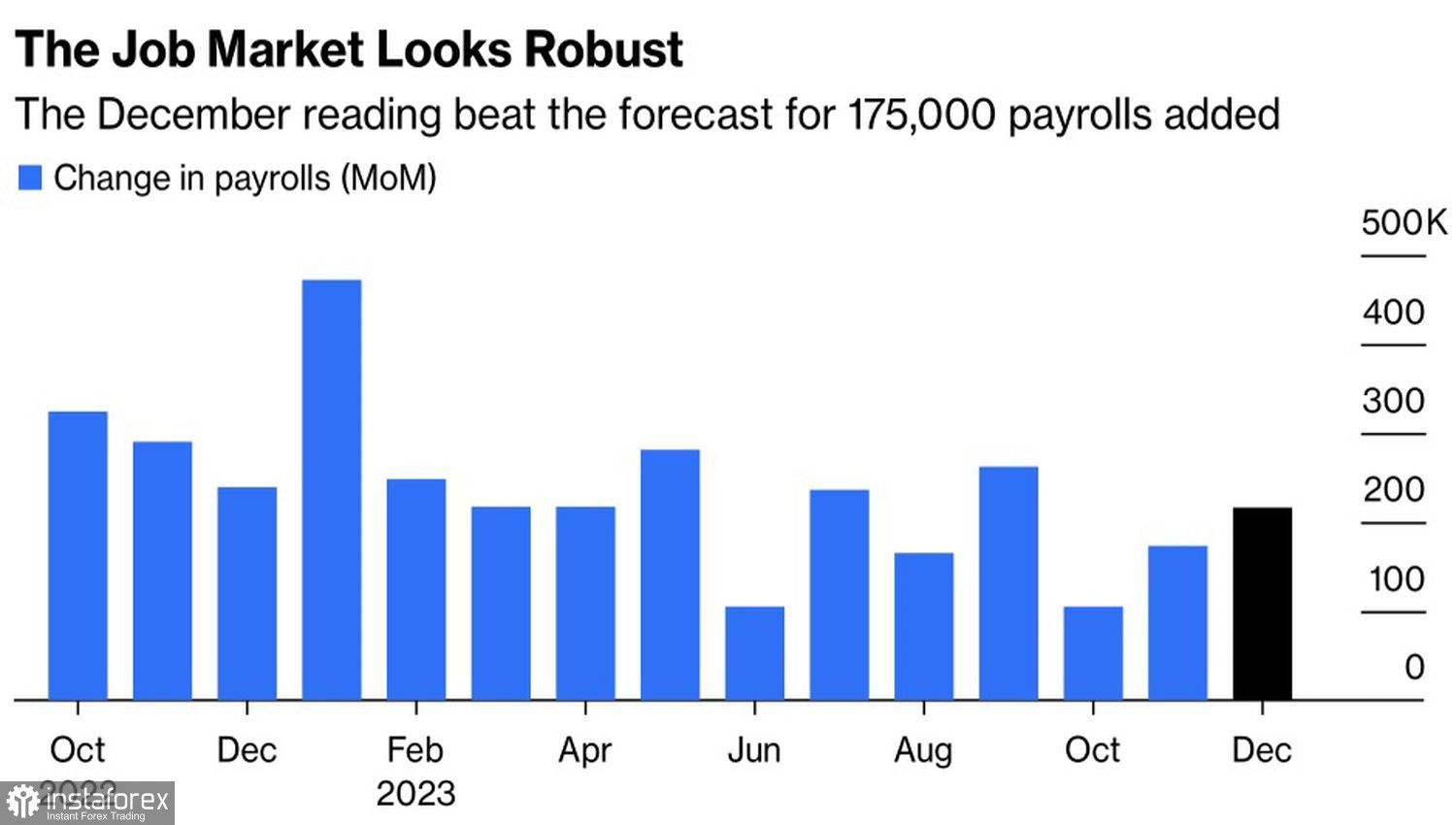

Markets are often driven by emotions. However, sometimes, investors need time to recover and digest the incoming information. The 216,000 increase in non-farm employment in the U.S. in December might have seemed impressive against Bloomberg experts' forecast of 175,000. However, the data for October and November were revised downwards, so after an initial drop, EUR/USD sharply rose and then returned to the levels from which it started.

Employment Dynamics in the USA

According to Goldman Sachs, the dynamics of non-farm payrolls, unemployment, and wage payments signal a soft landing of the U.S. economy. The bank predicts four cuts in the federal funds rate by 100 basis points, to 4.5%. This is more than the FOMC expects to do, but less than the financial markets would like to see. Their reassessment leads to an increase in the yield of treasury bonds and a fall in the S&P 500. That is, it creates a favorable environment for the bears on EUR/USD.

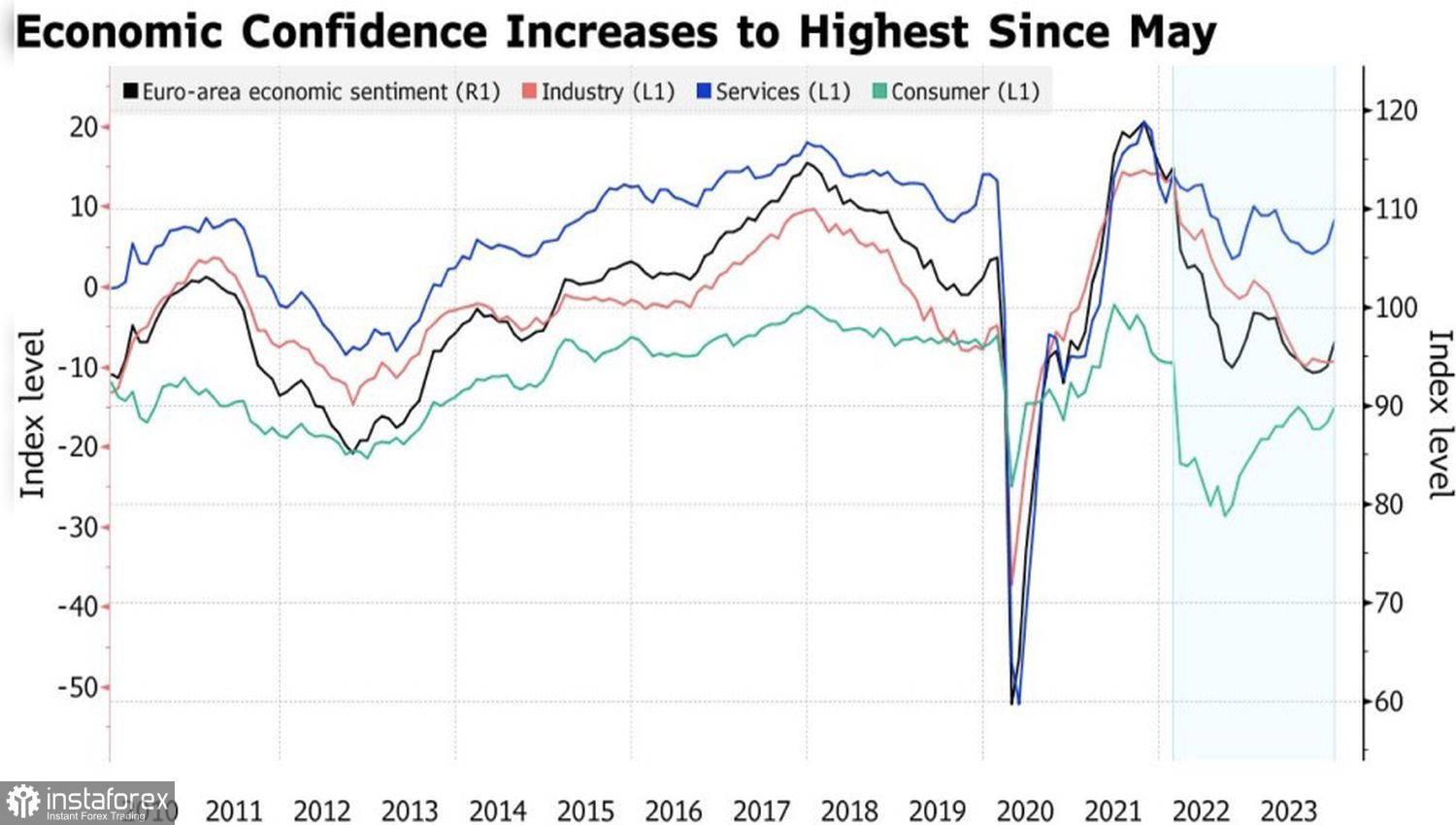

At the same time, to restore the upward trend in the main currency pair, a reduction in the divergence in economic growth between the U.S. and the eurozone is required. That is, positive macro statistics for the currency block. And if the improvement in economic confidence over the third consecutive month signals that the region may be moving towards gradual recovery, then disappointing data on German manufacturing orders raises doubts.

Dynamics of European Economic Confidence

Thus, to restore the upward trend in EUR/USD, either a rally in U.S. stock indices and a fall in treasury yields are needed, or their stabilization at the current level with simultaneous pleasant surprises from the eurozone economy. In case of a fall in the S&P 500, the worsening global appetite for risk will continue to lend a helping hand to the U.S. dollar as a safe-haven asset.

The key event of the week to January 12 is the release of inflation data in the U.S. Bloomberg experts predict a rise in consumer prices from 3.1% to 3.2% and a slowdown in core inflation from 4% to 3.8% on an annual basis. Such a dynamics of indicators will signal that reducing CPI and PCE from 3% to 2% will be more difficult for the Fed than from 9% to 3%. Essentially, this is another argument in favor of a slow weakening of monetary policy in 2024. Not what the market is counting on, but good news for the bears on EUR/USD.

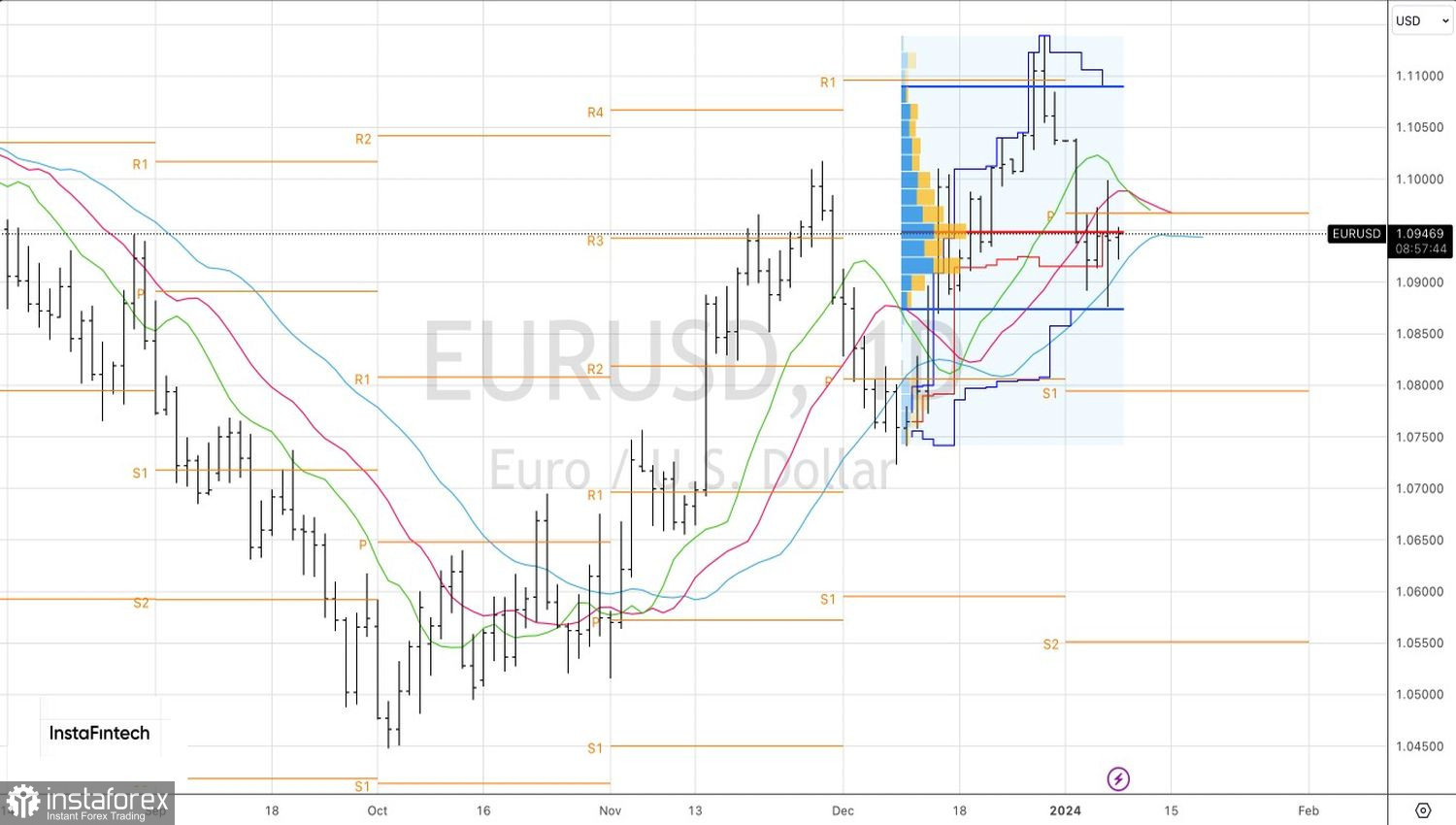

Overall, one should respect price action. Investors want to retreat from their recent 'bullish' bets on American stock indices and EUR/USD. It's better to accept this and look for opportunities for medium- and long-term long positions at more attractive levels.

Technically, on the daily chart of the main currency pair, there is the formation of an inside bar and a fair value assault by the bulls. If the market closes at current levels, traders will have an opportunity to enter short positions from 1.0925, or buy EUR/USD from 1.096.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română