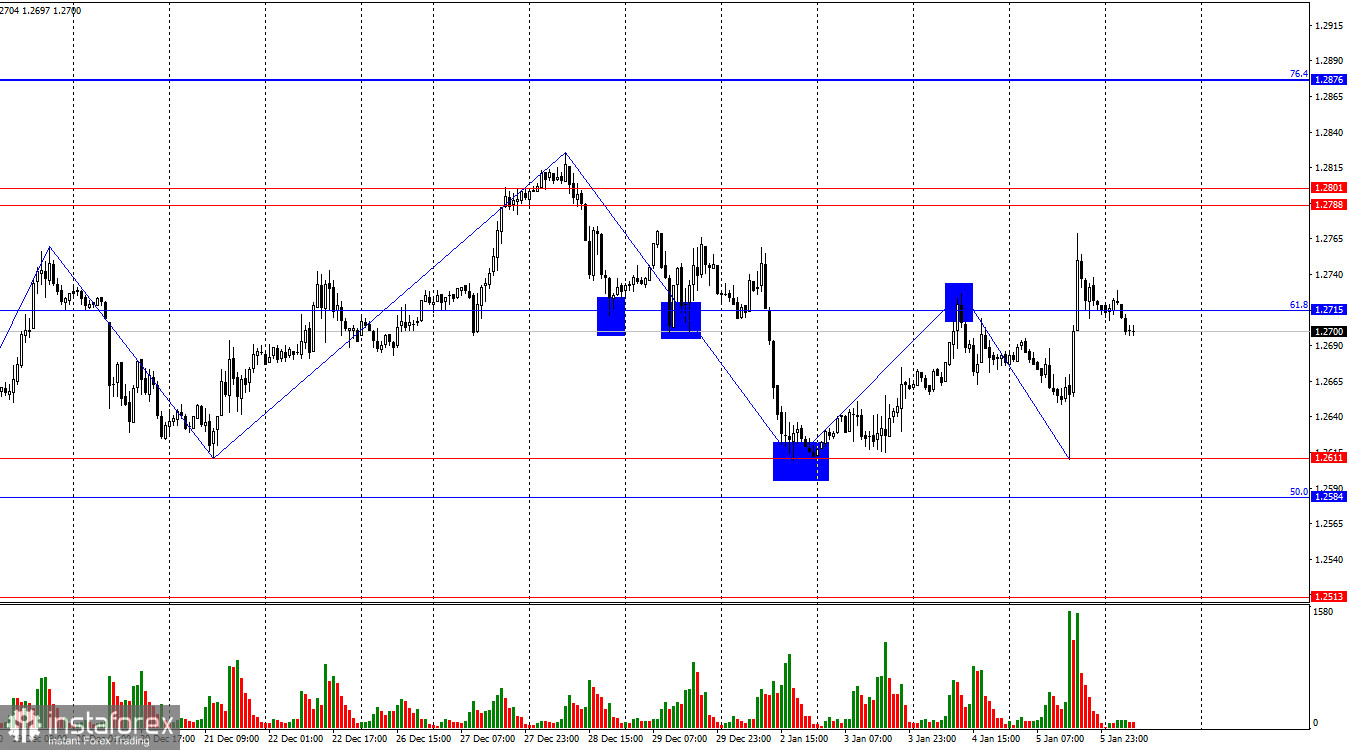

On the hourly chart, the GBP/USD pair experienced a decline on Friday, reaching the level of 1.2611, rebounding from it, and reversing in favor of the British pound with an ascent towards the corrective level of 61.8% (1.2715). This morning, it hovers precisely around this level. Trader activity might be subdued today as there will be no significant news. If the pair manages to secure itself above the 1.2715 level, it could begin a new upward movement towards the resistance zone of 1.2788–1.2801. Conversely, closing below 1.2715 would favor the dollar, potentially leading to a return to the support zone of 1.2584–1.2611.

The wave situation remains ambiguous. I mentioned that the current trends are relatively short-term, often consisting of single waves representing the entire trend. Bullish sentiment persists due to the absence of a decline in the British pound. However, the waves need to provide a clearer understanding of market dynamics. The most recent downward wave failed to breach the 1.2611 level, around which the lows of all previous waves are located. The new upward wave surpassed the peak of the previous one, suggesting that the British pound might anticipate a return to the 1.2788–1.2801 zone. I believe the current movement exhibits characteristics of a horizontal pattern.

In Friday's market, the information backdrop could have supported both the pound and the dollar but ultimately favored the British currency. Economic reports in the United States held significant importance for traders, as their release led to a veritable storm in the market. Traders deemed the November payroll figure reduction and the weak ISM Business Activity Index in the service sector more important than unemployment and December payroll figures. I can't blame them for this. The British pound still struggles to overcome its critical zone at 1.2584–1.2611, preventing bears from gaining momentum and initiating a downward trend. The price may fluctuate between the zones of 1.2584–1.2611 and 1.2788–1.2801 for some time.

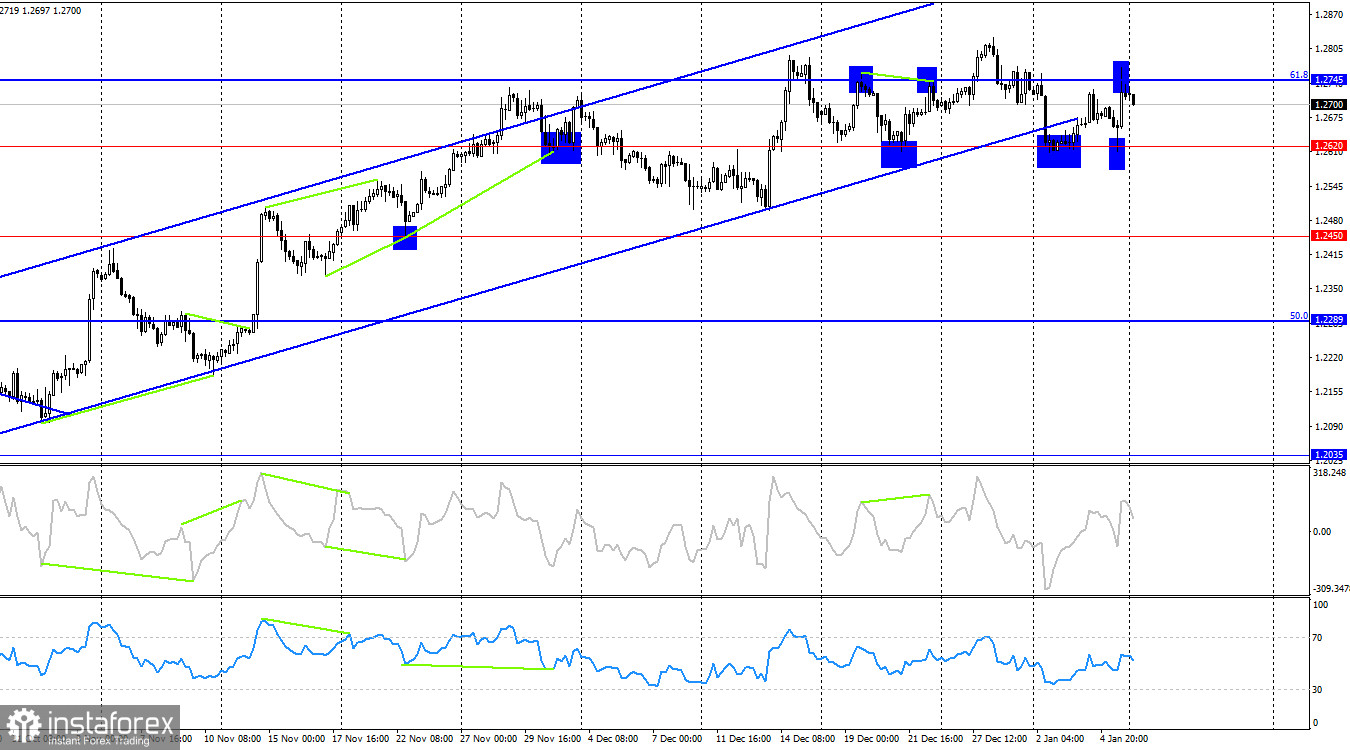

On the 4-hour chart, the pair has returned to the Fibonacci level of 61.8% (1.2745). A new bounce from this level would again favor the US dollar and lead to a decline towards the 1.2620 level. The horizontal movement between the levels of 1.2620 and 1.2745 is visible on the 4-hour chart. No imminent divergences are observed in any of the indicators, and the ascending trend corridor has been left behind. The trend may continue to shift towards a bearish direction.

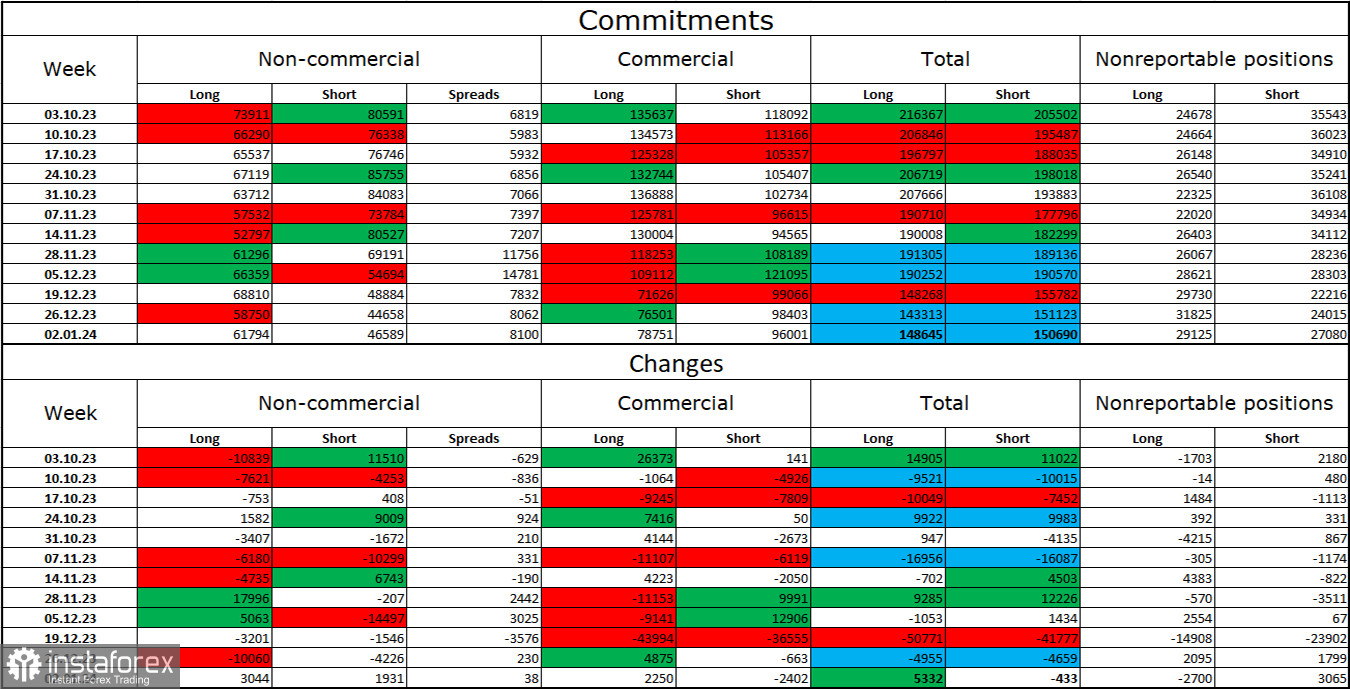

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders has shifted slightly in favor of the bulls over the past reporting week. The number of long contracts held by speculators increased by 3,044 units, while the number of short contracts increased by 1,931. The overall sentiment among large players shifted to a bearish bias a few months ago, but currently, the bulls hold a slight advantage. There is a gap between the number of long and short contracts: 62 thousand versus 46 thousand, but the gap is small and hardly increasing.

I believe there are excellent prospects for a decline in the British pound. I do not anticipate a strong rally in the pound. With time, the bulls will continue to shed their buy positions, as all potential factors for buying the British pound have already been exhausted. The recent growth witnessed over the past three months is a correction.

News Calendar for the US and the UK:

On Monday, the economic events calendar does not feature any noteworthy entries. The influence of the information backdrop on market sentiment is expected to be minimal today.

GBP/USD Forecast and Trader Advice:

Sales of the British pound may be possible today after it secures below the 1.2715 level on the hourly chart, with a target of 1.2611. Sales were also feasible on Friday after the rebound from the 1.2745 level on the 4-hour chart. These trades can still be kept open. Buying opportunities were present on Friday after the rebound from the 1.2611 level on the hourly chart. Currently, those positions can be closed. I do not consider new purchases today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română