The GBP/USD currency pair traded with an increase for some part of Thursday. During this time, the price stayed above the moving average line, maintaining the overall market sentiment characterized by a strong reluctance to sell the pound and buy the dollar. Essentially, the latest downward move of the pair ended near the previous local minimum. So, the bears couldn't breach even the most basic and straightforward barrier. What more can be said when the market refuses to sell the GBP/USD currency pair?

As we mentioned earlier, on Wednesday, the Fed's minutes were published, confirming the regulator's dovish stance for 2024. That may be why we saw the dollar decline in the next 24 hours. However, one more or one less decline doesn't matter anymore. The fact remains - the market once again showed its complete unwillingness to buy the dollar. And without this desire, there will be no decline in GBP/USD, no matter how strong the fundamental and macroeconomic background may be.

This week, the first reports from the US have already become available. The JOLTs report on the number of job openings in November showed slightly lower numbers than the market expected, and the ISM report for manufacturing in December came in at 47.4 points instead of 47.1. The JOLTs report did not support the dollar significantly, as its value turned out weaker than expected, and the ISM index was not strong enough to prompt the market to buy the dollar. It's worth noting that any value below 50 reflects negative dynamics in the industry.

Yesterday, the ADP report on private-sector employment was released. This report is analogous to the Non-Farm Payrolls report, which will be released today. Only Payrolls is considered a much more significant report, and ADP has always been considered its "younger brother." It is important to remember that the values and trends reported by these two reports often contradict each other. So, the ADP report may show a significant increase in non-farm employment, while the NonFarm report may show a much weaker figure. Therefore, the market usually ignores ADP.

Consequently, all the most important and interesting events this week will occur today. As mentioned, this includes the Non-Farm Payrolls report for December, the unemployment report, the wage report, and the ISM report on business activity in the services sector. All these releases, except the wage report, can significantly impact the US dollar's exchange rate.

Predicting the values of these reports is impossible for obvious reasons. We can only judge the potential impact of this data on the overall market sentiment. Suppose two out of three (or even three out of three) of these reports are positive for the dollar. Should we expect a sharp and prolonged decline in the pair afterward? Given how it has been trading lately, it's doubtful.

The price cannot even break its recent local lows, so the likelihood of a sterling collapse is minimal. The market needs to fundamentally change its attitude towards the dollar before it finally strengthens. Until then, regardless of the fundamentals and macroeconomics, we will continue to see the dollar decline and the pound rise to some extent. As we have all noticed, even falling below the moving average line does not play any role in pushing the pair south.

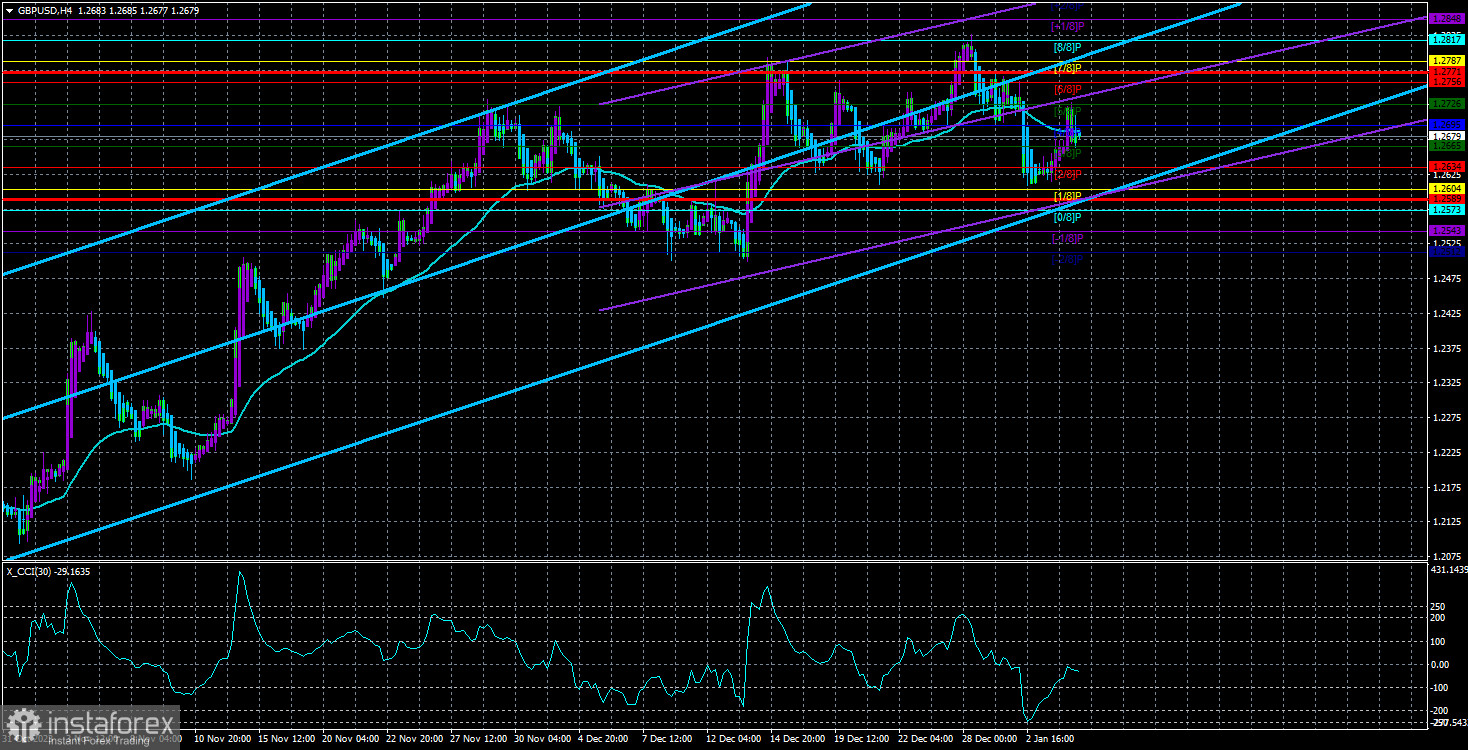

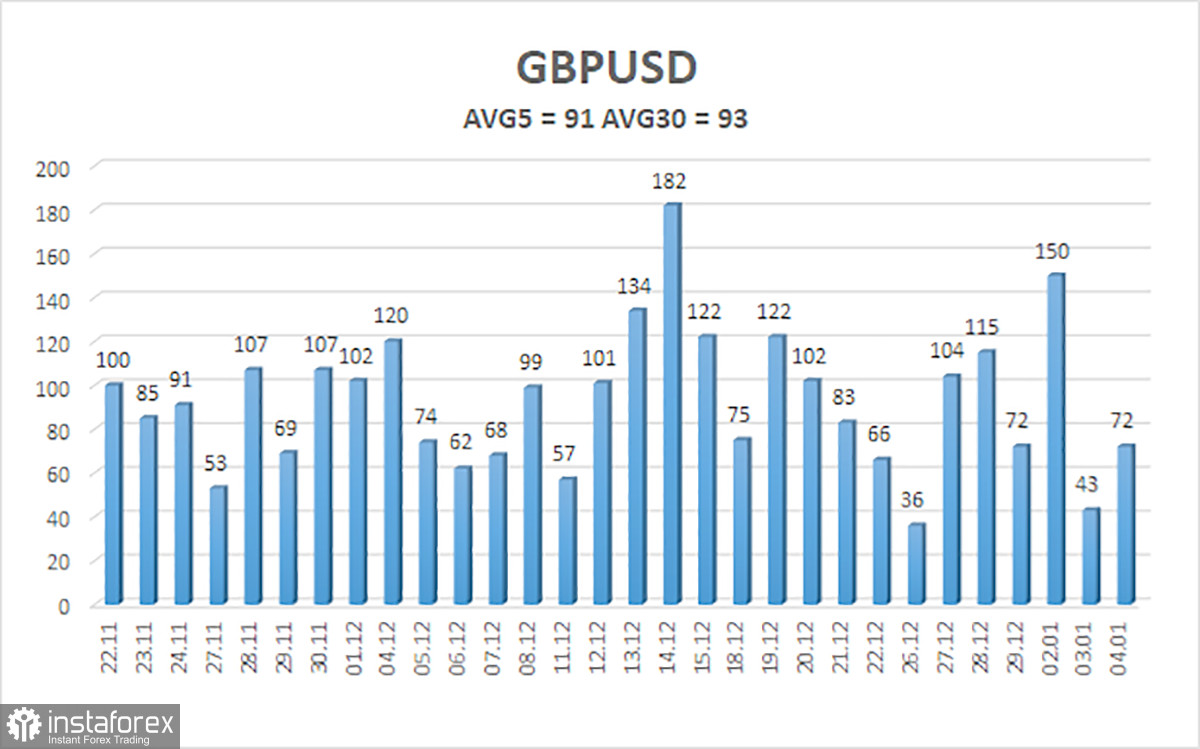

The average volatility of the GBP/USD pair over the last five trading days as of January 5th is 91 pips. For the GBP/USD pair, this value is considered "average." Therefore, on Friday, January 5th, we expect movements within the range limited by the levels of 1.2589 and 1.2771. A downward reversal of the Heiken Ashi indicator will indicate a new attempt to start a downward trend.

The nearest support levels:

S1 – 1.2665

S2 – 1.2634

S3 – 1.2604

The nearest resistance levels:

R1 – 1.2695

R2 – 1.2726

R3 – 1.2756

Trading recommendations:

The GBP/USD currency pair has firmly stayed below the moving average line, and further decline would be the most logical and predictable scenario. At this time, we consider it advisable to consider new short positions or maintain existing ones with targets at 1.2604 and 1.2589. Long orders can be considered after a price confirmation above the moving average, with targets at 1.2787 and 1.2817. On Friday, movements may be volatile with frequent reversals, as the macroeconomic background will be very strong.

Illustration explanations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel where the pair will trade the next day based on current volatility indicators.

CCI indicator - entering the oversold area (below -250) or overbought area (above +250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română