EUR/USD:

Yesterday's US employment data, as we anticipated, exceeded expectations. According to ADP, 164,000 jobs were created in the non-farm sector in December, compared to a forecast of 115,000 and 101,000 in November. Initial jobless claims also dropped to 202,000 from 220,000 the previous week (forecast was at 216,000). These reports renewed optimism about today's Non-Farm Payrolls report and other unemployment sub-indices. Even the expected 170,000 new jobs in the non-farm sector are considered a good figure.

As a result, the Dow Jones inched up by 0.03% yesterday, while the S&P 500 was less responsive, with a -0.34% decline. However, European stock markets closed the day with gains, and the euro was up by 22 pips.

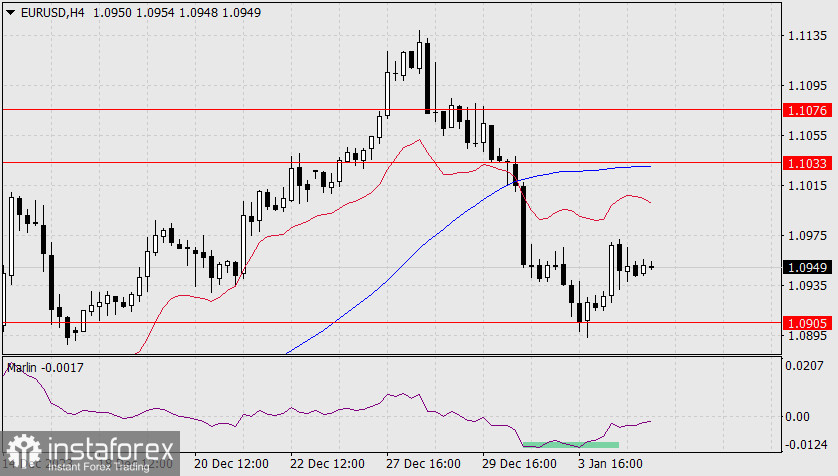

On the daily chart, we can see a price reversal from the balance indicator line and the target level of 1.0905. The Marlin oscillator is rising but has not yet left the bearish territory. Expectations are generally positive, with the price expected to reach target resistances at 1.1033, 1.1076, and 1.1185.

On the 4-hour chart, the price is visually rising, and the Marlin oscillator, after breaking away from the base marked by the green area, is approaching the boundary of the uptrend territory. The MACD line is very close to the 1.1033 level, emphasizing the significance of this resistance. Therefore, overcoming it could extend the price's growth in the medium-term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română