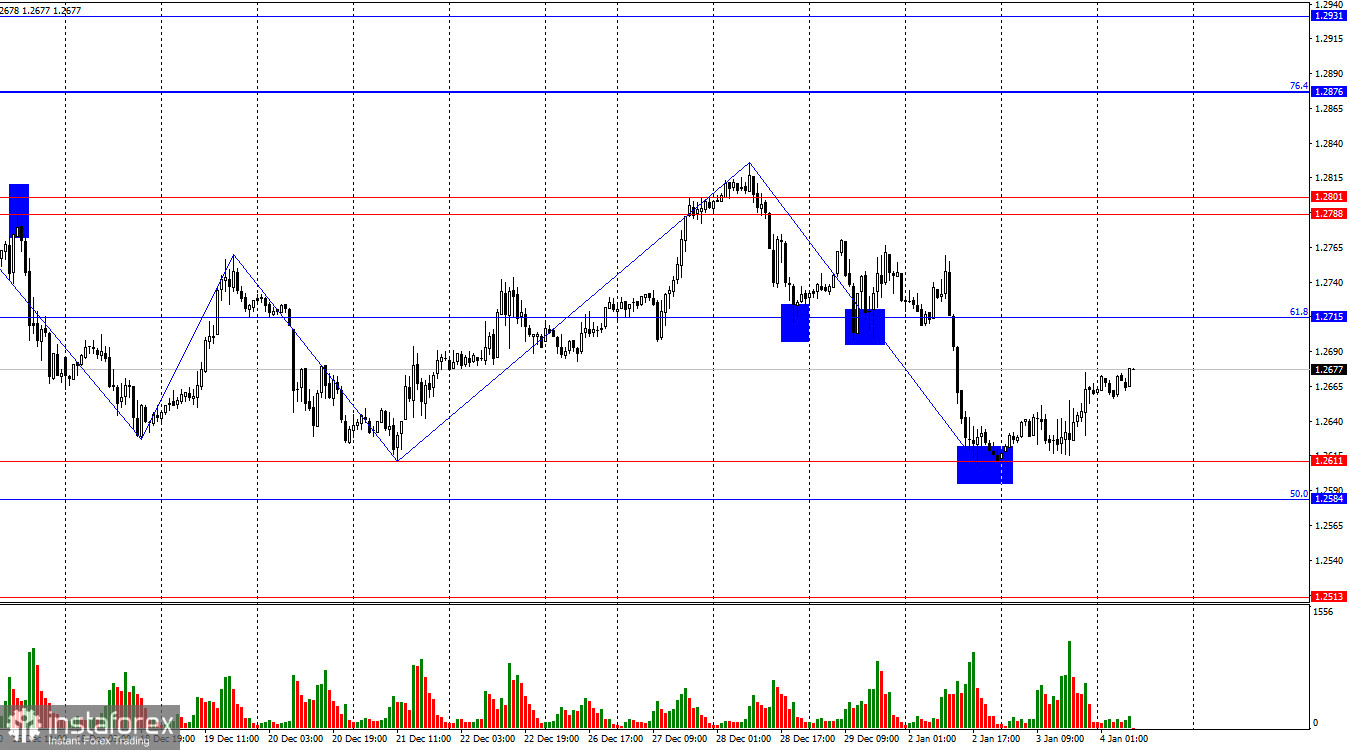

On the hourly chart, GBP/USD fell to 1.2611 and then bounced back, provoking a reversal and growth towards the 61.8% retracement level of 1.2715. A rebound from this will likely lead to a decline in the direction of the support area of 1.2584 - 1.2611, which acted as strong resistance several times. Meanwhile, a rise above the level of 1.2715 will increase the chances of continued growth towards the next level of 1.2788.

The situation with the waves remains ambiguous. The last upward wave broke through previous peaks, while the new downward wave struggles with the level of 1.2611, near which lies two previous lows.

The released Fed minutes did not add any new information, stating only that the members see interest rates to have reached the peak. Possibly, the monetary policy will ease if inflation continues to decline. The market reacted to this with small sell-offs in dollar.

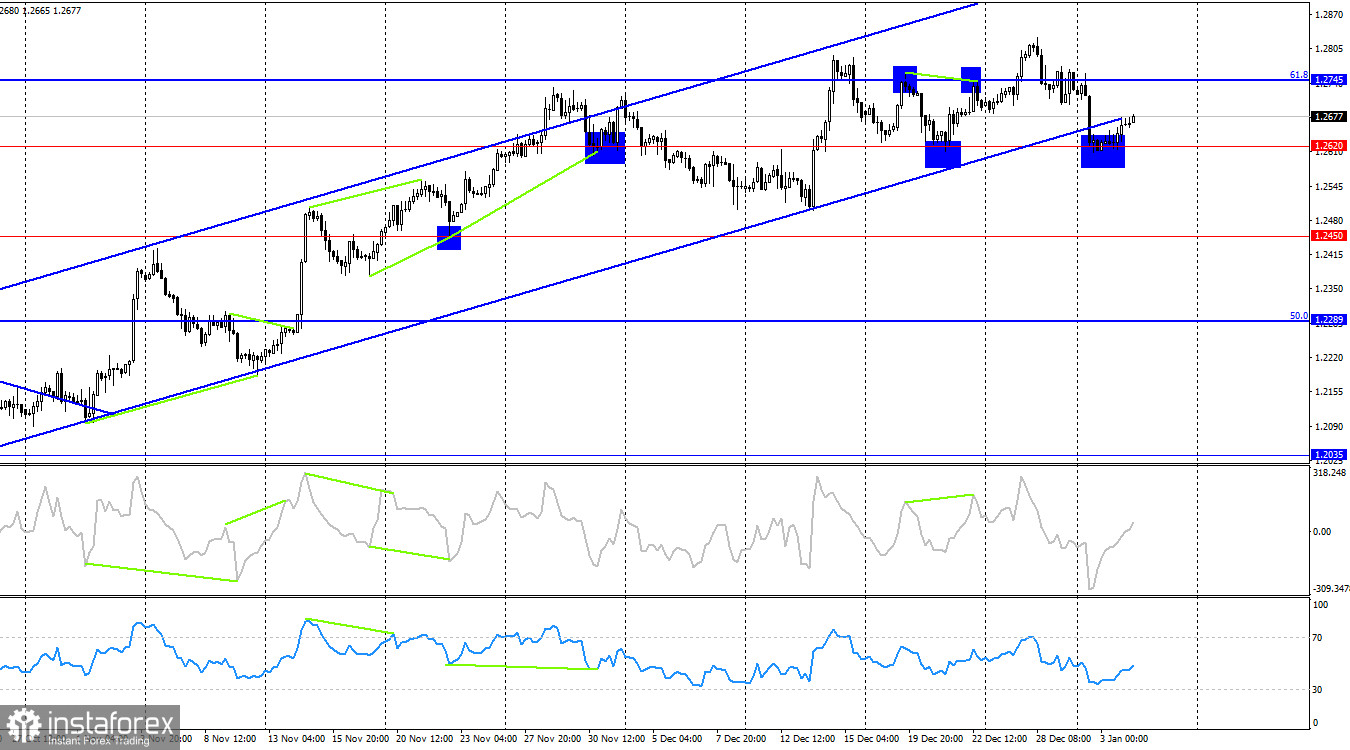

On the 4-hour chart, the pair completed a reversal in favor of dollar, moving below the upward channel and then falling to the level of 1.2620. A further decline under 1.2620 will lead to a plummet towards 1.2450. No emerging divergences appeared in any of the indicators.

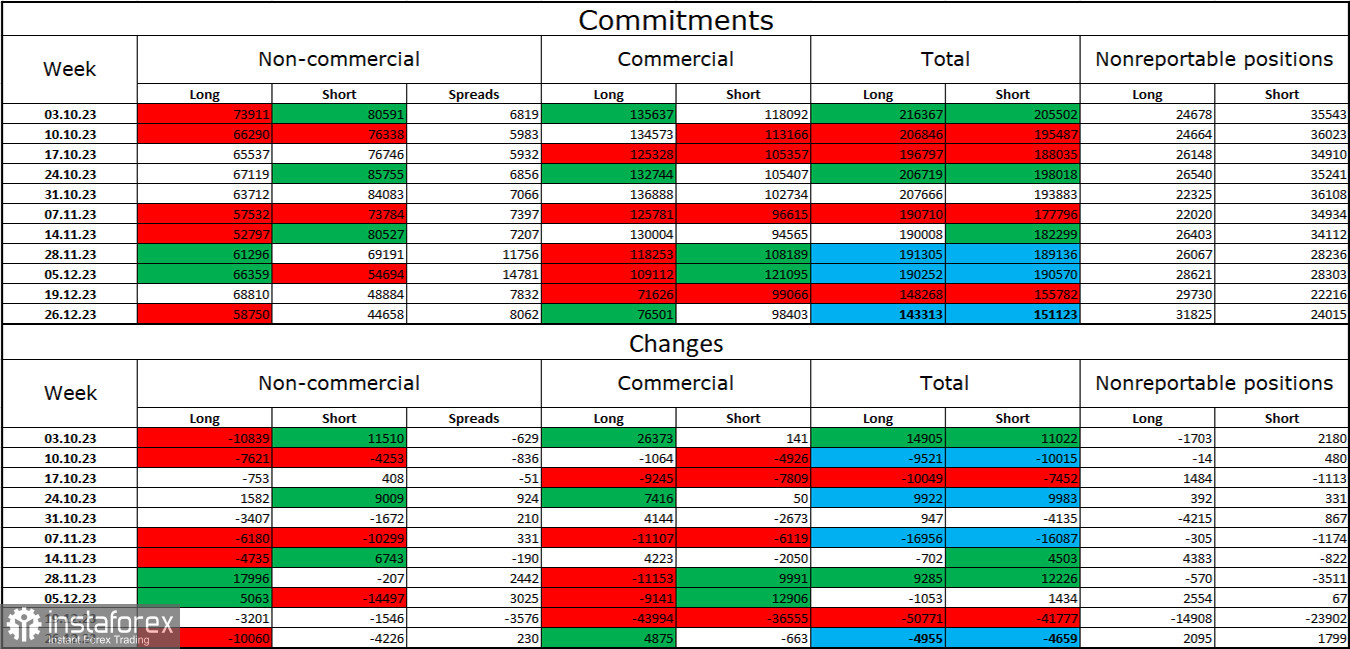

Commitments of Traders (COT) Report:

The mood changed in favor of the bears as the number of long contracts in the hands of speculators decreased by 10,060 units, while the number of short contracts decreased by 4,226 units. But even though sentiment shifted a few months ago, bulls have a slight advantage again, thanks to the gap between the number of long and short contracts: 59,000 against 45,000.

Pound may continue to fall as bulls will continue to get rid of buy positions. The growth in the last three months may just be corrections.

News calendar for the US and the UK:

UK - Services PMI (09-30 UTC).

US - ADP Employment Change (13-15 UTC).

US - Initial Jobless Claims (13-30 UTC).

US - Services PMI (14-45 UTC).

The economic calendar for Thursday contains several important entries, with the ADP report being the most significant one. The impact of the news on market sentiment today will be medium in strength.

GBP/USD forecast and tips for traders:

Sell-offs may occur if the pair consolidates below 1.2715 and heads towards 1.2611. Another consolidation below 1.2584 - 1.2611 today will lead to a further decline to 1.2513 and 1.2453, while growth will occur only after a rebound from 1.2611 to 1.27151 on the hourly chart. A rise above 1.2715 will allow an increase towards 1.2788.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română