There is a time to scatter stones and a time to gather them. Each event has its suitable moment. And what we see in the EUR/USD pair is the result of a reassessment of market expectations. Investors are beginning to doubt whether the Federal Reserve will provide the degree of monetary stimulus they had counted on. Despite the Central Bank signaling the end of the tightening cycle of monetary policy, it will be reluctant to cut the federal funds rate. What about the 150 basis points being discussed?

The EUR/USD rally is the result of expectations for a soft landing of the U.S. economy, which would force the U.S. dollar to be at the lower end of its smile. The dollar smile theory suggests that in conditions where GDP is growing at moderate rates and inflation is slowing, a favorable regime for stocks, dubbed 'Golden-haired' mode, is established. For the USD index as a safe-haven asset, on the contrary, this period is extremely unfavorable.

Nothing is eternal under the moon. A soft landing could ultimately be just a stepping stone to a recession or a surge in U.S. GDP. As a result, the dollar will move towards the upper part of its smile. A downturn in the American economy will increase demand for it as a reliable asset. An acceleration of gross domestic product will bring back talks of American exceptionalism. In any case, EUR/USD will be forced to fall. The question is only how long the idea of a soft landing will remain in the minds of investors. Employment statistics will help answer this.

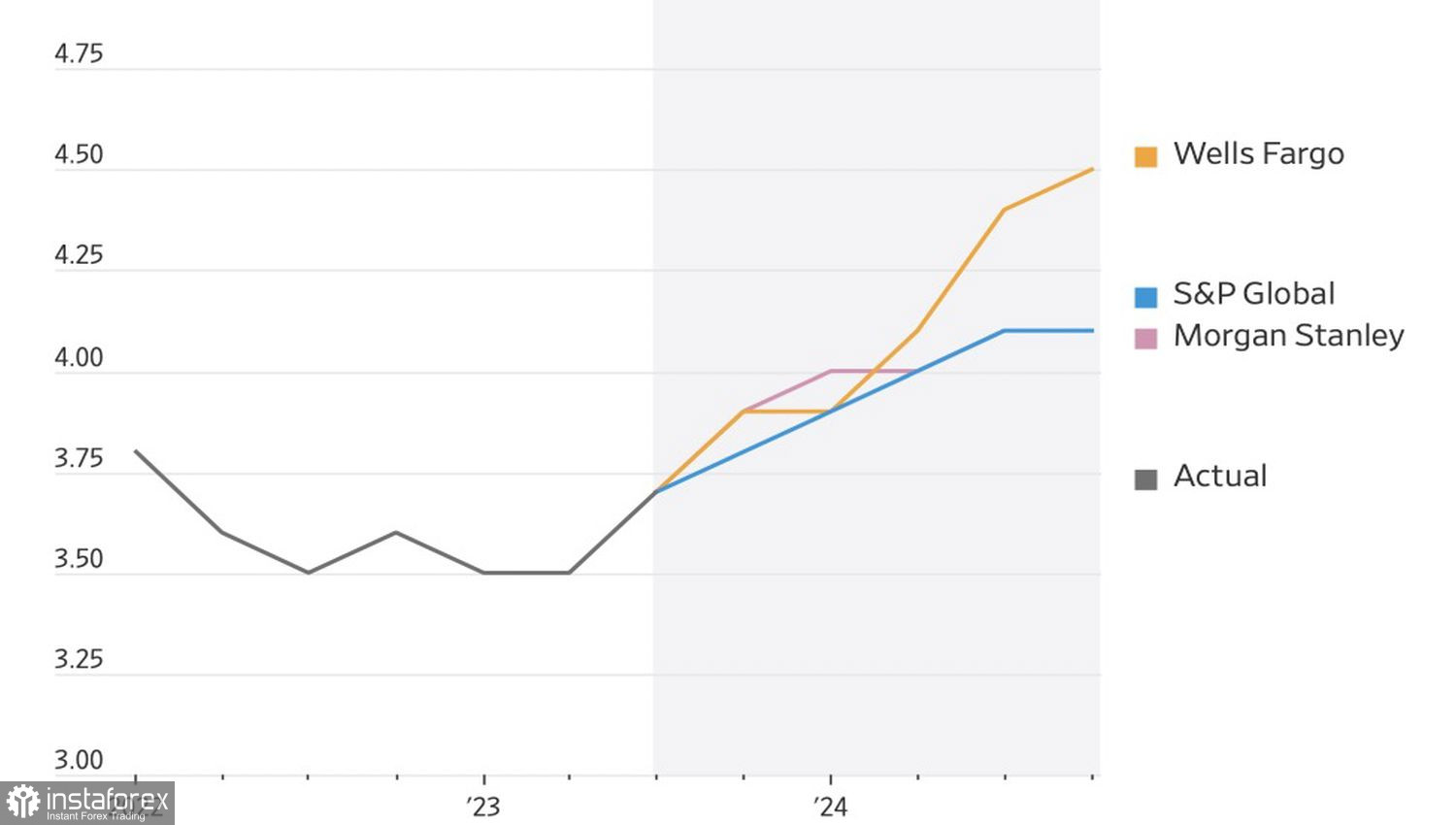

Dynamics and Forecasts for Unemployment in the U.S.

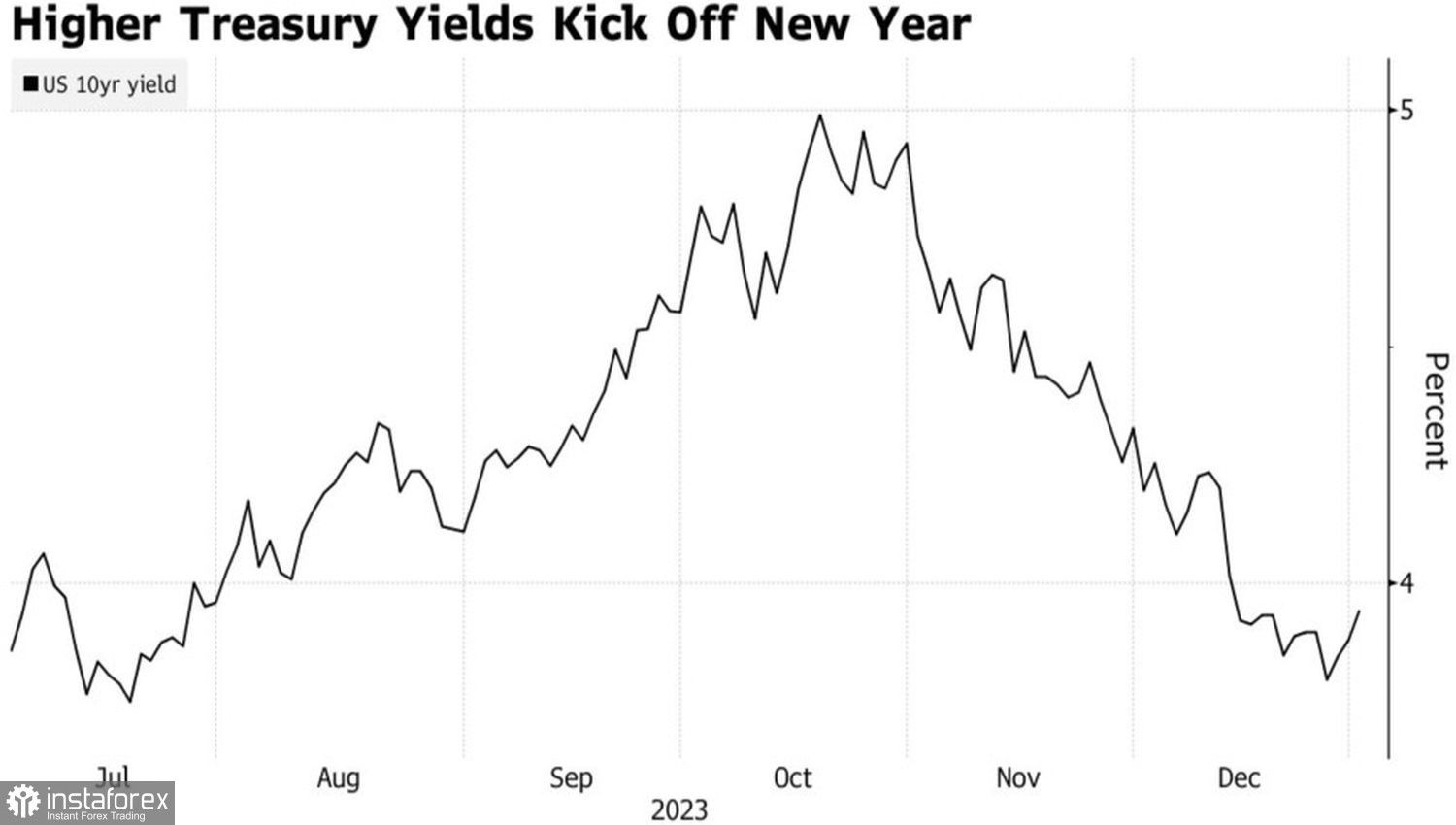

The labor market is an indicator of the health of the entire economy. Bloomberg experts predict a slowdown in non-farm payrolls from 199,000 to 163,000 in December. Such a result suggests a soft landing. If the pace of employment growth drops sharply and unemployment increases, fears of an approaching recession will push down the yields on Treasury bonds and U.S. stock indices. Safe-haven currencies will benefit from this.

Conversely, a surge in non-farm payrolls to 200,000–250,000 in December would be evidence that the States have withstood the aggressive monetary restriction of the Federal Reserve. Their economy is on the rise, which will increase the risks of a new peak in inflation and force the Central Bank to return to the theme of tightening monetary policy. Bears on EUR/USD will benefit from this.

Dynamics of Treasury Bond Yields

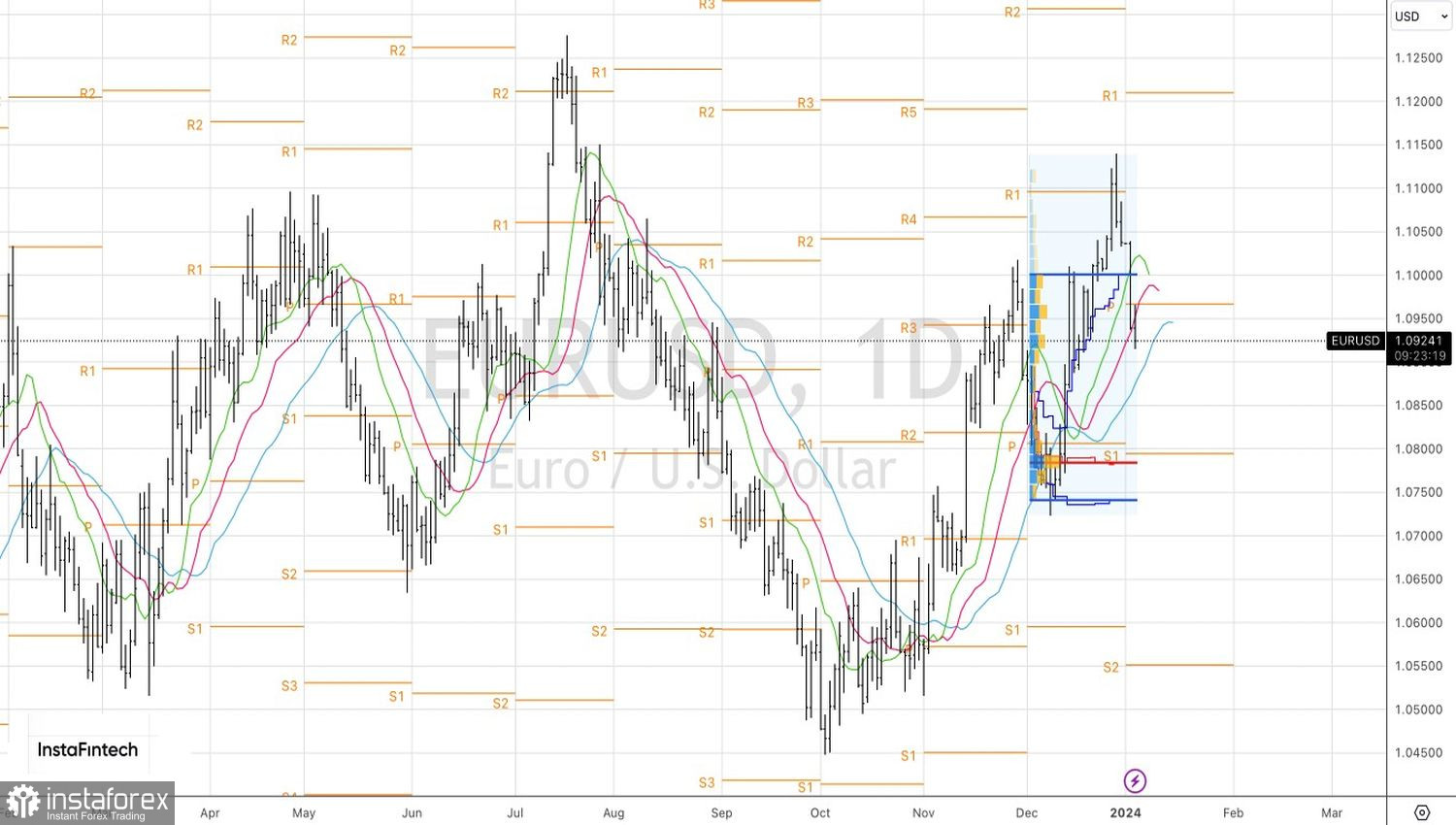

Thus, euphoria in the financial markets is gradually passing. Greed gives way to Fear, creating a tailwind for the American dollar and a headwind for the euro. If the S&P 500 develops a correction, the main currency pair risks returning to the range of 1.07–1.08.

Technically, on the daily chart, EUR/USD is retreating to an upward trend. The bears have managed to storm two of their three dynamic supports in the form of moving averages. The basis of the reversal was the Anti-Turtles pattern. The next important level is near 1.089. Only a confident rebound from it will allow switching shorts to longs. For now, it makes sense to stick to a selling strategy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română