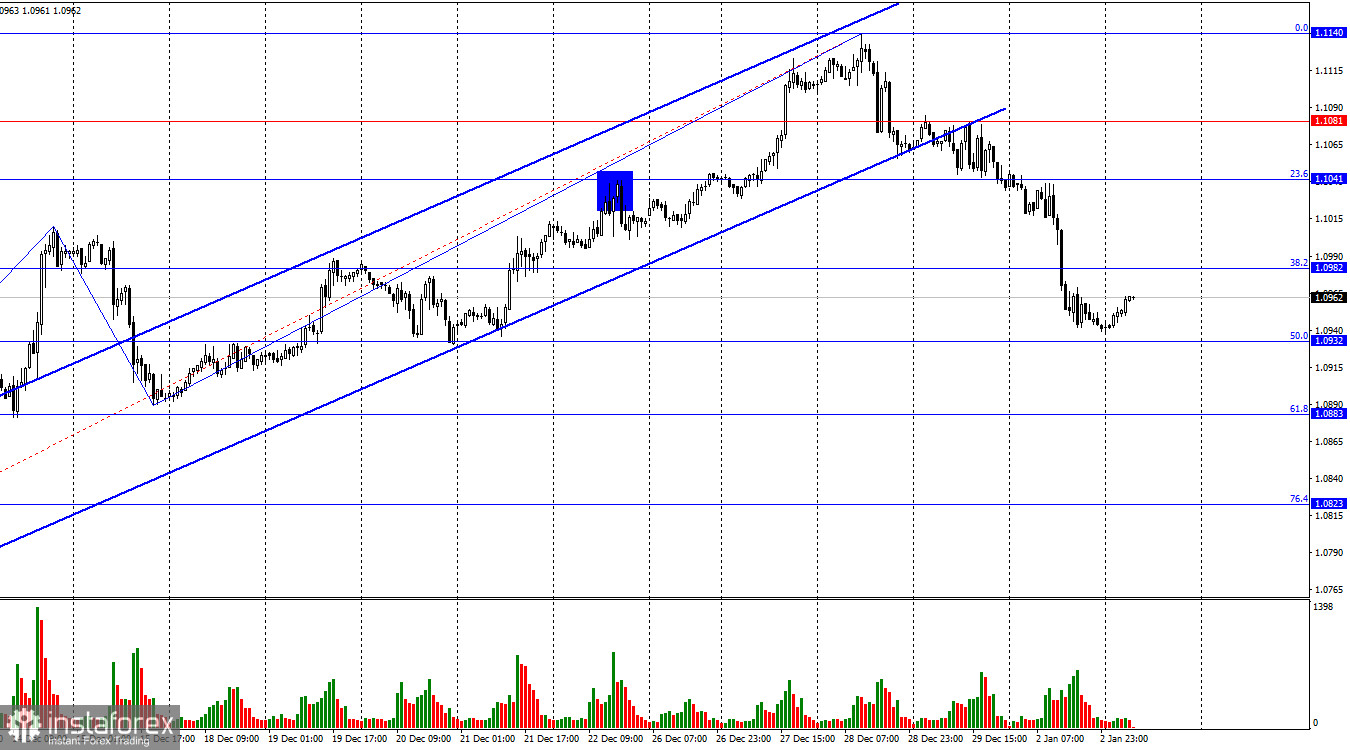

EUR/USD continued to grow, overcoming one level after another. First it consolidated below the 23.6% retracement level of 1.1041, and then it went below the 38.2% retracement level of 1.0982. This allows market players to look for new sell signals on the charts.

The situation with the waves remains ambiguous, as the last upward wave emerged strong, while the new downward wave appeared to be too weak. For now, only a closure below the channel signals a possible fall of the pair in the coming weeks. Waves will start to indicate a bearish trend when the pair breaks the last low (from December 15) or when a new upward wave fails to break the peak of the previous one (from December 28).

As for economic data, the EU Manufacturing PMI for December rose from 44.2 to 44.4, but this report hardly pleased buyers. Perhaps, in normal conditions, there will be a slight decrease in euro by 20-30 pips. But at this time, activity remains low, so the resistance appeared to be rather insufficient. Also, even without the report, euro will fall due to the consolidation below the price channel.

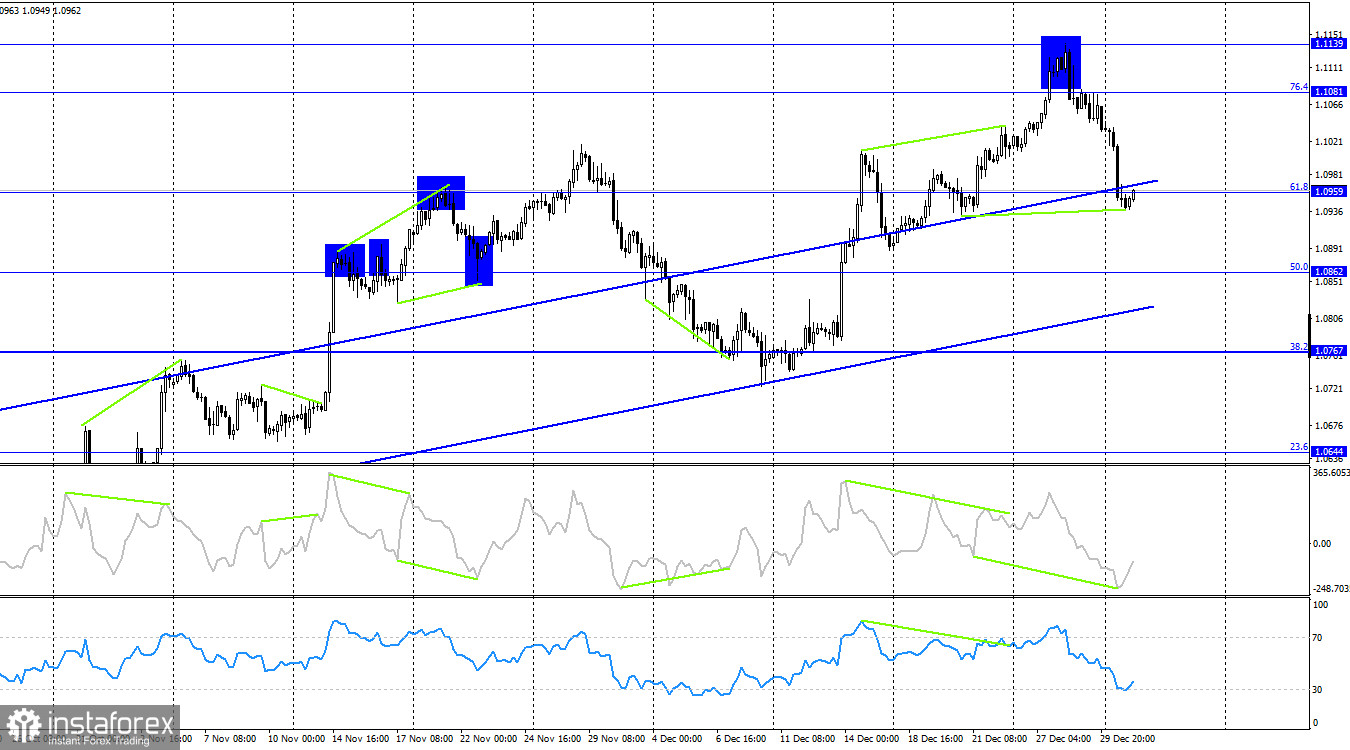

Euro bounced back from 1.1139 on the 4-hour chart, so a reversal in favor of dollar occurred. Another rebound from the 61.8% retracement level of 1.0959 will lead to a price increase, while a consolidation below the upward channel could result in a long-term decline.

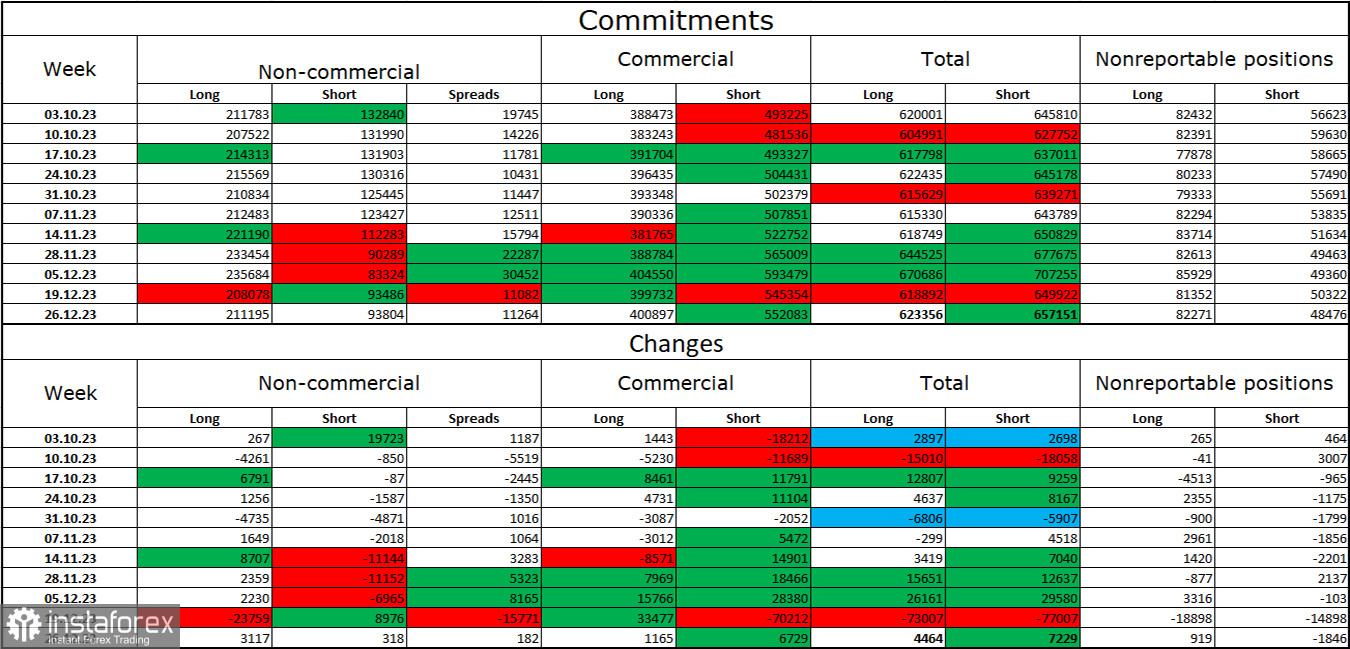

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 3,117 long contracts and 318 short contracts. The total number became 211,000 for long contracts and 94,000 for short contracts. Despite the huge difference, the situation may change in favor of the bears, as bulls have dominated the market for too long, and now they need a strong news background to maintain the trend. Professional traders may close long positions soon.

News calendar for the US and Europe:

EU – Unemployment Rate in Germany (08-55 UTC).

US - ISM Manufacturing PMI (15-00 UTC).

US - JOLTS Job Openings (15-00 UTC).

US - FOMC Meeting Minutes (19-00 UTC).

The economic calendar contains several important entries, especially in the US. The impact of the news on market sentiment today will be medium in strength.

GBP/USD forecast and tips for traders:

Sell-offs occurred in the pair after the consolidation below the price channel. The quote headed towards the target level of 1.0960, successfully reaching it. A rebound from the level of 1.0982 or closing below 1.0932 will lead to a further decline to 1.0883 and 1.0823, while a rebound from the level of 1.0959 on the 4-hour chart and the formation of a bullish divergence could result in an increase to 1.1081.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română