Stock markets showed mixed dynamics at the end of Tuesday's trading. Meanwhile, yields on US Treasuries and others increased, causing dollar to rise.

It seems that investors decided to adjust their positions in anticipation of the important labor market data from the US and consumer inflation report in the Eurozone. It led to a local rebound in Treasuries and strengthened dollar's rate. The ICE Index sharply recovered, and at the time of writing hit the level of 102.11 points.

However, the movements may be local and caused by the desire to fix part of the previously obtained profit. After all, global stock indices grew significantly at the end of last year, while government bond yields and dollar dropped sharply. The stock rally may resume and may even intensify if investors become more and more convinced that the world's central banks, led by the Fed, will begin to lower interest rates.

The upcoming inflation data in the Eurozone will be very important because forecasts say it will increase from 2.4% to 3.0% y/y. For the US labor market, there may be a decrease in the number of new jobs and an increase in unemployment.

A decent inflation report will convince the ECB to take a longer pause and not decide to lower rates immediately after the Fed begins to do so. Such a scenario will result in a rise in EUR/USD, especially if labor market data pressures dollar again.

Overall, stock indices may resume growth at the beginning of this year after a likely shallow correction. Dollar will also fall below 101.00 points in the coming days.

Forecasts for today:

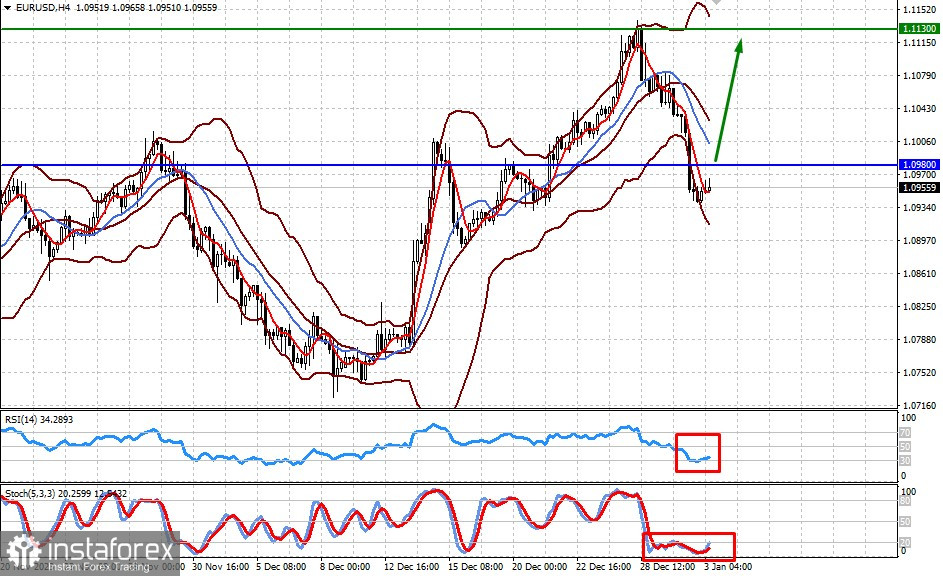

EUR/USD:

The pair will recover if consumer inflation data in the Eurozone exceeds expectations. If that happens, euro may surpass 1.0980 and head towards 1.1130.

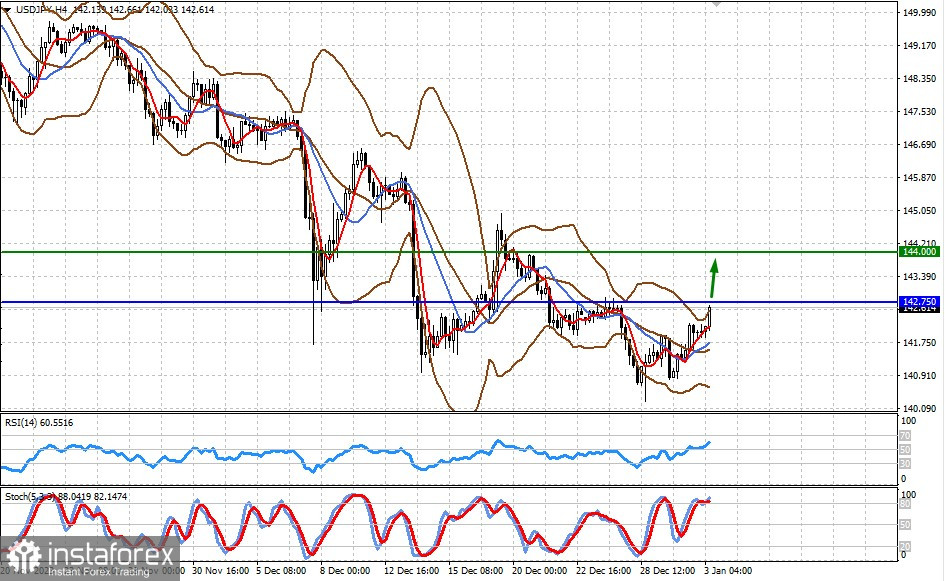

USD/JPY:

The pair may rise to 144.00 in anticipation of the US labor market data and minutes of the last Fed meeting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română