Analyzing Tuesday's trades:

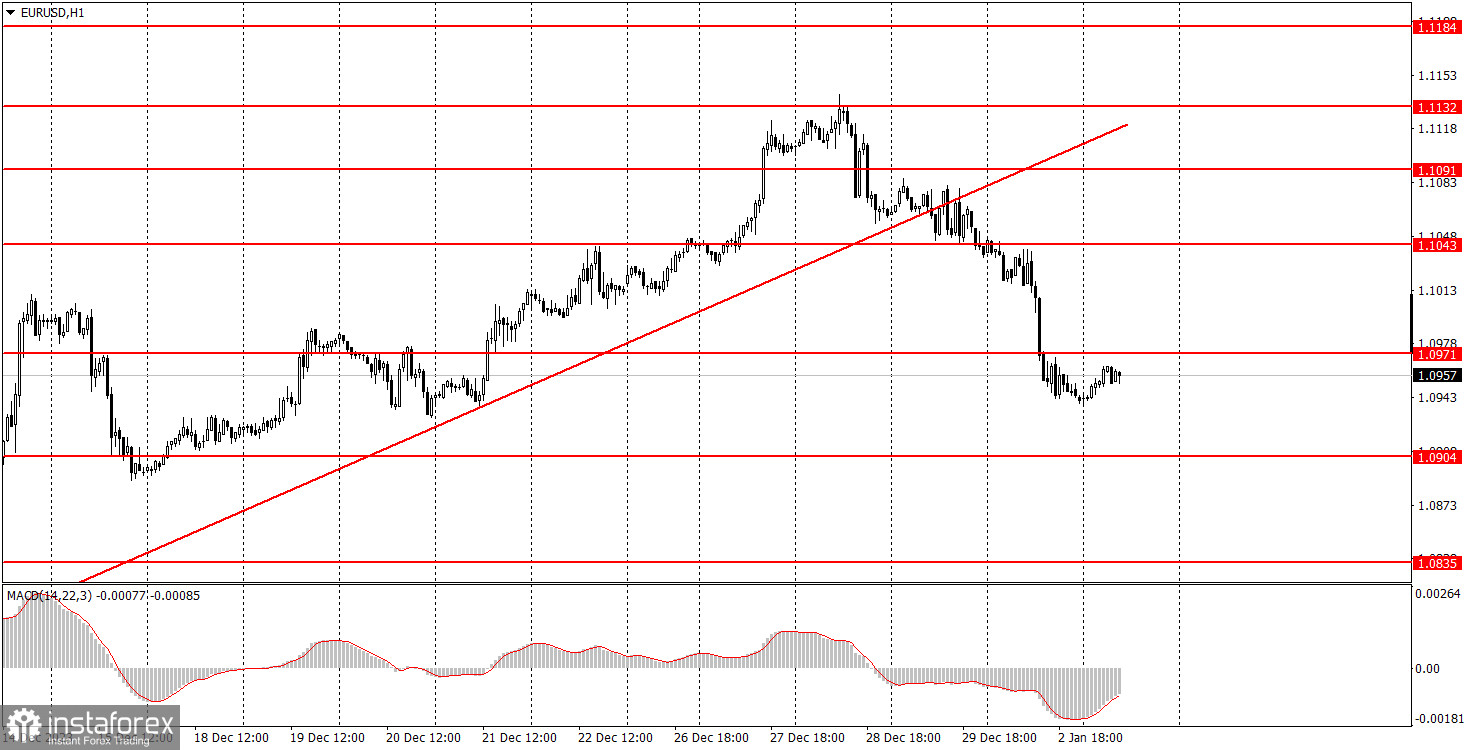

EUR/USD on 30M chart

EUR/USD continued to trade lower during the first trading day of the new year, which had started in the previous year. However, in the last days of 2023, the movement was very weak, but it noticeably intensified yesterday. The ascending trendline was broken, which suggested a downtrend. Therefore, yesterday's decline was entirely expected.

We have repeatedly warned you that the euro was overbought. It had been rising for a long time, often without a solid foundation or reason. However, at the same time, the trendline clearly indicated the continuation of the uptrend. The situation has now changed, and nothing should prevent the euro from falling further. We believe that the pair has risen too high once again, so it should only fall in the coming weeks and months.

Yesterday, the eurozone and Germany released the second estimates of their Services PMI data. We saw minor deviations from the initial estimates, so it doesn't seem like that these reports exerted pressure on the euro.

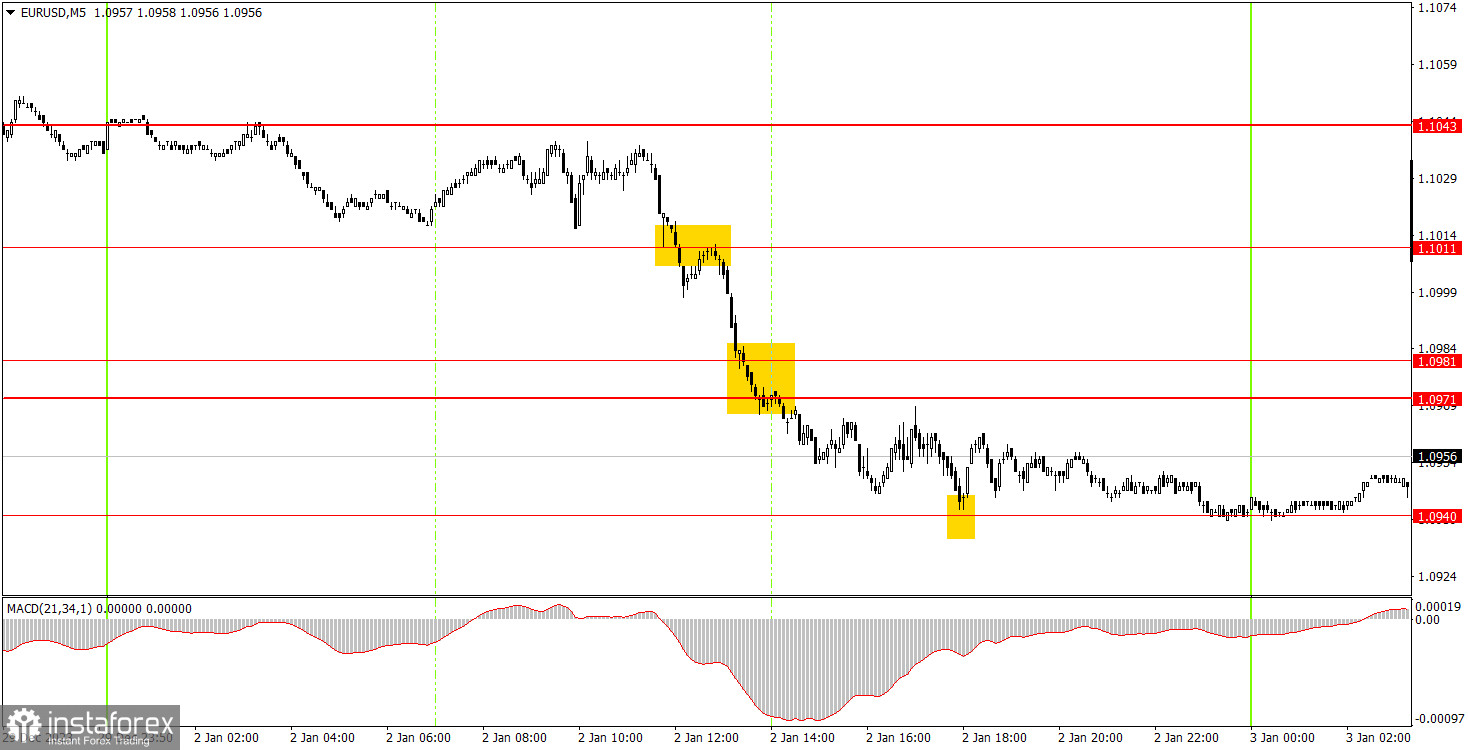

EUR/USD on 5M chart

On the 5-minute chart, several trading signals were generated. First, the pair broke through the level of 1.1011, which should have been used to open short positions. Later, the pair overcame the range of 1.0971-1.0981, and the price dropped to the level of 1.0940, near which the downward movement ended. Beginners could close their short positions around 1.0940 in the evening. The profit from the trade was about 50 pips. Not bad for the first trading day of the year.

Trading tips on Wednesday:

On the hourly chart, EUR/USD finally has a chance to form a downtrend. Of course, the decline can be gradual and weak, so we shouldn't expect to see such active movements every day as we did yesterday. But the fact is that the pair has already to trade lower. This week, the US will release many important reports that can influence the dollar's exchange rate. The first report on the labor market will be published today.

There is no movement yet. We believe that today one should start from the level of 1.0940. The price failed to overcome it twice, so there is a possibility of rising towards the range of 1.0971-1.0981. Overcoming this mark will allow us to open long positions using 1.1011 as a target. If the price consolidates below 1.0940, this will open up opportunities for you to sell with 1.0904 as a target.

The key levels on the 5M chart are 1.0733, 1.0767-1.0781, 1.0835, 1.0896-1.0904, 1.0940, 1.0971-1.0981, 1.1011, 1.1043, 1.1091, 1.1132-1.1145, 1.1184, 1.1241, 1.1279-1.1292. On Wednesday, the US will release important ISM reports for the manufacturing sector and JOLTs reports on job openings. Therefore, there may be sharp price reversals and increased volatility in the second half of the day.

Basic trading rules:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română