Analysis of GBP/USD 5M

GBP/USD faced strong negative pressure during the first trading day of the week, month, and year. Yesterday, the pound fell by almost 150 pips throughout the day and managed to settle below the Senkou Span B line. It's worth noting that the price had previously crossed the ascending trendline, providing us with at least two signals of a bearish trend reversal.

This movement didn't come as a surprise to us. In recent weeks, we have repeatedly mentioned that the British pound was significantly overbought and could fall at any moment. Furthermore, in the medium-term perspective, we anticipate further declines for the pound. From our perspective, it had corrected higher in recent months, even more strongly than it should have. However, now a downtrend, which presumably began on July 14th, may persist.

Yesterday, second estimates of Manufacturing PMI data for December were released in both the UK and the US. The UK PMI turned out to be worse than expected and worse than the November figure. However, we can confidently say that this report, which has long been below the "waterline," could not trigger a steep decline in the pound. The US PMI also came in below expectations, and as we can see, the dollar didn't have any issues with that.

There were several trading signals yesterday. Initially, the pair settled above the 1.2726 level, allowing for long positions. However, the bounce from the critical line called for closing long positions and opening short ones. Subsequently, the pair fell by approximately 150 pips and only stopped around the 1.2620 level, where you should have taken profit, resulting in at least 120 pips of profit.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has been changing quite frequently in recent months. The red and green lines, representing the net positions of commercial and non-commercial traders, often intersect and, in most cases, are not far from the zero mark. According to the latest report on the British pound, the non-commercial group closed 10,000 buy contracts and 4,200 short ones. As a result, the net position of non-commercial traders decreased by 5,800 contracts in a week. Since bulls currently don't have the advantage, we believe that the pound will not be able to sustain the upward movement. The fundamental backdrop still does not provide a basis for long-term purchases on the pound.

The non-commercial group currently has a total of 58,800 buy contracts and 44,700 sell contracts. Since the COT reports cannot make an accurate forecast of the market's behavior right now, and the fundamentals are practically the same for both currencies, we can only assess the technical picture and economic reports. The technical analysis suggests that we can expect a strong decline, and the economic reports have also been significantly stronger in the United States than in the United Kingdom for quite some time now.

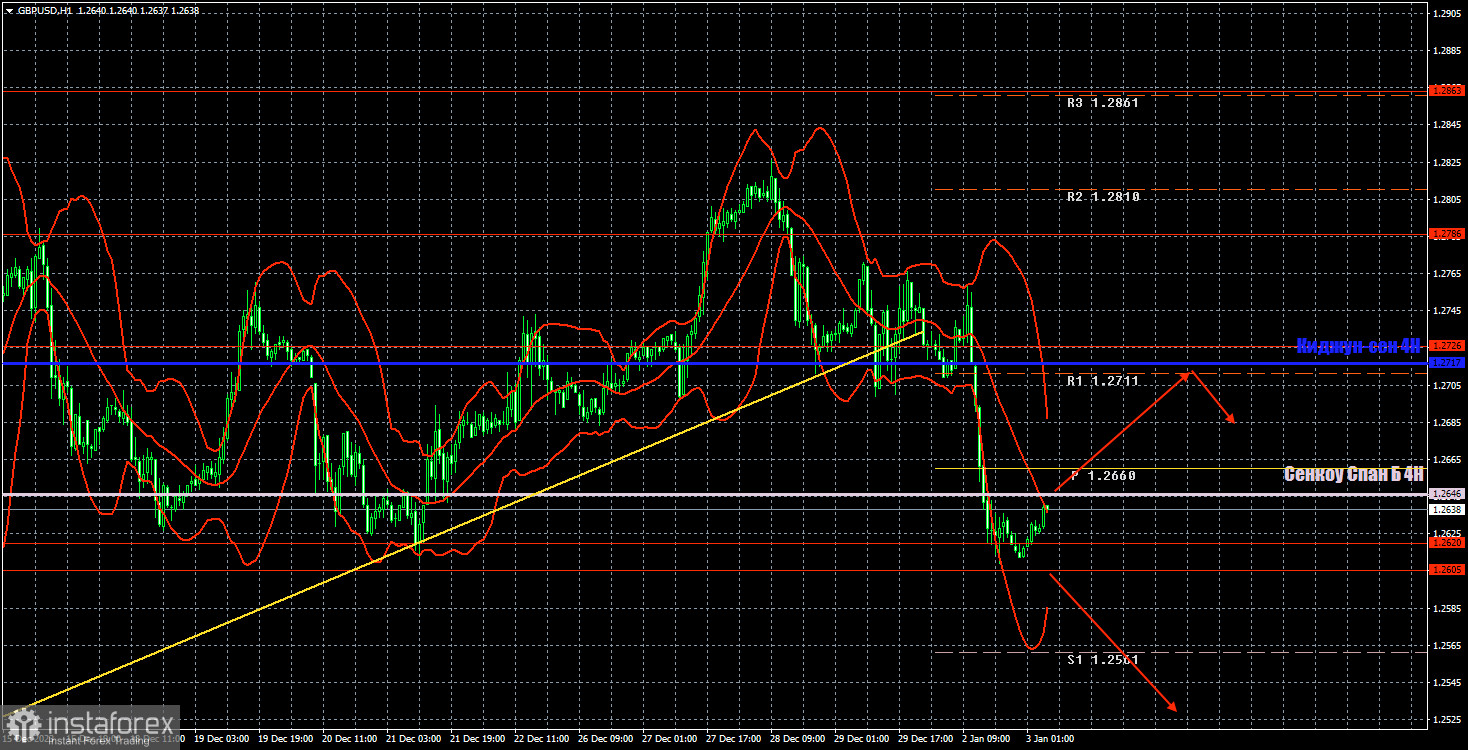

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD has finally started a downward movement that we have long been waiting for. We believe that the British pound doesn't have any good reason to strengthen in the long-term and it still doesn't. Therefore, at the very least, we expect the pair to return to the level of 1.2513. The price has finally crossed the trendline, passed below the Senkou Span B line, but we haven't breached the important area of 1.2605-1.2620. Therefore, an upward bounce is possible.

On Wednesday, we expect the pair to correct higher, possibly up to the Kijun-sen line. In case the pair bounces from this line or breaches the 1.2605-1.2620 area, you may consider new short positions using 1.2513 as a target, which we already mentioned. You can buy, but in small amounts. The pound has a limited potential to rise. The target is 1.2717.

As of January 3, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2513, 1.2605-1.2620, 1.2726, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B line (1.2646) and the Kijun-sen line (1.2717) lines can also serve as sources of signals. Don't forget to set a breakeven Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

Today, there are no significant reports lined up in the UK. From the US docket, we can look forward to two reports: JOLTs and the ISM Manufacturing PMI data. In the evening, the minutes of the FOMC meeting will be published. Market movements in the second half of the day can be quite volatile.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română