Since the end of 2021, the Japanese yen has weakened against the U.S. dollar by 20%. Central banks, led by the Fed, began to tighten monetary policy, while the Bank of Japan has still not moved away from monetary stimulus. As a result, the yield on Treasury bonds grew rapidly, its differential with Japanese counterparts widened, and USD/JPY quotes confidently moved upward. In November 2023, everything turned upside down.

The trigger was the BoJ, which began to discuss the harms and benefits of negative rates. Investors took this as a signal of normalization of monetary policy. Moreover, the Bank of Japan almost abandoned control over the yield curve, making the target range ceiling of 1% flexible. Experts at Bloomberg expect a tectonic shift in April – the Bank of Japan will raise the overnight rate for the first time in many years. Against the backdrop of declining borrowing costs by the Fed and other regulators, the divergence in monetary policy will start to favor the "bears" in USD/JPY.

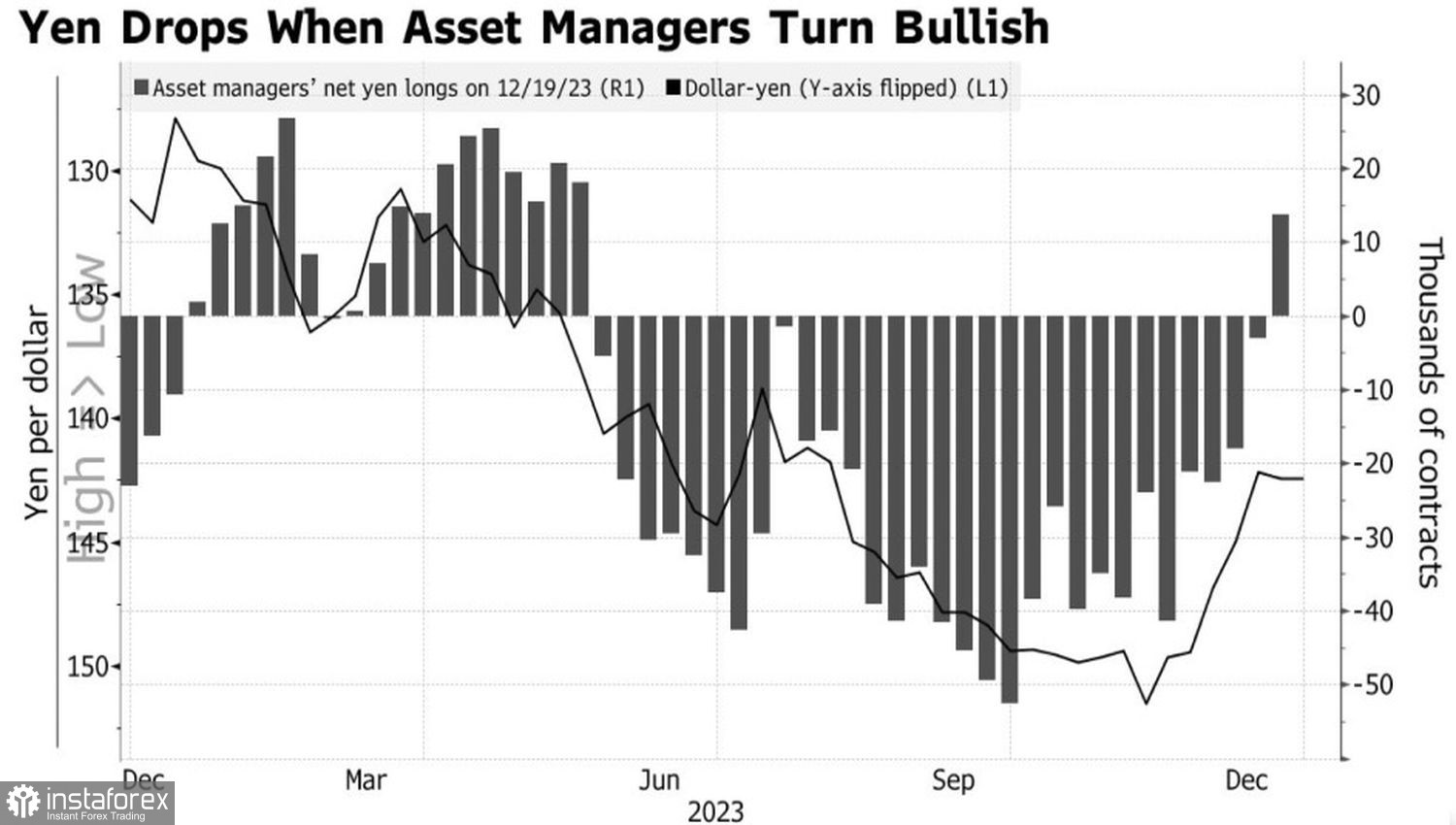

Markets grow on expectations. It's not surprising that, against this backdrop, the U.S. dollar lost about 6% of its value relative to the yen in November-December. Asset managers' positions on the Japanese currency in the futures market have become "bullish" for the first time in a long time.

Dynamics of Speculative Positions on the Yen

Jefferies warns USD/JPY bears not to get carried away. In recent years, as soon as speculators switched to the side of net yen buyers, the pair invariably went up, punishing asset managers for their carelessness. However, in 2022-2023, the Fed raised rates, and in 2024, it intends to lower them. As a result, the tailwind for the analyzed pair changed to a headwind.

Another thing is that the markets ran ahead of themselves. -150 basis points on the federal funds rate in the coming year is an overly aggressive scenario. The FOMC forecasts only -75 bps, and Bloomberg experts -100 bps. Investors are beginning to realize their mistake, the party for U.S. stock indices is ending, and their correction opens the door for a USD/JPY pullback.

The medium and long-term prospects of the pair will likely not change because of this. The divergence in monetary policy between the Fed and the Bank of Japan will lead to a narrowing of the differential between U.S. and Japanese bond yields and strengthen the downward trend in USD/JPY. For now, it should be assumed that the current upward movement of the pair is nothing more than a correction to the "bearish" trend. Fundamentally, nothing has changed; the market just needs a breather.

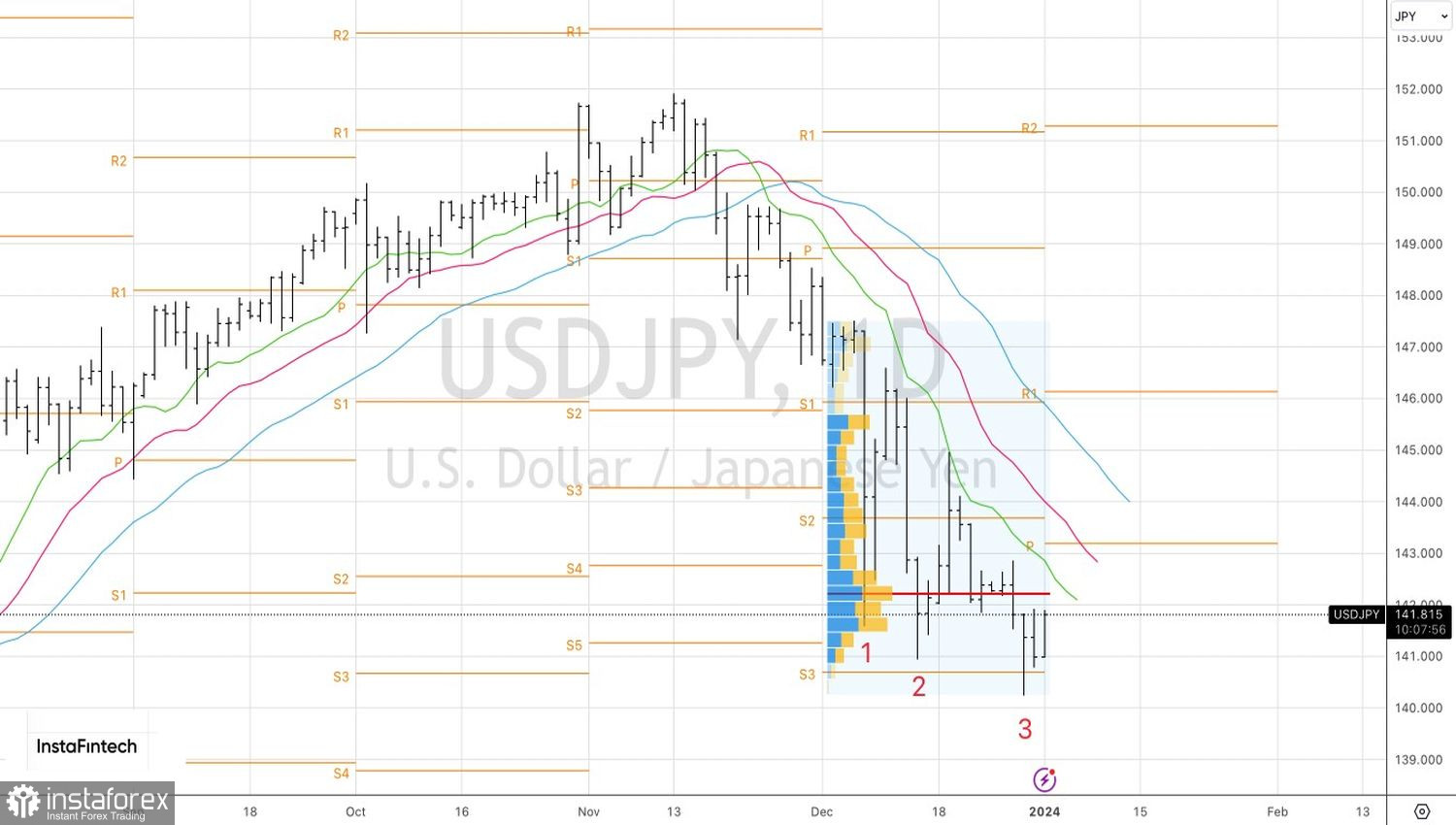

Technically, on the daily chart of USD/JPY, a Three Indians reversal pattern has formed. Its execution is key to the pullback. The weakness of the bears is also indicated by the pair's inability to storm the support near the pivot level of 140.7, as well as a bar with a long lower shadow. A breakout of the fair value at 142.2 will be an important argument in favor of buying the U.S. dollar against the Japanese yen.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română