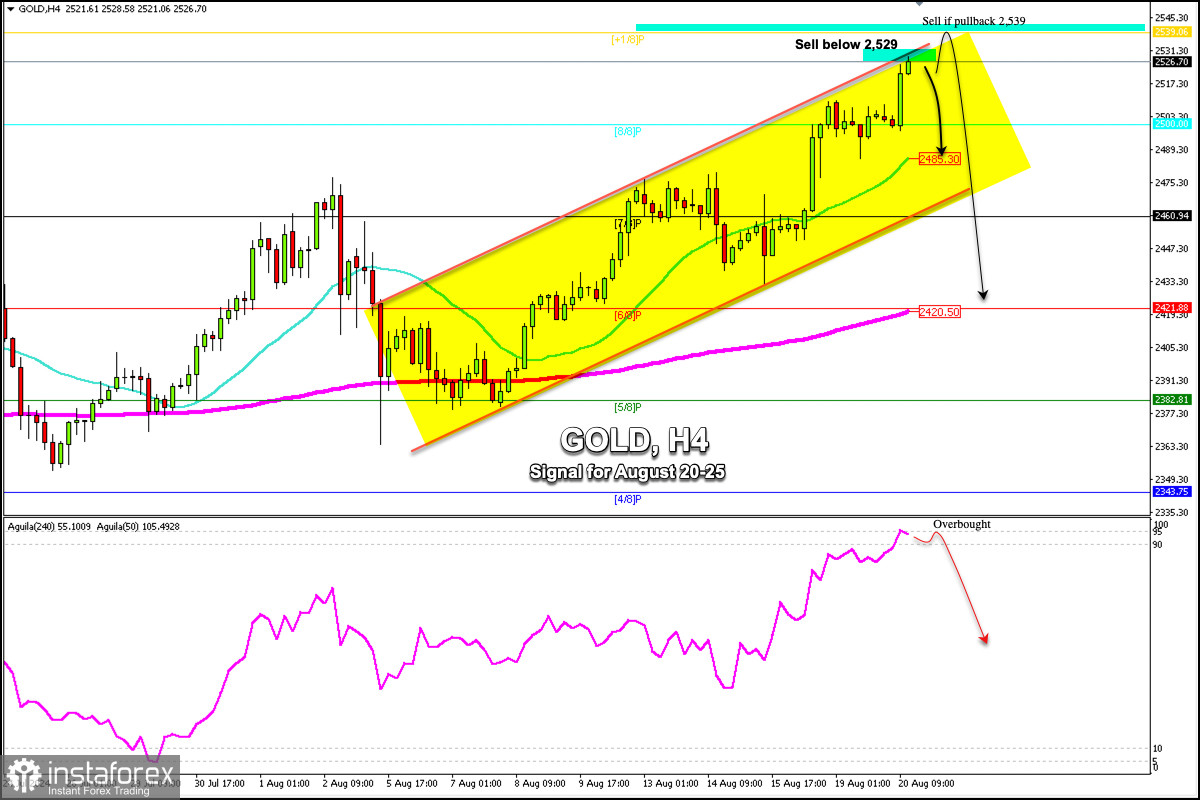

Early in the American session, gold (XAU/USD) is trading around 2,526.70, having reached the top of the uptrend channel. The price is approaching +1/8 Murray which represents strong resistance. Gold is in a key zone. We believe that if it continues its rise in the next few hours, it could find difficulties below 2,539.

If the price of gold drops below the zone between 2,529 and 2,539, it could be seen as an opportunity to sell, since technically the metal is overbought. Thus, a technical correction is expected in the coming days.

If gold faces strong resistance in the 2,529 area, it could turn around and make a strong technical correction and fall towards the 21 SMA area located at 2,485. Finally, the instrument could reach the 200 EMA which coincides with the 6/8 Murray around 2,420.

Because the market is reaching overbought levels and if your strategy is to buy, the key is to wait for the price to reach the psychological level of 2,500 to resume buying. Besides, we should wait for 2,485 to be hit where a technical bounce could occur.

Our trading plan for the next few hours is to sell below 2,527 or 2,539, with targets at 2,510, 2,500 and finally, at 2,485. The eagle indicator supports our bullish strategy, which means that a technical correction is imminent in the next few days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română