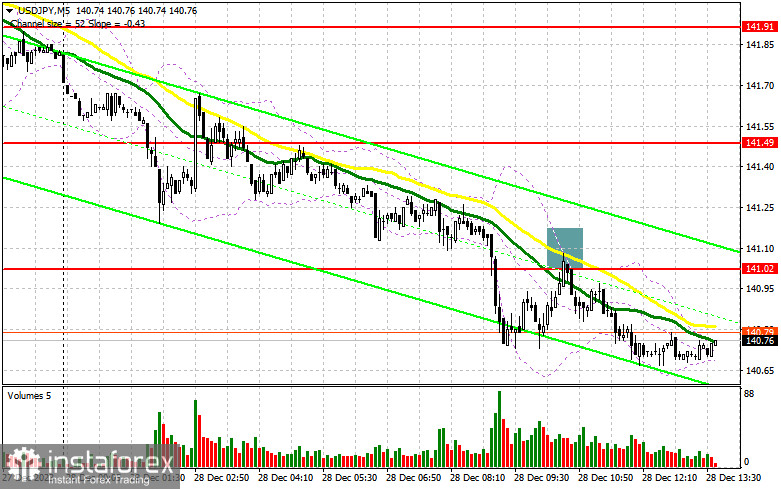

In my morning forecast, I drew attention to the level of 141.02 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. A breakout and a retest of 141.02 from bottom to top provided a good entry point for selling the pair, which resulted in a drop of more than 35 points. The technical picture was only slightly revised for the second half of the day.

To open long positions on USD/JPY, the following is required:

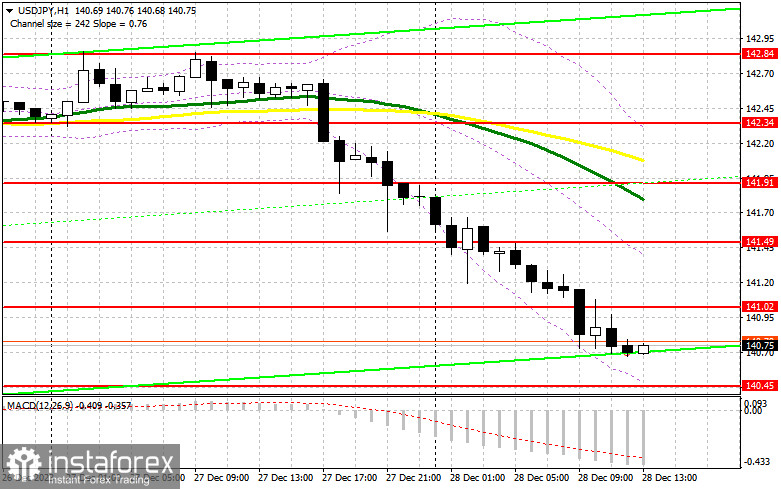

With strong statistics and a significant reaction of the pair to the data on initial jobless claims in the United States and changes in pending home sales, we can expect a small recovery in USD/JPY, which has already exceeded the monthly minimum. If the numbers disappoint, the pressure on the pair will persist, and we will eagerly observe further decline toward the support at 140.45, where I expect active buying to occur. Forming a false breakout would be the optimal scenario for opening long positions during the American session. The target for buyers in this case will be the resistance at 141.02, which played a supportive role earlier in the morning. A breakout and a retest from top to bottom of this range will lead to another entry point for buying, pushing USD/JPY to 141.49. The ultimate target will be the area around 141.91, where I plan to make a profit. This area also coincides with the location of the moving averages, which support bearish sentiment. In the scenario of a decline in the pair and the absence of activity at 140.45 from buyers, and keep in mind that our trend is downward, the pressure on the pair will increase, leading to a new round of selling. In this case, I will consider entering the market at around 139.91, but only a false breakout will signal long positions. I plan to buy USD/JPY immediately on a rebound only from the monthly minimum at 139.32 with the goal of a 30-35 point correction within the day.

To open short positions on USD/JPY, the following is required:

Sellers performed excellently in the first half of the day. To maintain the bearish trend, bears need to show themselves around the resistance at 141.02, where there will be a surge in case of positive labor market statistics in the United States. Only the formation of a false breakout at 141.02, similar to what I explained earlier, will confirm the presence of large players in the market and provide a selling signal capable of pushing USD/JPY towards 140.45. A breakthrough and a retest from the bottom to the top of this range will deal a more serious blow to the buyers' positions, triggering stop orders and opening the path to 139.91. The more distant target will be the area around 139.32, where I plan to take profit. In the scenario of USD/JPY rising and the absence of activity at 141.02 in the second half of the day, profit-taking may begin, leading to an upward correction in USD/JPY. In this case, postponing sales until testing the next resistance at 141.49 is best. In the absence of downward movement, I will sell USD/JPY immediately on a rebound only from 141.91, but with the expectation of a downward correction of the pair by 30-35 points within the day.

Indicator signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The author on the H1 chart determines the period and prices of moving averages and differs from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator at 140.45 will act as support.

Indicator Descriptions:

• Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

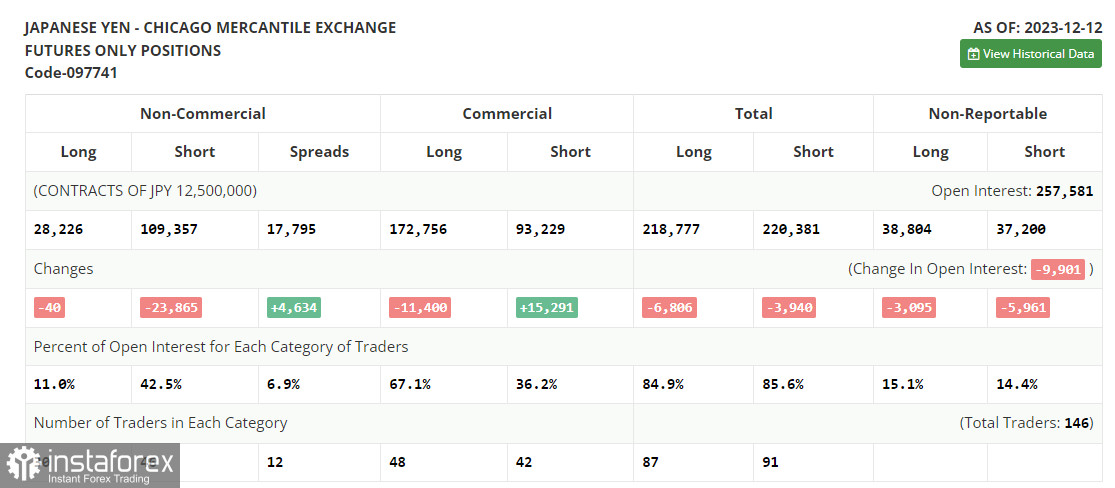

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' long and short positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română