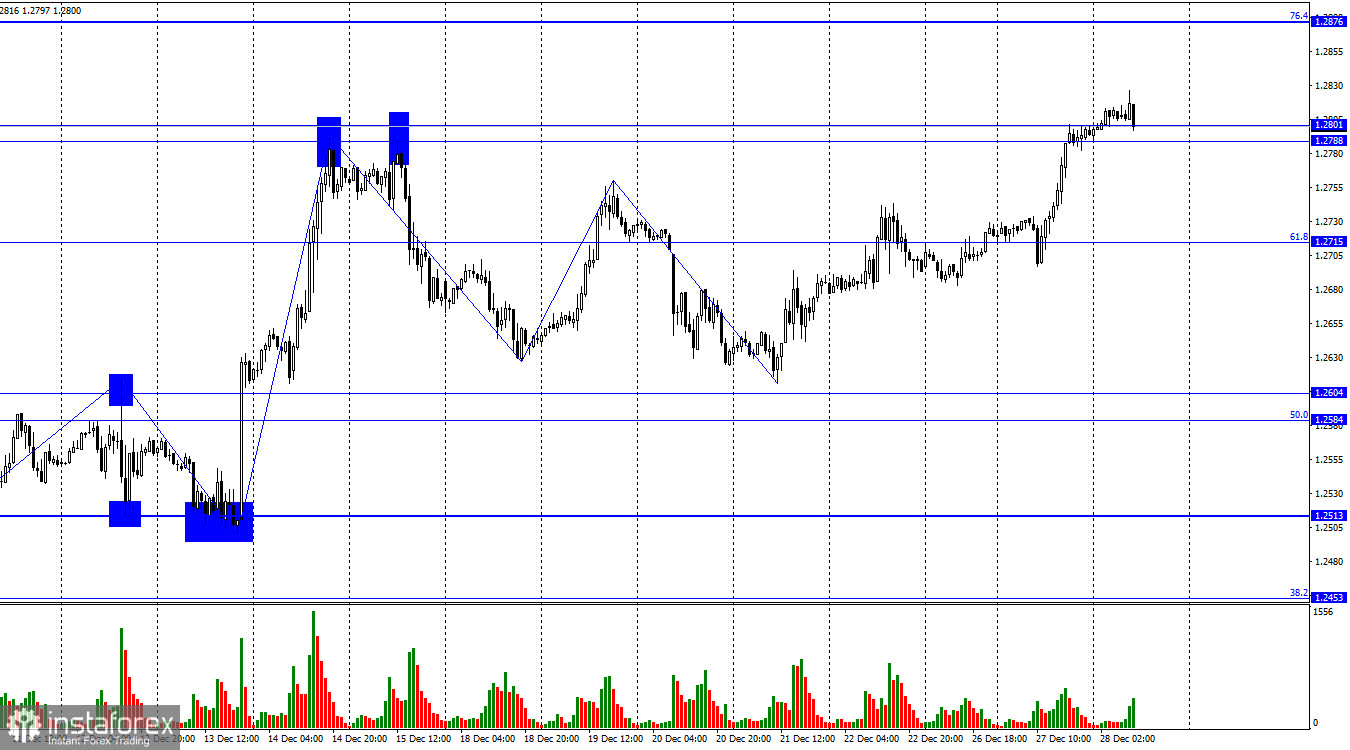

On the hourly chart, the GBP/USD pair has risen to the resistance zone of 1.2788–1.2801 and held above. This consolidation allows us to count on further growth towards the next Fibonacci level of 76.4%–1.2876. Closing the pair's rate below the zone of 1.2788–1.2801 will favor the US dollar and initiate a new decline toward the corrective level of 61.8% (1.2715). It is worth noting that the British pound does not have such a strong "bullish" trend as the euro. Thus, a decline in the pound sterling is still possible this week.

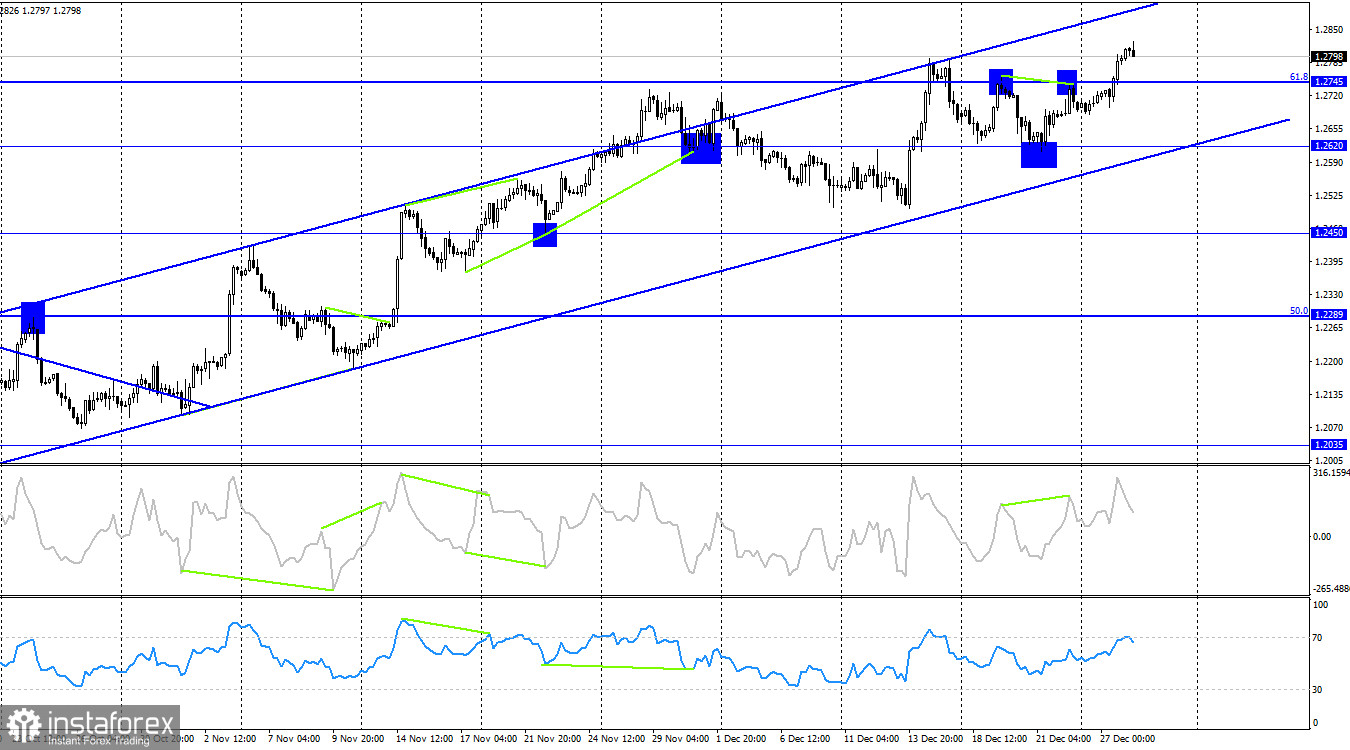

The situation with waves could be clearer. Trends change too frequently and become shorter. The latest "bullish" trend is just one wave. The last downward wave barely broke the lows of the previous wave. The last upward wave broke the last two peaks but can still become a single wave. Waves currently need to provide an answer to the question of future direction. The information background needs to be present, and the market actively takes advantage of it, but while the situation is clear for the euro, it is rather complicated for the pound.

Throughout the current week, there will be a consistent lack of news and important events. It is worth noting that even the speeches of politicians, bankers, and officials should not be counted on, as almost all of them have gone on Christmas and New Year holidays. As we can see, the British pound strengthened significantly yesterday, but not many expected such a move. Today and tomorrow should be based solely on levels since no other signals will exist.

On the 4-hour chart, the pair has risen to the Fibonacci level of 61.8% (1.2745) and held above. Thus, there was a reversal in favor of the British currency, and the growth process towards 1.3044 has resumed. The ascending trend corridor still characterizes traders' sentiment as "bullish," and at the moment, there are no signs of this trend ending. There are no new impending divergences right now. I will expect the beginning of a "bearish" trend only after closing below the ascending corridor.

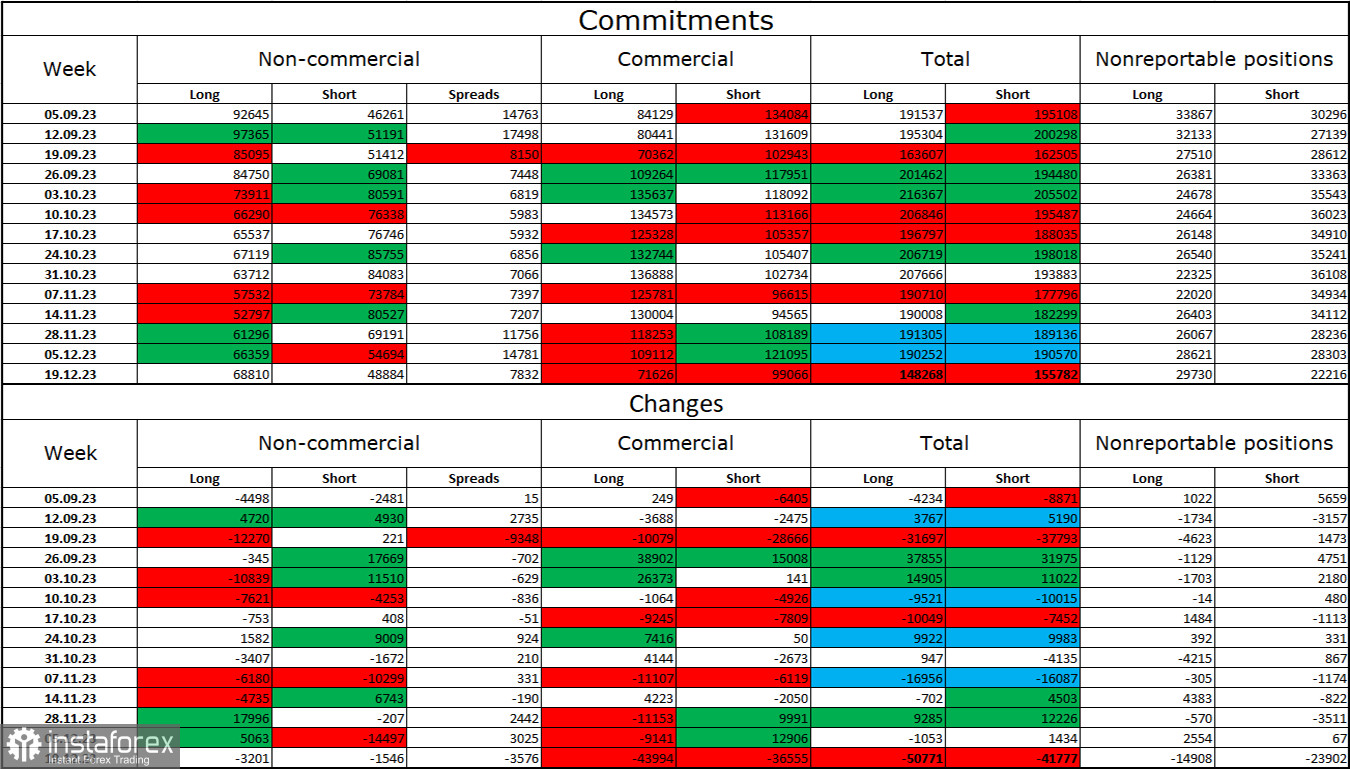

Commitments of Traders (COT) Report:

The sentiment in the "non-commercial" trader category has hardly changed over the past reporting week. The number of long contracts held by speculators decreased by 3,201 units, while the number of short contracts decreased by 1,546. The overall sentiment of major players changed to "bearish" a few months ago, but at present, bulls have the upper hand again. The gap between long and short contracts is increasing in favor of bulls: 68,000 against 48,000. The British pound still has excellent prospects for further decline. I do not expect a significant rise in the pound soon. Over time, bulls will continue to get rid of buy positions since the long-term information background currently favors the dollar. The recent growth we've seen in the past two months is a correction.

News Calendar for the US and the UK:

On Thursday, the economic events calendar contains a few interesting entries. The impact of the information background on market sentiment will be absent today.

Forecast for GBP/USD and Trader Tips:

Buy opportunities for the British pound were possible yesterday after holding above the 1.2715 level on the hourly chart. The nearest targets at 1.2788 and 1.2801 have been reached. Today, I doubt the continuation of the pound's growth and selling can be considered if the pair consolidates below the zone of 1.2788–1.2801 with a target of 1.2715.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română