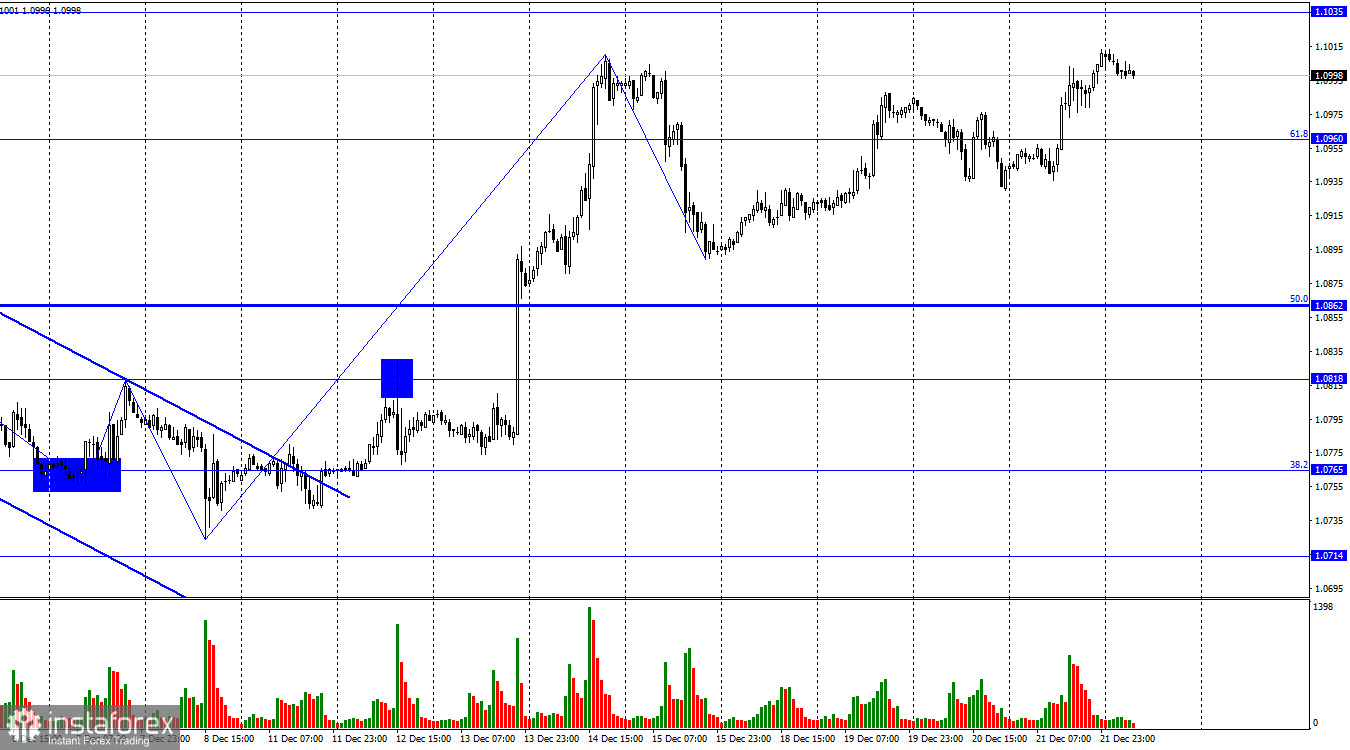

On Thursday, the EUR/USD pair executed a new reversal in favor of the European currency and consolidated above the corrective level of 61.8% (1.0960). Thus, the upward process may continue toward the next level at 1.1035. A rebound of the pair's rate from this level will favor the US currency and some decline towards 1.0960. Closing quotes above 1.1035 increase the likelihood of continued growth towards the next Fibo level of 76.4% (1.1081).

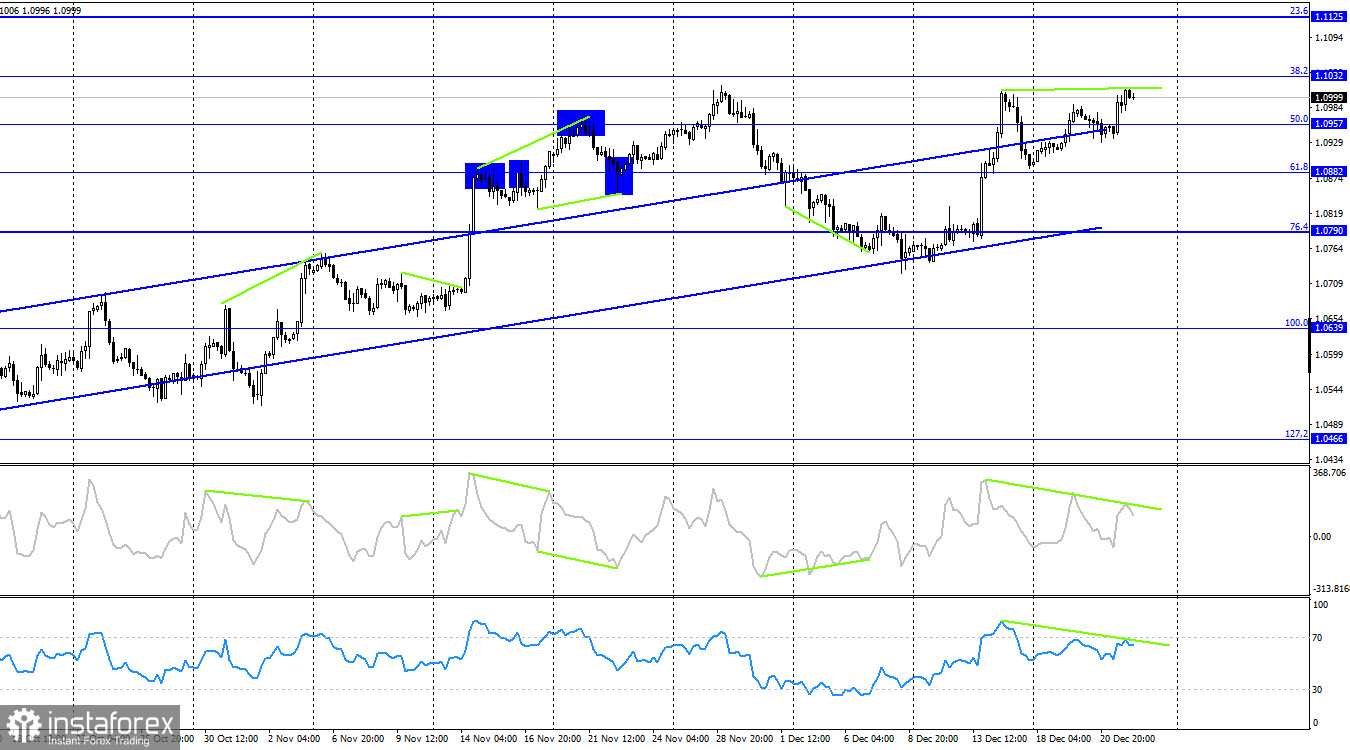

The wave situation remains quite clear. The last downward wave was too weak to consider the "bullish" trend completed. The new upward wave reached the previous peak but has not yet broken it. If there is no breakout, it will be the first sign of the completion of the "bullish" trend. If, in the future, the new downward wave confidently breaks the low from December 15, it will be the second sign of a trend reversal.

The key and perhaps the only event of the past day was the US GDP report. The final value for the third quarter was 4.9%. Based on the two previous estimates, traders expected a slightly higher value, and the figure of 4.9% disappointed them. Bullish traders became active again, and the US dollar fell again. The US currency is not experiencing the best times right now. Over the past month and a half, too much economic data has turned out worse than the market expected, and the meetings of the Fed and the ECB have shown that the US regulator may be the first to cut interest rates in 2024. All these factors are putting pressure on the US currency.

The current scenario does not suggest a potential decline in the pair, as neither the chart pattern, wave pattern, nor the information background provide indications for such a move. It is likely, but there are no signs of its beginning yet.

On the 4-hour chart, the pair has consolidated above the corrective level of 50.0% (1.0957), allowing it to continue its growth towards the next Fibo level of 38.2% (1.1032). The impending "bearish" divergence in CCI and RSI indicators warns of a possible reversal in favor of the dollar and the start of a decline toward the level of 1.0882. The ascending trend corridor continues to characterize the current sentiment of traders as "bullish."

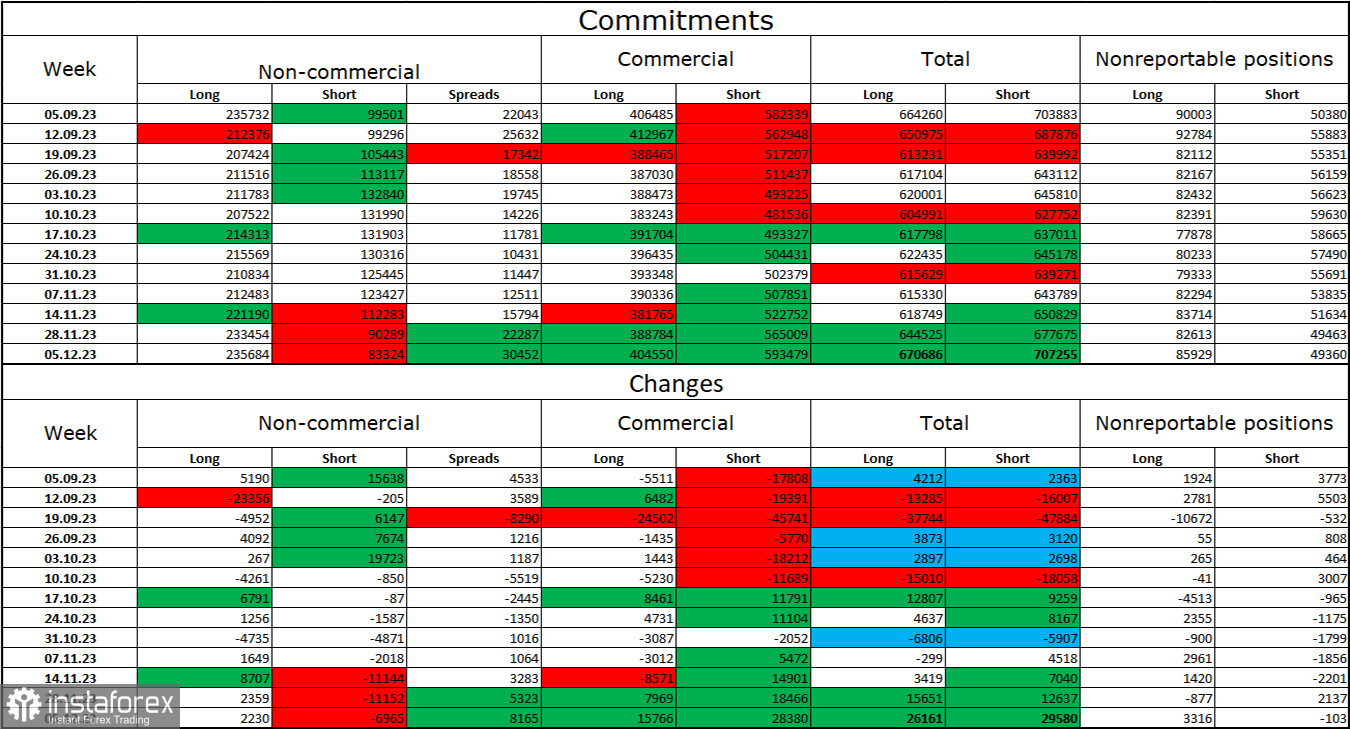

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 2,230 long contracts and closed 6,965 short contracts. The sentiment of major traders remains "bullish" and is intensifying again. The total number of long contracts concentrated in the hands of speculators now stands at 235 thousand, while short contracts amount to only 83 thousand. The difference is again threefold. However, the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong background of information to maintain the "bullish" trend. I do not see such a background now, although the situation may change after the Fed and ECB meetings. Professional traders may resume closing Long positions soon. The current figures allow for a resumption of the decline in the euro in the coming months.

News Calendar for the US and the Eurozone:

US – Core Personal Consumption Expenditures Price Index (13:30 UTC).

US – Durable Goods Orders (13:30 UTC).

US – Personal Income and Outlays (13:30 UTC).

US – University of Michigan Consumer Sentiment Index (15:00 UTC).

On December 22, the economic events calendar contains several important entries in the US. The impact of the information background on trader sentiment today may be of moderate strength.

EUR/USD Forecast and Trader Tips:

Buying the pair was possible yesterday when closing above the 1.0960 level on the hourly chart. Targets are 1.1035 and 1.1081. Today, a rebound from the 1.1035 level or closing below 1.0960 on the hourly chart will allow selling the pair with a target of 1.0862.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română