Analysis of EUR/USD 5M

EUR/USD failed to overcome the level of 1.0935 and rose to the level of 1.1006 again. If last week's growth was due to an important fundamental background that genuinely supported the euro and acted against the dollar, then yesterday and the day before (and throughout the current week), there was no such background. The pair simply increased by 100 pips, which is its peak values. And that's all the market needs to know about the logic behind the current movements. Someone might say that yesterday's US Q3 GDP report turned out to be worse than expected, which triggered the dollar's fall. However, if we look at the 5-minute chart – the pair started to fall even before the report was published, and after its release, the US dollar did not fall. Therefore, the GDP report is not relevant here. It certainly did not push traders to buy the dollar, but it also didn't trigger the decline.

Currently, the price continues to stay above all Ichimoku lines, and there is still no signs of a downtrend. When we say that we expect the pair to fall, this means that we rely on the overall fundamental background. The technical aspect supports the euro's growth.

Speaking of trading signals, only one was generated yesterday. Throughout the European session, the pair was in the range of 1.0935-1.0949, and at the end of it, EURUSD finally settled above this mark. Traders could open long positions based on this signal, and by the end of the day, the pair rose to the level of 1.1006, where long positions could be closed. The profit was about 40 pips.

COT report:

The latest COT report is dated December 12. In the first half of 2023, the net position of commercial traders hardly increased, but the euro remained relatively high during this period. Then, the euro and the net position both decreased for several months, as we anticipated. However, in the last few weeks, both the euro and the net position have been rising. Therefore, we can conclude that the pair is correcting higher, but the correction cannot last long because it is still a correction.

We have previously noted that the red and green lines have moved significantly apart from each other, which often precedes the end of a trend. Currently, after a small correction, these lines are diverging again. Therefore, we stick to the scenario that the upward trend should come to an end. During the last reporting week, the number of long positions for the "non-commercial" group decreased by 3,800, while the number of short positions increased by 1,100. Consequently, the net position decreased by 4,900. The number of BUY contracts is still higher than the number of SELL contracts among non-commercial traders by 148,000. In principle, it is now evident even without COT reports that the euro should continue to fall.

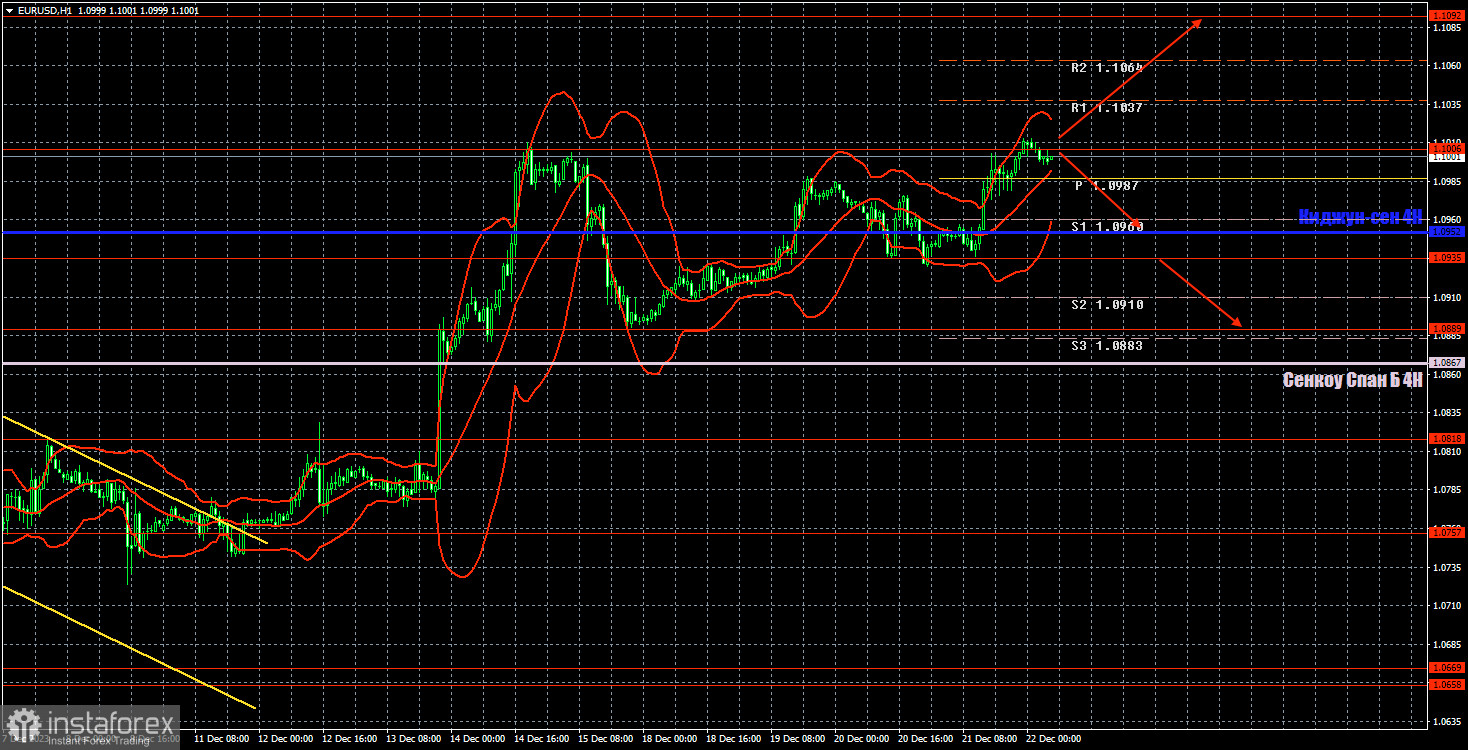

Analysis of EUR/USD 1H

On the 1-hour chart, EUR/USD has climbed to the level of 1.1000 for the second time. We believe that the euro has risen very high already, but this week the price is increasing again instead of falling, although it has no good reason to do so. Therefore, we can only go with the trend right now.

Today, we will consider the rebound from the level of 1.1006 as a potential sell signal. The level of 1.1006 is not only a level but also the pair's last peak. A rebound is quite possible. If this happens, you can consider shorts with targets at 1.0935 and 1.0889. You can also consider longs after consolidating above the level of 1.1006 using 1.1092 as a target.

On December 22, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0818, 1.0889, 1.0935, 1.1006, 1.1092, 1.1137, as well as the Senkou Span B (1.0867) and Kijun-sen (1.0952). The Ichimoku indicator lines can shift during the day, so this should be taken into account when identifying trading signals. There are also auxiliary support and resistance levels, but signals are not formed near them. Signals can be "bounces" and "breakouts" of extreme levels and lines. Don't forget to set a breakeven Stop Loss if the price has moved in the right direction by 15 pips. This will protect against potential losses if the signal turns out to be false.

On Thursday, there are no important reports or events lined up in the European Union. The US docket will feature important reports on durable goods orders and personal consumption expenditures. In the evening, the consumer sentiment index from the University of Michigan will be released. If the reports turn out to be weak, the dollar may continue to fall.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română