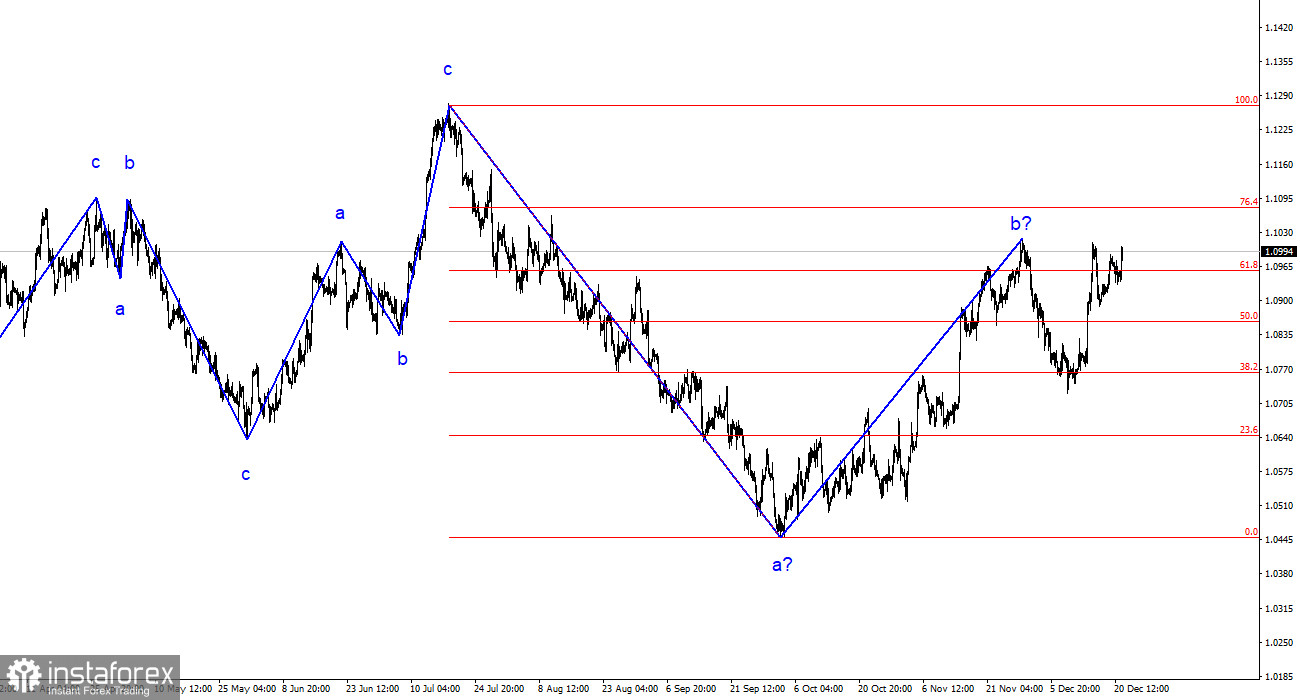

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. The construction of another three-wave structure - a downward one - is continuing. Perhaps the presumed waves 1 and 2 are completed, suggesting that the pair has moved on to building the third wave, which should lead to a decrease in the pair to the area of the 4th figure and below. The risk of complicating the presumed wave 2 or b persists since the market is unstable, and the news background can be interpreted in favor of any currency. Nevertheless, I expect a resumption of the decline in the euro quotes.

Regardless of how wave 2 or b ultimately turns out (it may take an even more protracted form), the overall decline of the European currency will only be completed if, in any case, the construction of the third wave of the downward trend is required. The only option is the complication of the entire wave structure of recent months to an unrecognizable state.

The euro/dollar pair slightly increased on Thursday. But this "slight" was enough for the US dollar to retreat again. It retreated in a situation where there was no longer anywhere to retreat. The current wave analysis suggests a significant decrease in the pair right now. Otherwise, the entire wave picture may change beyond recognition. The strengthening of the American currency could have started a month or a month and a half ago. However, first (in November), the market received a whole series of unfavorable reports from the United States, which postponed the dollar's rise. In December, the results of the Fed and ECB meetings were such that the market had no choice but to reduce demand for the US currency. And today, the final GDP report for the third quarter was released.

This report requires a more detailed examination. Initially, economic growth was forecasted at 4.8-4.9%, but the first and second estimates showed growth at 5.2%. This information helped the dollar greatly, but the report was still on its side. Today, it has become known that the US economy grew by only 4.9%, as originally expected. And the dollar collapsed. It did not rise on the first and second (more optimistic) estimates but instead began to fall again on the third estimate, which did not differ from the original forecast. The dollar ran into total bad luck. As soon as the market seemed ready to build wave 3 or c, a disastrous report came out in the United States (or disastrous from the market's point of view), and the American currency came under pressure again.

General conclusions.

Based on the analysis, the construction of a downward set of waves continues. Targets around the level of 1.0463 have been perfectly worked out, and the unsuccessful attempt to break through this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so I expect the construction of an impulsive downward wave 3 or c with a significant decrease in the pair soon. I still expect a decline with targets located below the low of wave 1 or a. Stop-loss orders can be placed above the peak of the presumed wave 2 or b.

On the larger wave scale, it can be seen that the construction of a corrective wave 2 or b continues, which, in length, is already more than 61.8% from the first wave, according to Fibonacci. As I have already said, this is not critical, and the scenario with the construction of wave 3 or c and a decrease in the pair below the 4th figure remains in force.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română