The drop in U.S. stock indices did not significantly scare the bulls on EUR/USD. They attributed the peak in the S&P 500 to extreme activity in the options market, which was likely of a temporary nature. The main driver of the broad stock index rally from October to December, in the form of expectations of a loosening of the Federal Reserve's monetary policy, remains in force. Especially considering that FOMC officials talk about the need for monetary expansion.

Philadelphia Federal Reserve President Patrick Harker supported the bullish attacks on EUR/USD by stating that rates needs to be lowered. However, the Federal Reserve does not intend to do so immediately, which is surprising since just three weeks ago, officials were convinced of the need for a prolonged keeping of borrowing costs at a plateau; and now they openly abandon their views. This does not give the U.S. dollar peace of mind.

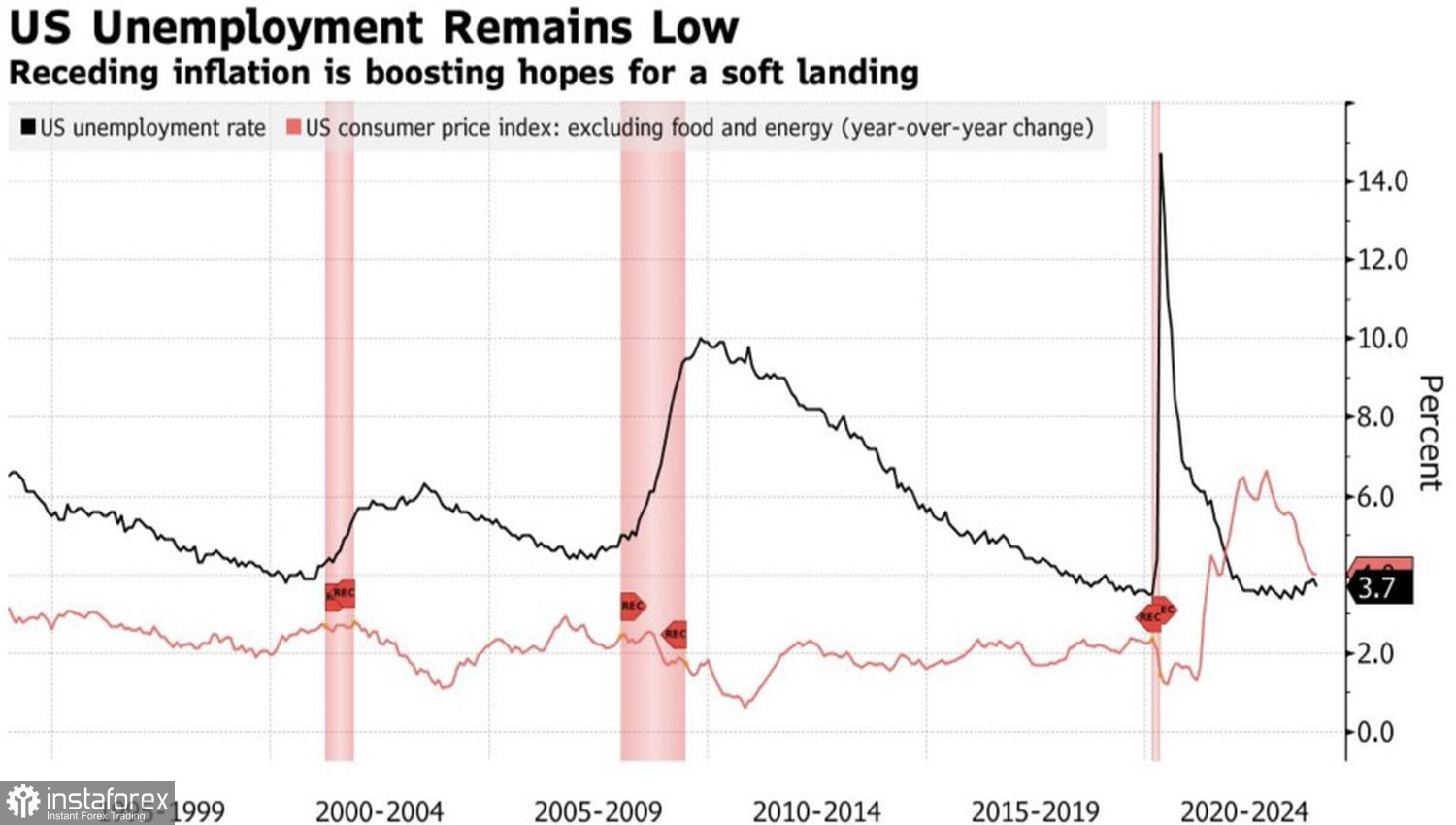

So why lower interest rates? If inflation is plummeting, borrowing costs at 5.5% are a kind of monetary restriction. It cools the labor market and the economy as a whole. Moreover, no one has canceled the connections between indicators. If prices are falling rapidly, unemployment should rise. Its acceleration is a matter of time. To prevent this, a reduction in the federal funds rate is required.

U.S. Inflation and Unemployment Dynamics

The logic of the Federal Reserve is understandable. The central bank does not want to bring the U.S. economy into a recession, hopes for a soft landing, and will do everything possible for this. However, in reality, what needs to be feared is not a GDP downturn, but its acceleration. The financial conditions softened by the dovish pivot of the Federal Reserve can heat up the American economy to a bright red. As a result, inflation will rise again, and Jerome Powell and his colleagues will be forced to return to the idea of resuming the cycle of monetary restriction.

Investors understand this perfectly. Therefore, good news from the United States becomes bad for the S&P 500 and EUR/USD, and vice versa. Positivity increases the chances of both a soft landing and GDP acceleration. Negativity brings a recession closer. In the event of a recession, the Federal Reserve will definitely lower the federal funds rate, so neither stocks nor the euro should fear a downturn in the US economy.

Everything is clear with the Federal Reserve. As for the ECB, its leading or lagging actions compared to American colleagues will depend on the state of the eurozone economy. It may already be in a recession, implying an earlier start to the easing of monetary policy and pressure on the euro. However, for now, ECB officials are doing their best to convince investors that the market is wrong.

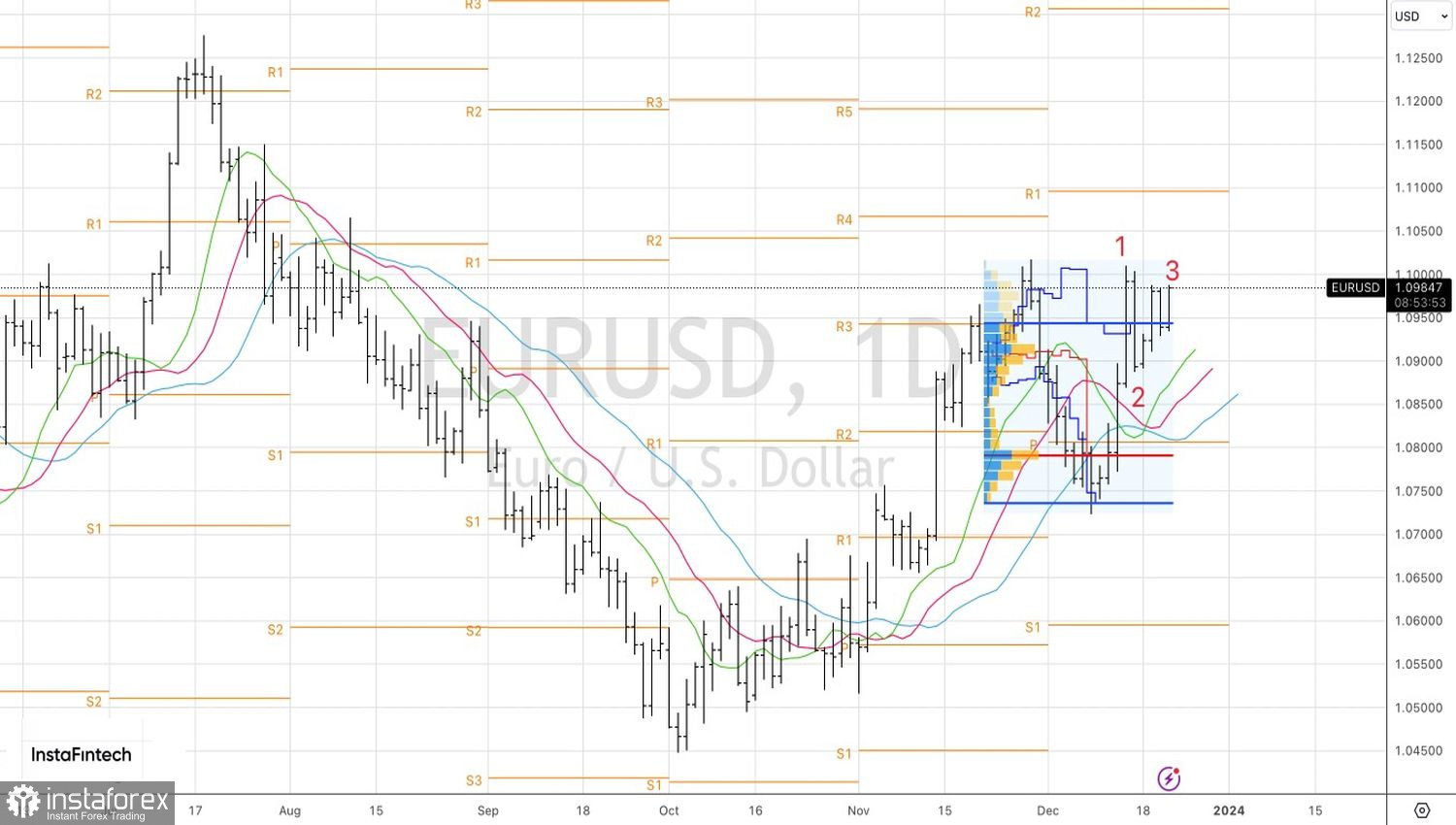

Technically, on the daily chart of EUR/USD, the bulls are trying to play out an inside bar. A successful assault on resistance at 1.0985 will increase the risks of updating the December high and will be the basis for forming long positions. Conversely, the inability of buyers to do so is a sign of their weakness. At the same time, the return of the euro to the fair value range of 1.0735-1.0945 is a reason for selling.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română