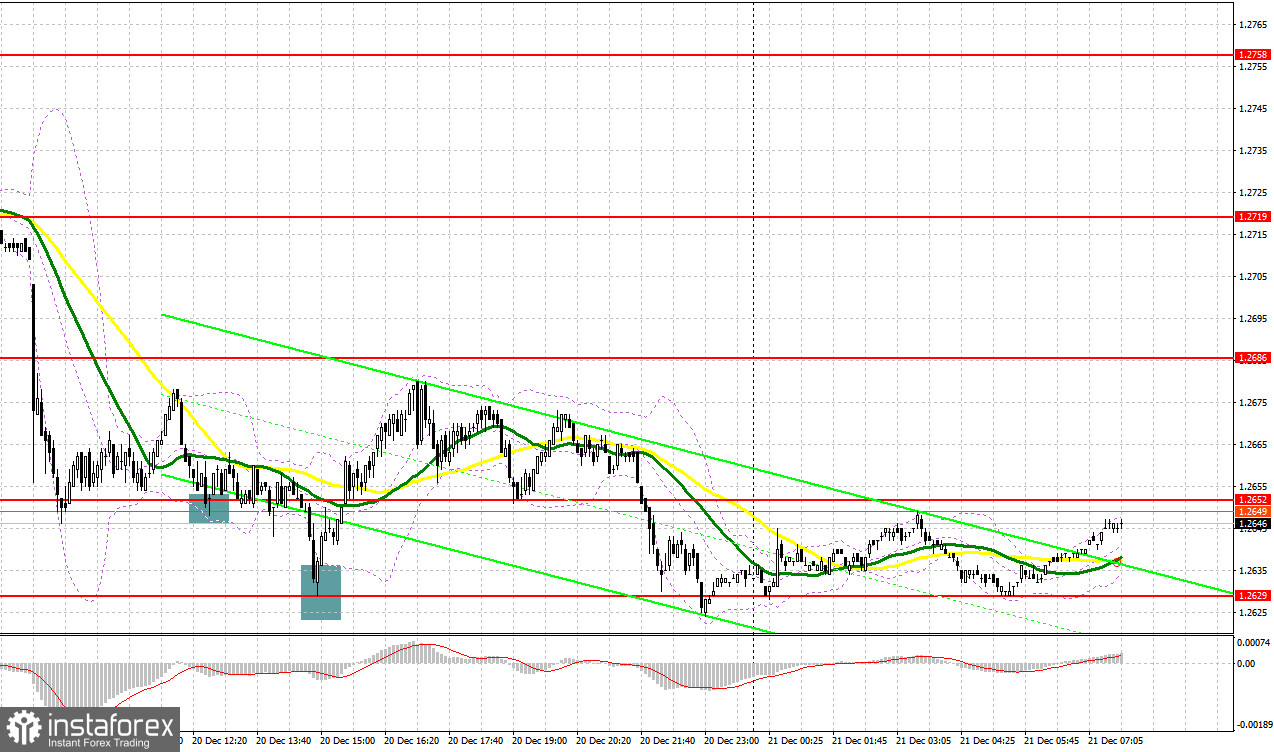

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2652 as a possible entry point. A decline and a false breakout at this mark generated a buy signal. As a result, the pair rose by more than 25 pips. In the afternoon, after the pound fell, safeguarding 1.2629 produced a buy signal, which sent the pair up by 49 pips.

For long positions on GBP/USD:

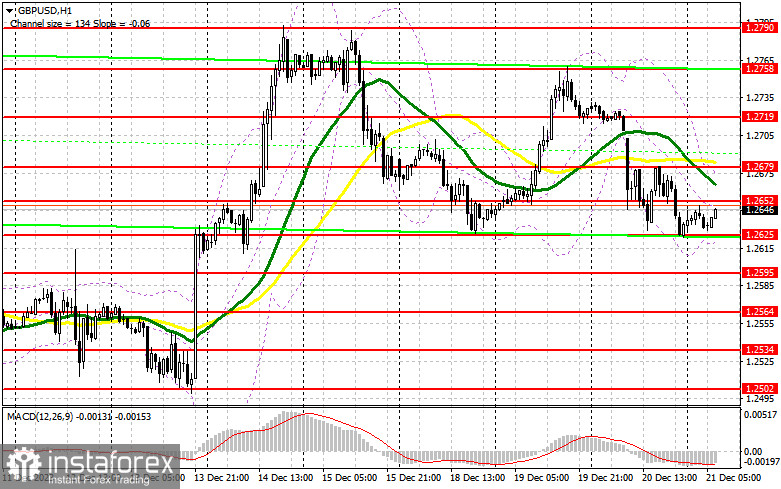

News that UK inflation fell in November exerted pressure on the pound, as the chances that the Bank of England will cut rates in the first half of 2024 increased significantly. Despite the bulls' best attempts to push the pair to recover, it didn't work. Today, we have the UK public sector net borrowing figures and retail sales according to the Confederation of British Industry. A decline in retail sales is another signal that the UK inflation will continue to fall, which is bad for the pound. In this case, before buying we would like to see a false breakout form at 1.2625. This will create a buy signal, with the goal of pushing the pair to the area of 1.2652. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2679, which is in line with the bearish moving averages. The furthest target will be the area of 1.2719, where I will take profits. If the pair falls and there is no buying activity at 1.2625, and most likely that will be the case, only a false breakout near the next support at 1.2595 will signal opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.2564, aiming for an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers have the chance to support the corrective phase. In this case, the bears need to defend the nearest resistance at 1.2652. Forming a false breakout there after the release of UK data would be a good reason to open short positions with the goal of moving the price down and a test of the support at 1.2625. A breakout and an upward retest of this range will deal a more serious blow to the buyers' positions, leading to the removal of stop orders and opening the way to 1.2595, where the buyers will be more active. The furthest target will be 1.2564, where I will take profits. If GBP/USD rises and there is no activity at 1.2652 in the first half of the day, the only thing the bulls will achieve is getting the pair to trade in the sideways channel. In such a scenario, I would delay short positions until a false breakout at 1.2679. If there is no activity there either, I will sell GBP/USD immediately on a bounce right from 1.2719, considering a downward correction of 30-35 pips.

COT report:

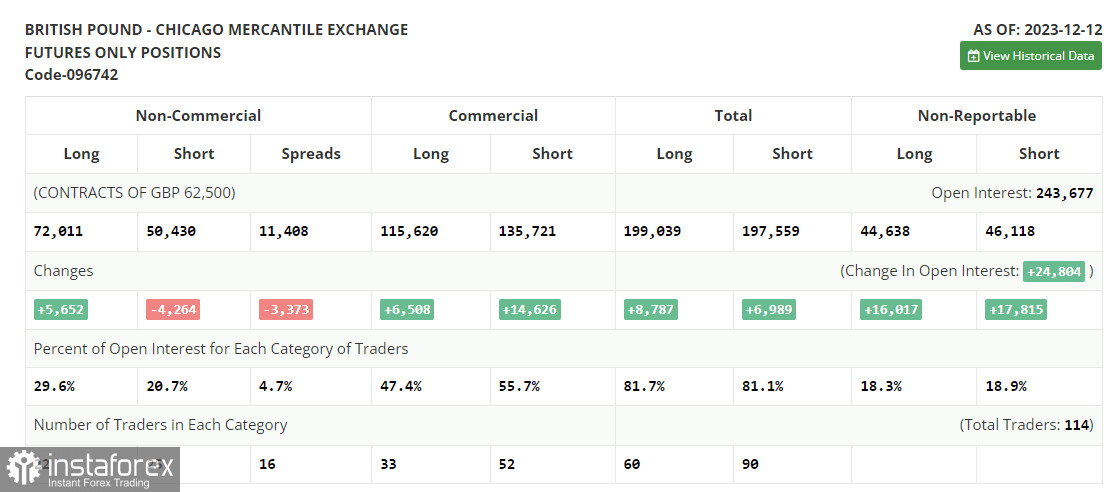

The Commitment of Traders (COT) report for December 12 showed an increase in long positions and a decline in short ones. Obviously, there is still demand for the pound, as the Bank of England's recent decision to leave interest rates unchanged as it continues its fight to curb inflation, as well as statements by BoE Governor Andrew Bailey that rates will remain high for an extended period, has revitalized the pound. As a result, the British currency strengthened against the U.S. dollar. Another thing is how the UK economy, which has been struggling lately, will react to all this. A batch of UK and US inflation data will be released soon, and if prices rise, we can bet on the pair's further growth. The latest COT report indicates that non-commercial long positions rose by 5,652 to 72,011, while non-commercial short positions were down by 4,264 to 50,430. As a result, the spread between long and short positions decreased by 3,373.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower border near 1.2625 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română