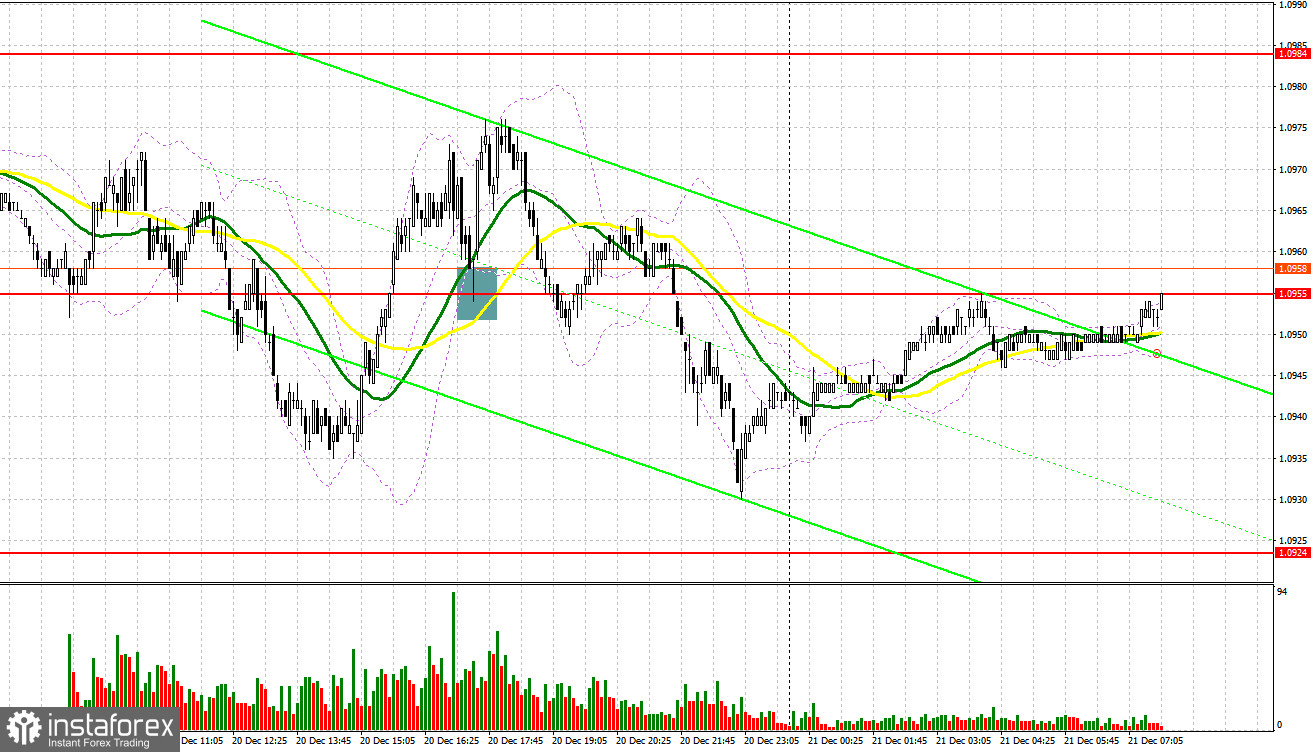

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0955 as a possible entry point. A decline and a false breakout at 1.0955 produced a buy signal, but after the pair rose by 15 pips, major players became less active. In the afternoon, long positions near 1.0955 could bring about 20 pips of profit and that was the end of it.

For long positions on EUR/USD

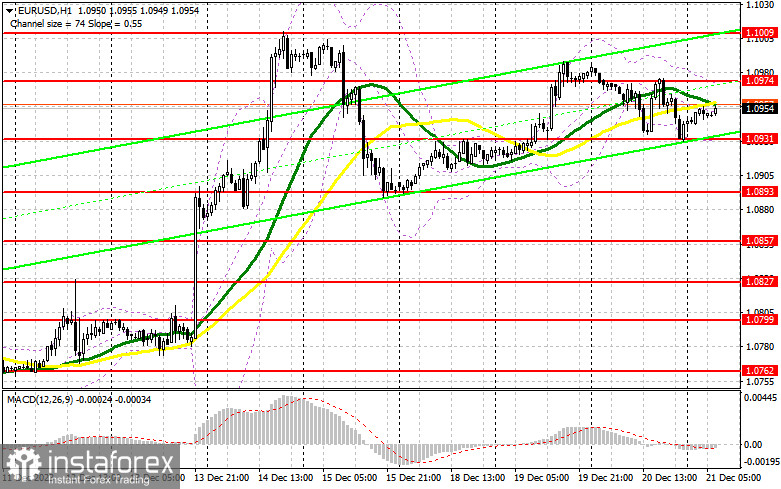

Yesterday's strong US data on the consumer confidence indicator exerted pressure on the euro, and the pair traded in a sideways channel, which limited the euro's growth potential. In the absence of economic reports in the first half of the day, I expect low volatility and bulls' attempts to return to yesterday's high. If the pair remains under pressure, I will act on a false breakout near the support at 1.0931. An unsuccessful consolidation below this level will confirm the entry point for long positions, in hopes that the euro will recover and test the nearest resistance at 1.0974, established yesterday. A breakout and a downward test of this range will produce a buy signal and a chance to bring back the uptrend, with the prospect of testing 1.1009. The furthest target would be this month's new high at 1.1041, where I plan to take profits. If EUR/USD declines and there is no activity at 1.0931, we can expect a sharp fall. In this case, it will be possible to enter the market after forming a false breakout near 1.0893. I will open long positions immediately on a rebound from 1.0857, bearing in mind an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

The sellers succeeded in stopping the progress of the bull market and now the most important thing is not to miss 1.0974. Slightly below this level, we have the moving averages that favor the bears. Forming a false breakout at 1.0974 will generate a sell signal with the goal of testing the lower band of the sideways channel and the nearest support at 1.0931, established yesterday. Only after a breakout and consolidation below this range, as well as an upward retest, do I expect another sell signal at 1.0893. The lowest target will be 1.0857, where I will take profits. In case of an upward movement of EUR/USD during the European session, as well as the absence of the bears at 1.0974, I will postpone selling the pair until the price tests the next resistance at 1.1009. There, selling is also possible but only after a false breakout. I will open short positions immediately on a rebound from 1.1041 aiming for a downward correction of 30-35 pips.

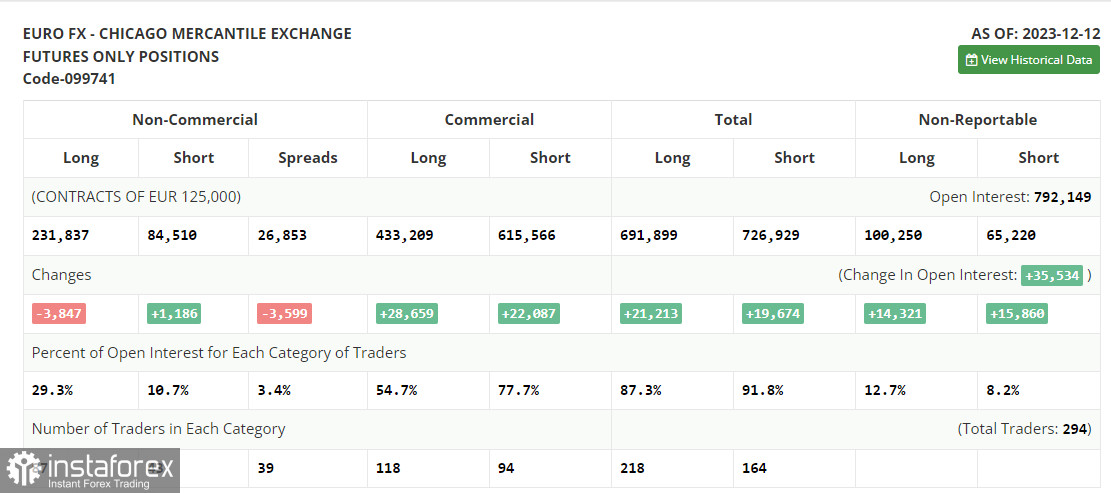

COT report:

The COT report for December 12 indicates a decrease in long positions and an increase in short ones. Obviously, the Federal Reserve's December meeting and its sudden pivot together with the European Central Bank's tough stance had a minor effect on the positioning of major players, as buyers of risky assets clearly have the advantage. A number of reports related to inflation in the eurozone and the US will be released soon, which will throw light on the Fed's stance on 2024. But whatever the data, we will expect further growth from the euro in the medium term. The COT report indicated that long non-commercial positions fell by 3,847 to 231,837, while short non-commercial positions increased by 1,186 to 84,510. As a result, the spread between long and short positions decreased by 3,599.

Indicator signals:

Moving averages:

Trading just around the 30- and 50-day moving averages indicates sideways movement.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0931 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română