As soon as Bank of England representatives expressed their unwillingness to lower interest rates due to high inflation, the pace of consumer price growth slowed from 4.6% to 3.9%. Pound reacted to this by rushing down, especially since many expected the Bank of England to be the last to embark on monetary policy easing. The decline in pound also brought euro down, but the latter only demonstrated extremely modest declines.

The upcoming data on US jobless claims will not have a significant impact on market sentiment as changes may be purely symbolic. For example, the number of initial claims may increase by only 7,000, while the number of continuing claims may decrease by 1,000. GDP data for the third quarter may also be ignored since it will just confirm previous estimates.

The volume of short positions in EUR/USD fell around 1.1000, leading to a rebound from the resistance level. If pressure continues, the pair may decrease to 1.0900. But if the price stabilizes above 1.1000, the trend may shift upward.

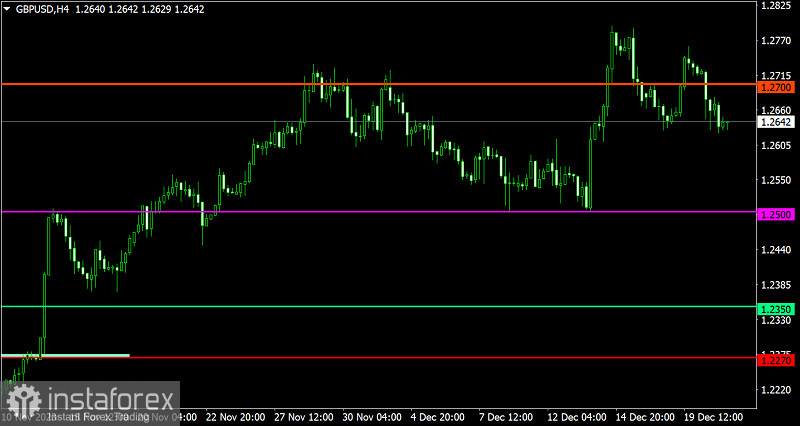

The correction in GBP/USD continues. Short positions may surge around the level of 1.2600, but until then, the pair could move to 1.2700.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română