EUR/USD

Higher Timeframes

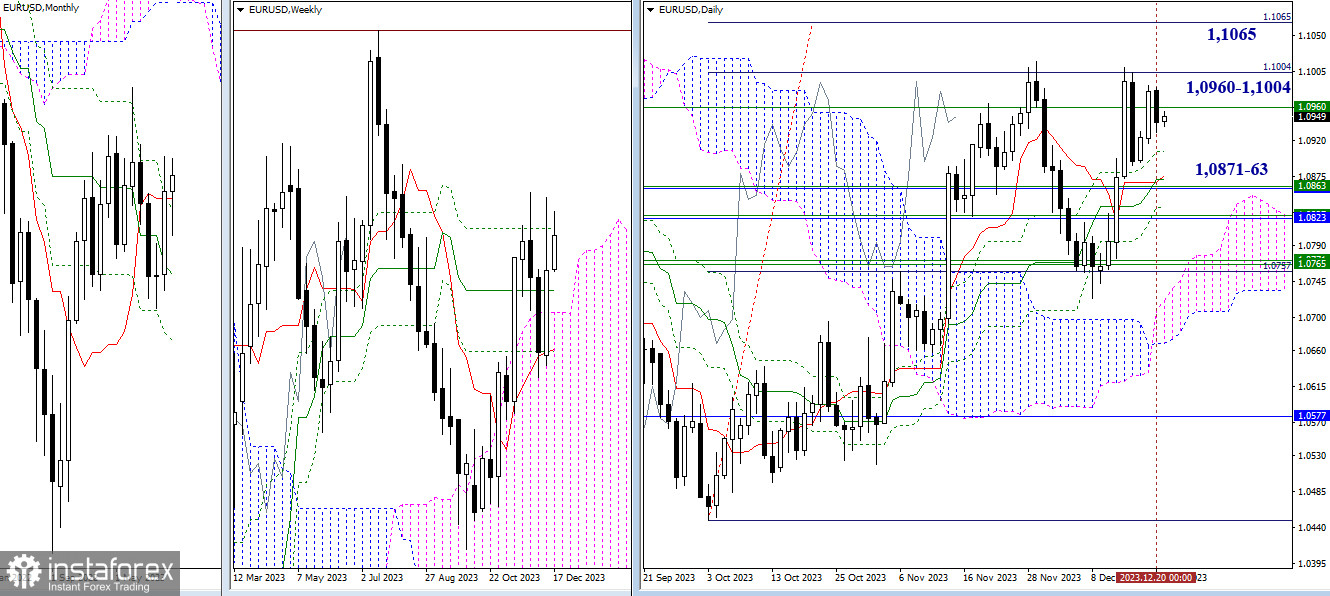

The pair continues to interact with the range of 1.0960 – 1.1004 (the final level of the weekly Ichimoku cross + the first level of the daily target). The next upward target in this segment continues to be the 100% execution of the daily target on the breakout of the Ichimoku cloud (1.1065). Inability to overcome the resistance at 1.0960 – 1.1004 will bring bearish sentiment back to the market. On their way downward, bears can currently identify a sufficiently wide support zone of 1.0906 – 1.0871-63 – 1.0823 – 1.0765, combining levels of varying strength from all higher timeframes.

H4 – H1

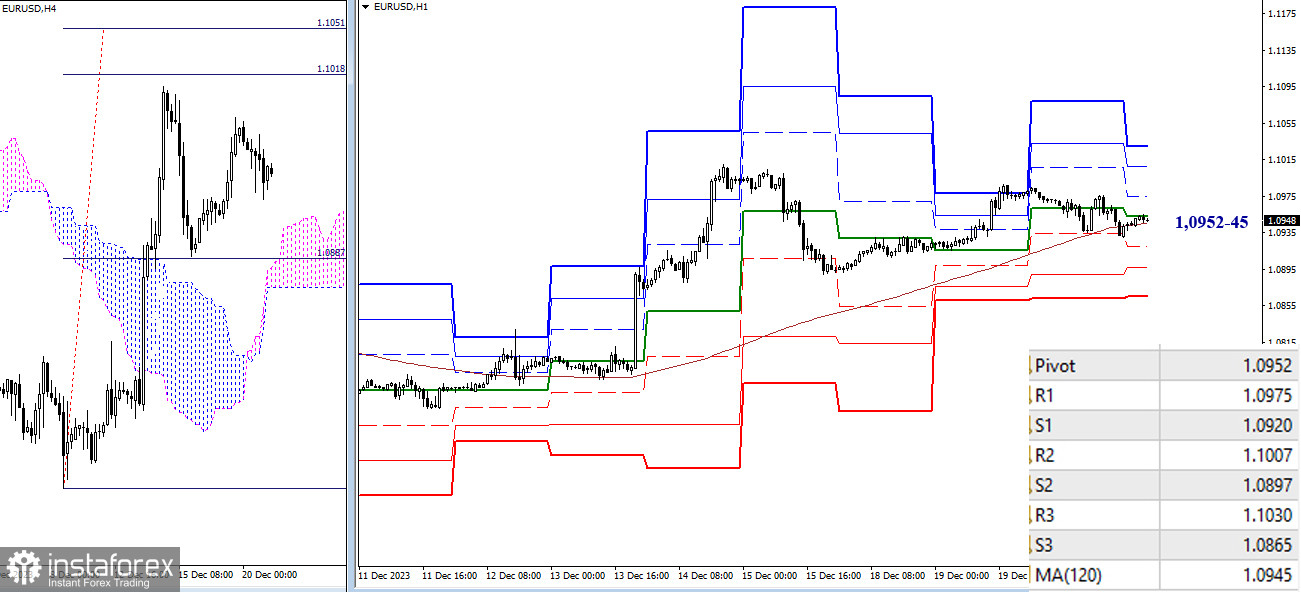

Trading in the correction zone on lower timeframes led to testing key levels, which today have practically merged at the boundaries of 1.0952 – 1.0945 (central pivot point + weekly long-term trend). A breakdown of these supports may shift the current balance of power in favor of bears. Subsequent targets for the decline today are 1.0920 – 1.0897 – 1.0865 (supports of classic pivot points). Maintaining activity above key levels will keep the main advantage on the bulls' side. The recovery of bullish positions within the day today is possible through testing and overcoming the resistances of classic pivot points (1.0975 – 1.1007 – 1.1030).

***

GBP/USD

Higher Timeframes

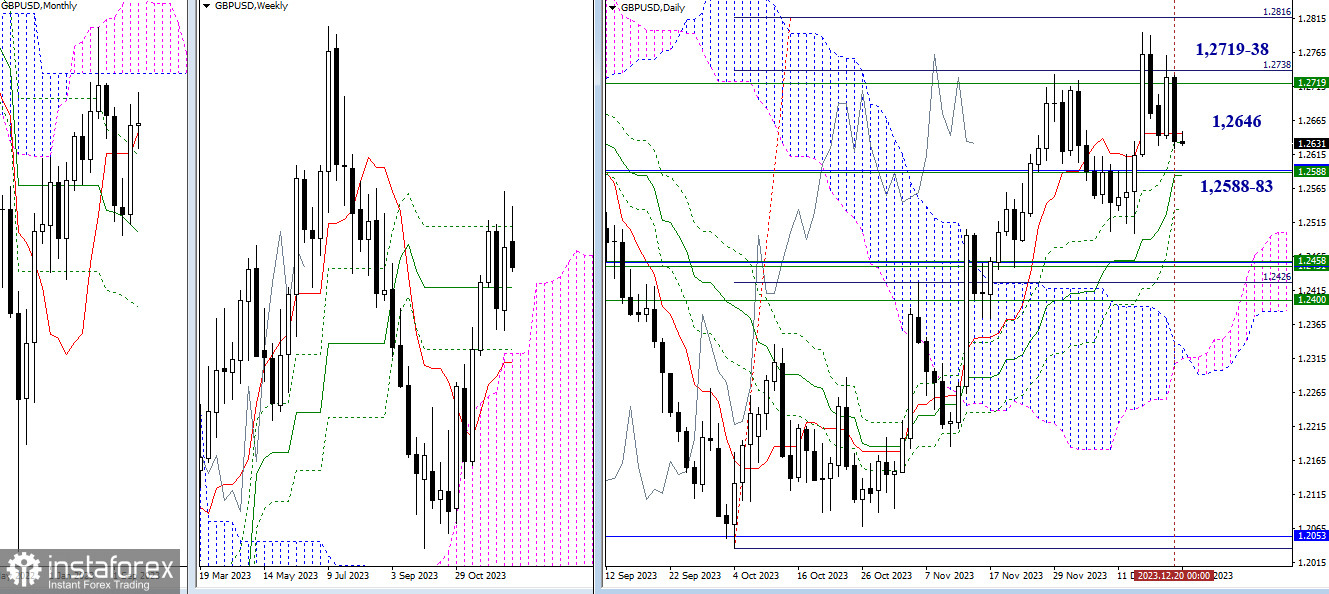

The recent testing of the range 1.2719-38 (the final level of the weekly cross + the first target) has failed. Bulls failed to overcome the resistance, and the opponent has already managed to return the situation under the daily short-term trend (1.2646). If the strengthening of bearish sentiments continues, the most important tasks in this market segment will be the breakdown of the accumulation of supports from different timeframes (1.2588-83) and the elimination of the daily golden cross (1.2533).

H4 – H1

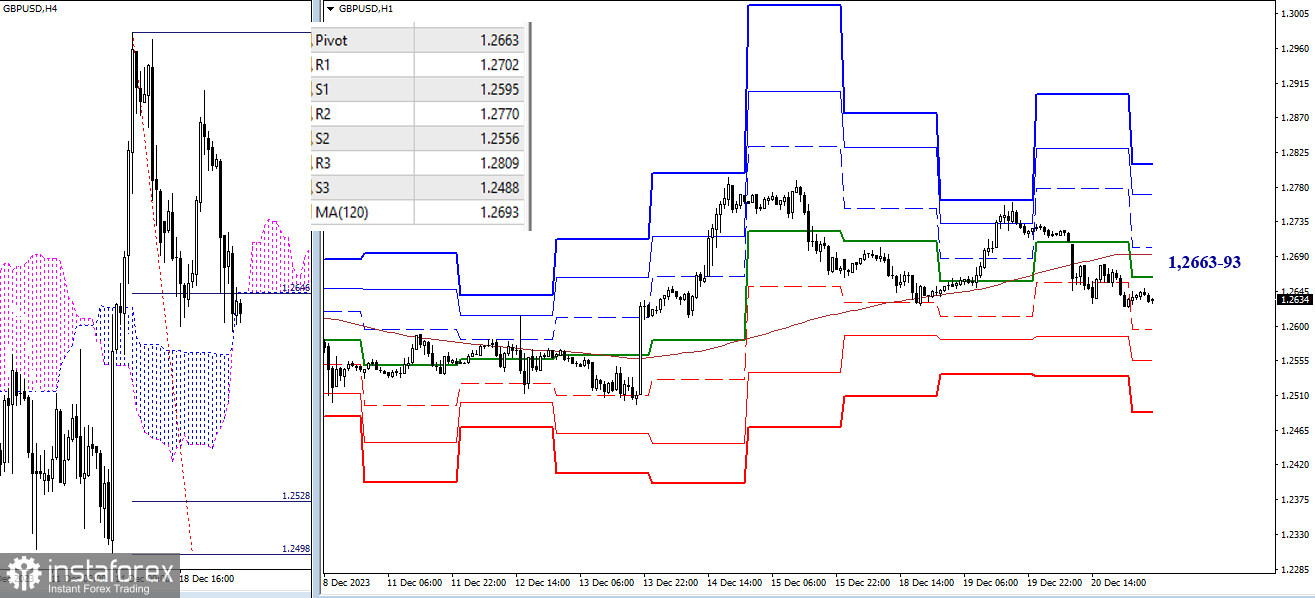

Bears managed to gain an advantage yesterday, as they have now gained a foothold on lower timeframes and are trading below key levels responsible for the current balance of power. The key levels currently act as resistances, located at 1.2663 (central pivot point of the day) – 1.2693 (weekly long-term trend). Further development of the situation within the day is possible through testing supports (1.2595 – 1.2556 – 1.2488) or resistances (1.2702 – 1.2770 – 1.2809) of classic pivot points.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română