EUR/USD

The cause of yesterday's corrective move can be attributed to the stock market; the S&P 500 fell by 1.47%, and the dollar index rose by 0.26%. Of course, we won't interpret every black candle as the collapse of the pre-New Year rally or the beginning of a global crisis, as the decline was triggered by other factors, fueled by the cautious remarks of Federal Reserve officials T. Barkin, R. Bostic, A. Goolsbee. Even representatives of the European Central Bank, K. Knot, M. Kazaks, J. Nagel, have leaned towards a "dovish" side.

Today, the U.S. will release data on GDP for the 3rd quarter, and tomorrow, data on durable goods orders and consumer spending are expected to come out as positive. US markets open on Tuesday, and there are no clear reasons for mass closure of long positions even before the new year.

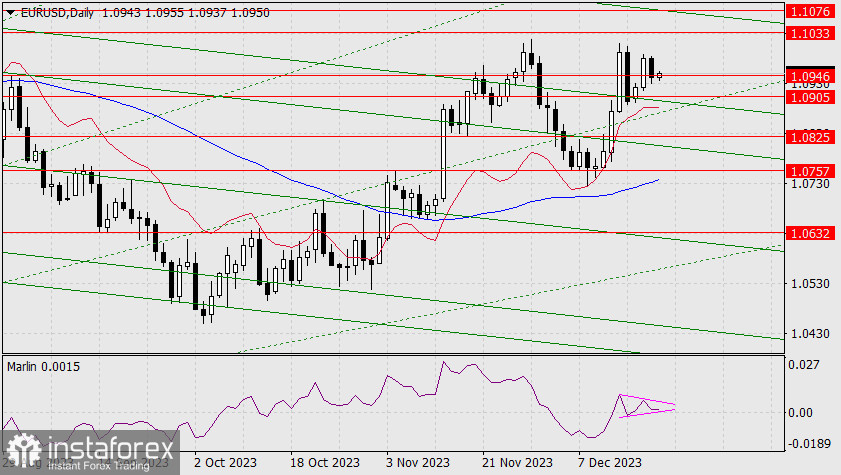

On the daily chart, the price tested support at 1.0946, and this morning, the pair is gradually rising. The signal line of the Marlin oscillator is developing in a miniature triangle, a sign of an impending upward movement. The targets remain the same: 1.1033, 1.1076.

On the four-hour chart, the price is staying above both indicator lines, and there has been no consolidation below the support. Marlin has entered negative territory, which may slightly slow down the euro's recovery, possibly for the structure of the Marlin triangle on the daily chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română