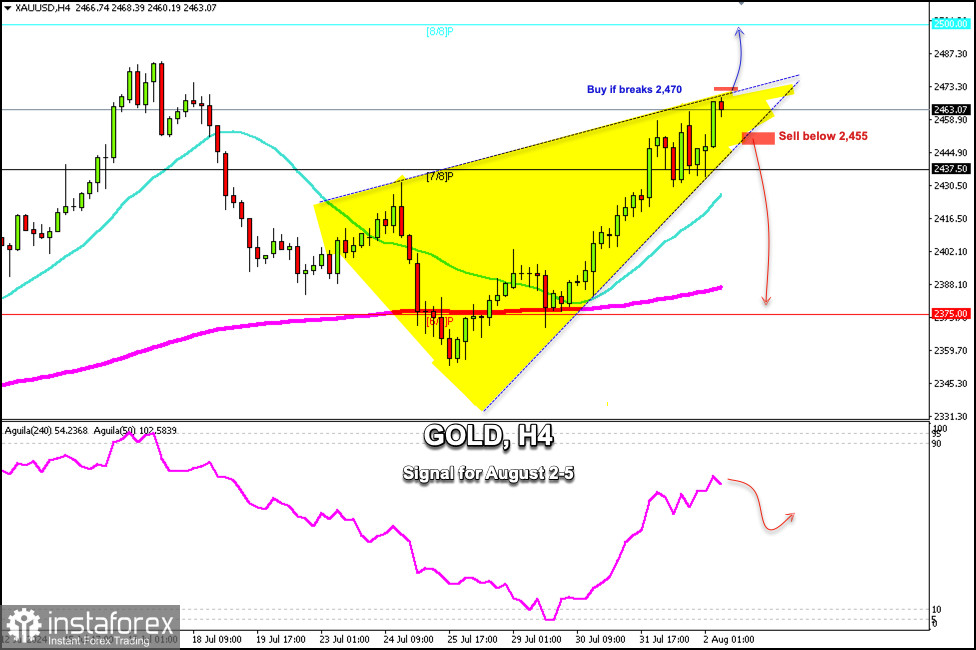

Early in the American session, gold is trading at 2,463 within the symmetrical triangle pattern and showing positive signals but reaching overbought levels which is likely to cause a technical correction. Then, the metal could resume its bullish cycle.

The US nonfarm payrolls will be released in a few hours. Thus, markets will be overwhelmed by strong volatility.

We believe that if the US data indicates robust employment, we could expect a strong technical correction in gold. The price could reach 2,437 and even accelerate its bearish cycle and reach 6/8 Murray at 2,375.

On the other hand, if the US data reflects weak employment, we could expect gold to continue its bullish cycle, but we should expect a break and consolidation above 2,470.

If this scenario occurs, gold could reach the high of July 17 around 2,483.48 and eventually reach 8/8 Murray around the psychological level of 2,500.

We see an exhaustion of bullish strength in gold. Only a break of the bullish trend channel and a consolidation below 2,455 could entail a technical correction for gold.

Therefore, we should pay attention to this point since below this area, we could expect a fall towards the 21 SMA located at 2,422 and finally towards the 200 EMA located at 2,385. It could be seen as a selling opportunity.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română