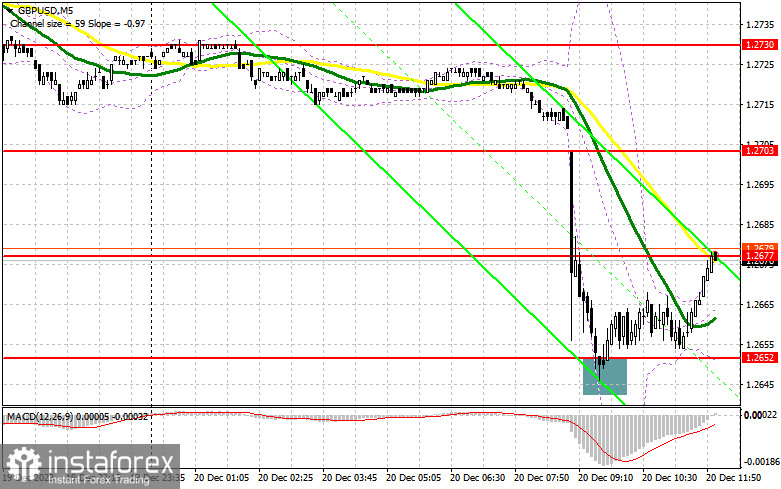

In my morning forecast, I drew attention to the level of 1.2652 and recommended making decisions based on it for market entry. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout at 1.2652 led to a long entry point, resulting in a pair's rise by more than 25 points. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD, the following is required:

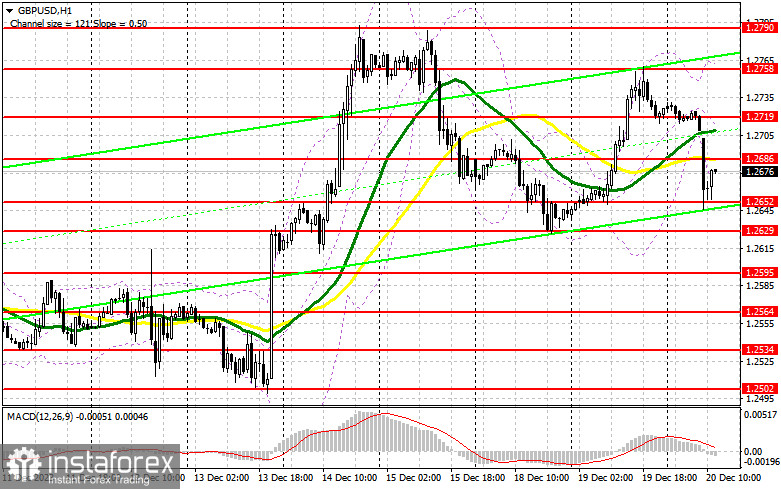

The decline in inflation in the UK, which surprised traders, led to a sharp drop in the pair in the first half of the day. The price decrease indicates that the Bank of England may consider changing its interest rate policy early next year, even though it categorically denied such a possibility just a week earlier. In the second half of the day, much will depend on the US Consumer Confidence Index and existing home sales volume. An increase in these indicators will lead to a return of demand for the dollar and a further decline in the pair. In the case of strong statistics, only the formation of a false breakout around 1.2652 will allow for a long entry point, expecting a small upward correction in the second half of the day. The target will be the area of 1.2686, formed at the end of the European session, just above which the moving averages, favoring sellers, are located. Breaking and consolidating above this range will lead to the removal of bear stop orders and a more significant rise in the pound to around 1.2719. The ultimate goal will be this month's maximum of 1.2758, where I will take profits. In the scenario of further decline in the pair and the absence of bullish activity at 1.2652 in the second half of the day, as everything seems to be leading, the pressure on the pair will increase. In this case, only a false breakout around the next support at 1.2595 will signal for opening long positions. I plan to buy GBP/USD immediately on the rebound only from 1.2564, to correct within the day by 30-35 points.

To open short positions on GBP/USD, the following is required:

Sellers regained control of the market, completely playing out yesterday's rise in the pound based on expectations of maintaining high inflation in the UK. In the case of weak US statistics, bears will surely try to defend the nearest resistance at 1.2686, where the formation of a false breakout will signal a sale with the goal of another drop to around 1.2652. It is unlikely that active participation of major players can be expected there, as this level has already been worked out. Breaking and reverse testing from bottom to top of this range against the backdrop of strong US statistics will deal a serious blow to bull positions, leading to the removal of stop orders and opening the way to 1.2629. A more distant target will be the area of 1.2595, where I will take profits. In the scenario of GBP/USD growth and the absence of activity at 1.2686 in the second half of the day, buyers may count on stopping the pound's decline and locking the pair in a sideways channel. In this case, I will postpone sales until a false breakout at 1.2719. If there is no downward movement, I will sell GBP/USD immediately on the rebound from 1.2758, but I am only expecting a pair correction down by 30-35 points within the day.

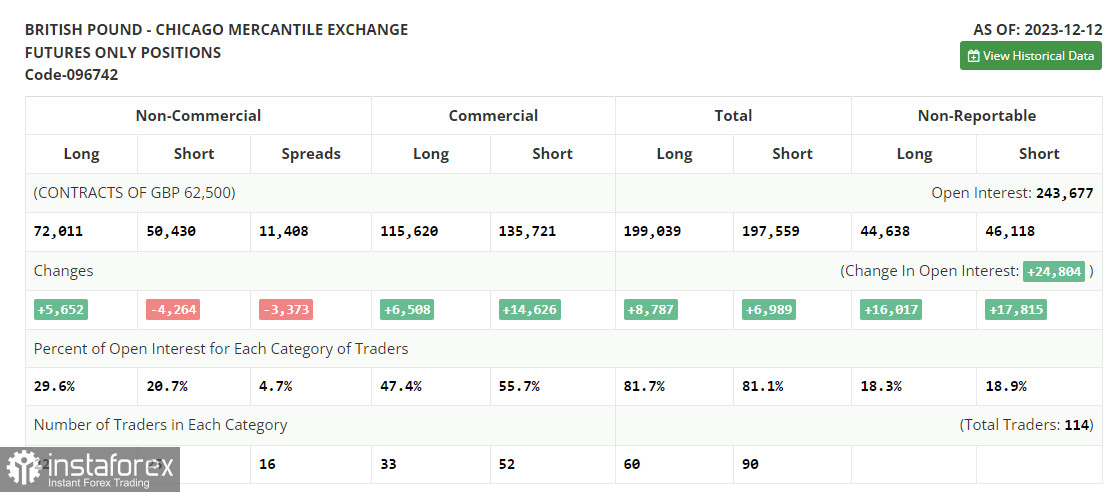

In the COT report (C the followingommitment of Traders) for December 12, there was a sharp increase in long positions and a decrease in short positions. Demand for the pound is being maintained, as the recent decision of the Bank of England to leave rates unchanged in anticipation of further combating high inflation, as well as statements by Bank of England Governor Andrew Bailey that rates will remain high for an extended period - all of this revived the pound and led to its strengthening against the US dollar. Another matter is how the UK economy, facing significant challenges lately, will continue to react to all this. Soon, a batch of data on inflation in the UK and the US will be released, and in the case of rising prices, one can expect further strengthening of the pair. In the latest COT report, it is stated that non-commercial long positions increased by 5,652 to the level of 72,011, while non-commercial short positions fell by 4,264 to the level of 50,430. As a result, the spread between long and short positions decreased by 3,373.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.2695, will act as support.

Indicator Descriptions:

- Moving Average (MA) - determines the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.

- Moving Average (MA) - determines the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.

- Moving Average Convergence/Divergence (MACD) - Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands - Period 20.

- Non-Commercial Traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long Non-Commercial Positions represent the total long open positions of non-commercial traders.

- Short Non-Commercial Positions represent the total short open positions of non-commercial traders.

- The Total Non-Commercial Net Position is the difference between non-commercial short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română