Wisdom comes with age. But sometimes age comes separately. Enough time has passed for the markets to assess the consequences of the Federal Reserve's dovish pivot. The updated FOMC forecasts revealed three rate cuts for federal funds in 2024. The loser appears to be the U.S. dollar. Who will benefit? Can the EUR/USD take advantage of the Fed's favor?

According to Goldman Sachs, the main beneficiaries of the Fed's dovish pivot will be the British pound, the Australian and New Zealand dollars, as well as the Korean won, and the South African rand. On the contrary, the euro, Japanese yen, and Chinese yuan will have limited gains. The reason lies in the weakness of the economies behind them. Their problems will restrain the bullish attacks on EUR/USD.

However, as long as market optimism goes off the scale, and greed pushes S&P quotes to record highs, the euro feels at home. Investors' faith in a quick return of U.S. inflation to the 2% target and a soft landing for the U.S. economy serves as a guide for U.S. stock indices.

Dynamics of U.S. Stock Indices

According to a Bank of America survey, there have been so many "bulls" in the market since the beginning of 2022. Investors are reducing the share of cash in portfolios and have the largest overweight in bonds in the last 15 years. The calculation is based on the Goldilocks regime, when inflation slows down, and the economy is neither cold nor excessively hot. About 66% of respondents predict a soft landing.

The consequences can be sadder if this scenario does not materialize. At the end of 2022, the majority also believed in a recession in the U.S. economy, but its striking resilience allowed the Fed to raise the federal funds rate higher than expected. How significant will the market shake be if the central bank returns to the topic of tightening monetary policy?

However, for now, FOMC officials are radiating optimism. According to San Francisco Fed President Mary Daly, if progress is made, the Fed will acknowledge that progress. The FOMC's forecast of three acts of monetary expansion in 2024 is realistic, and the central bank needs to think about avoiding too rapid unemployment growth. The Fed's return to the dual mandate is great news for stocks and EUR/USD.

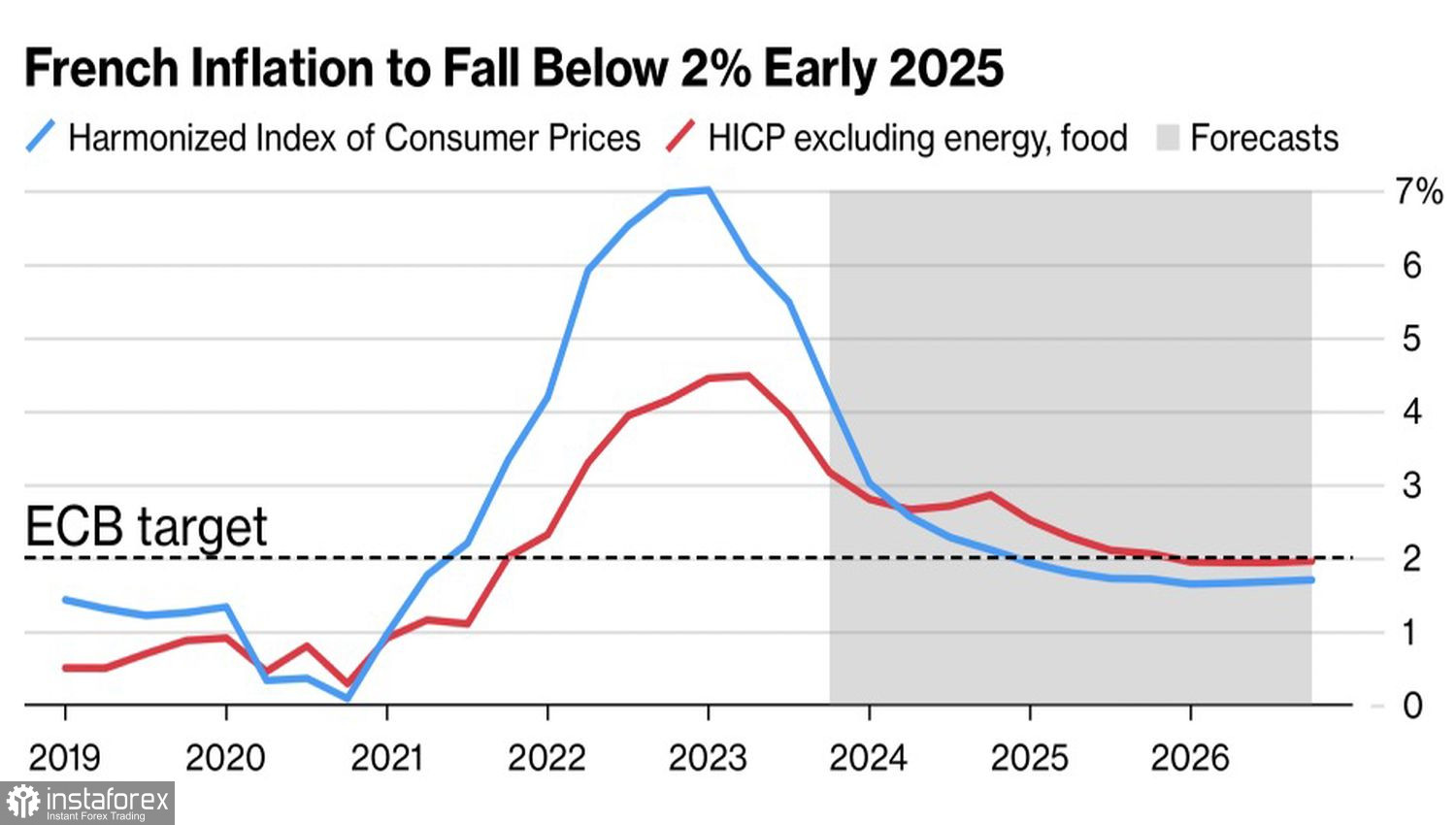

Dynamics of French Inflation

Meanwhile, the Bank of France's reduction of the inflation forecast in the country to 2.5% in 2024 and 1.8% in 2025 signals that a "dovish" pivot from the ECB can be expected soon. Francois Villeroy de Galhau was one of the first to start talking about a deposit rate cut. Let's wait for other members of the Governing Council to support him.

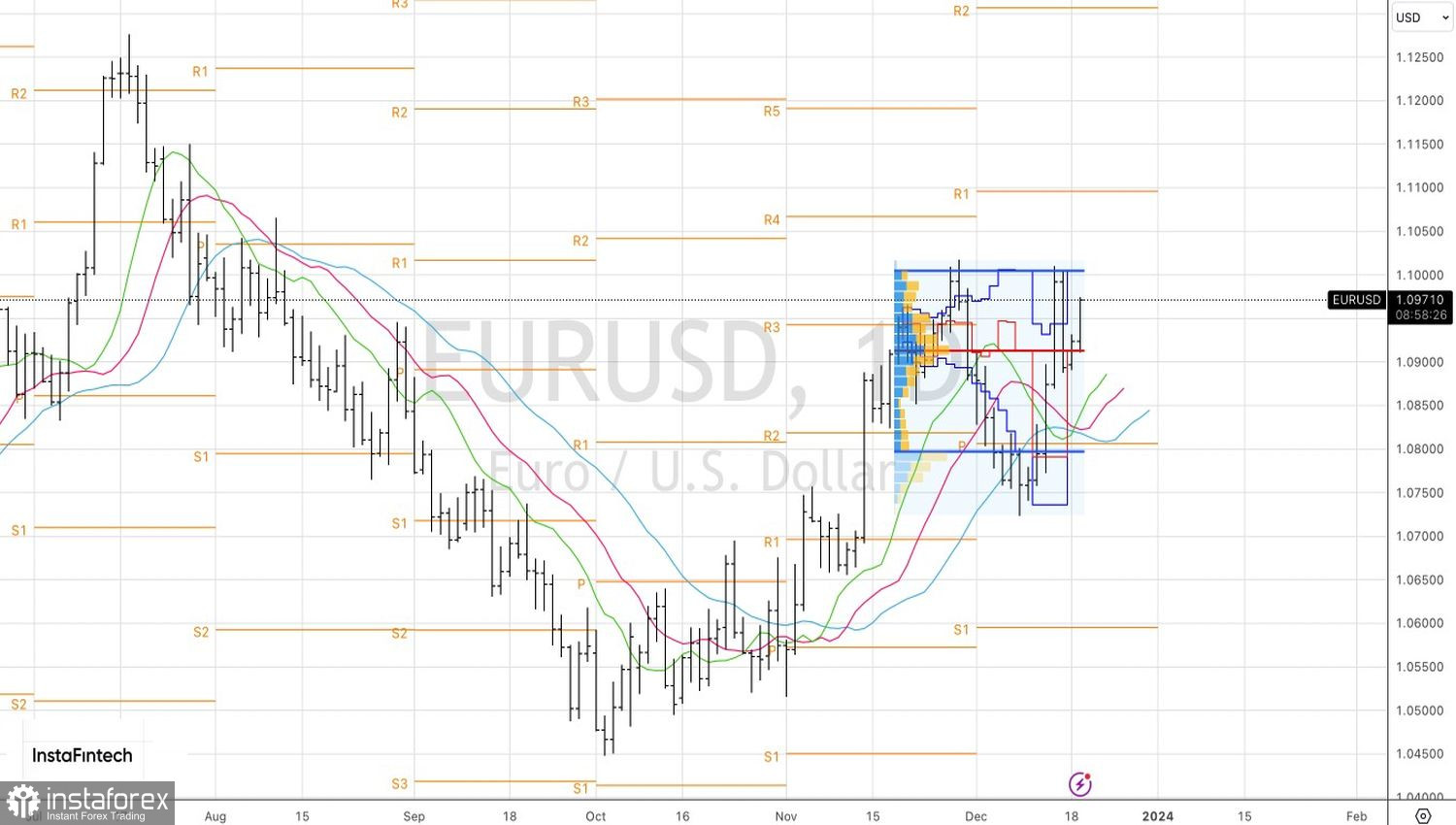

Technically, on the daily chart, EUR/USD played out an inside bar. A confident breakout of resistance at 1.1 is required for the rally to continue, which will be the basis for adding to long positions opened from 1.094. Conversely, the return of the euro to fair value at $1.091 is a reason to sell.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română