Ben Broadbent, a deputy governor of the Bank of England, said on Monday that in the current uncertain environment it was too early to say the labor market was cooling. His statement may suggest that the central bank kept rates unchanged for this reason. In particular, the sharp surge in wages, which can strongly impact inflation, has raised concerns for the British central bank. The pound continued to fall after these statements. This is largely because, judging by these statements, the BoE is willing to sacrifice economic growth and the well-being of the citizens for price stability. This is not the best scenario. However, according to recent data, the pace of wage growth, both with and without bonuses, has slowed down. And inflation was decreasing even when wages were rising. So, there aren't many reasons for the central bank to be concerned. Most likely, the decision to keep interest rates unchanged is due to the Federal Reserve and the European Central Bank maintaining their rates.

Today, another BoE official will speak. However, not as high-ranking as Broadbent. And it is unlikely that this official will mention anything new. Most importantly, it is unlikely to change the impressions of yesterday's statements. Given the nearly empty economic calendar, we can assume that the market will try to consolidate around the achieved values.

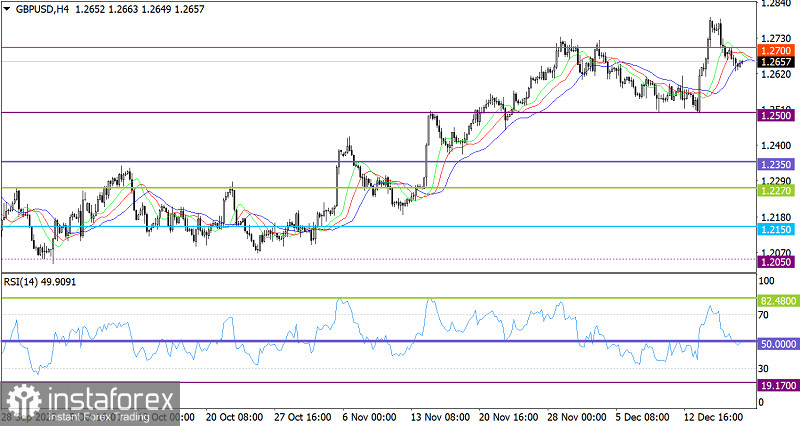

The GBP/USD pair is in a corrective phase from the 1.2800 level, leading to an increase in short positions, causing the British currency to depreciate by approximately 1%.

On the 4-hour chart, the RSI downwardly crossed the 50 middle line, indicating an increase in the volume of short positions in the corrective phase.

On the same time frame, the Alligator's MAs are intersecting each other. This technical signal suggests a slowdown in the upward cycle.

Outlook

The corrective stage is just a tactic in the current upward cycle. There are no crucial changes in the price, so if the quotes return above the 1.2700 level, this could indicate an increase in long positions. As long as the corrective phase persists, it may persist for some time.

The comprehensive indicator analysis in the short-term and intraday periods indicates a corrective phase. Indicators signal an uptrend in the medium term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română