Federal Reserve Chair Jerome Powell's speech last week had a crucial effect. I can't say there was anything that was particularly groundbreaking in his speech, but Powell suddenly changed the course of his rhetoric. In recent months, he had repeatedly stated that the central bank was not abandoning plans to raise rates if the situation required it. And suddenly, in early December, he stated that further tightening was unlikely, and rates would be lowered next year. The market was prepared for the upcoming policy easing but was completely unprepared for such a sharp pivot. This played a cruel joke on the dollar.

Based on all of the above, it follows that the Fed does not intend to start lowering rates at the next meeting, so the dollar may feel somewhat secure. Demand has declined over the past two months, but it cannot fall continuously only on the basis of the fact that the Fed will transition to a more dovish policy next year. If we look at current inflation indicators, it is more likely that the European Central Bank will be the first to lower rates. And this is a quite concrete reason to reduce demand for the euro, not the dollar.

Cleveland Fed President Loretta Mester said in an interview on Monday that markets had gotten "a little bit ahead" of the central bank by immediately expecting a rate cut. She says that the next phase is not when to reduce rates, but about how long they need monetary policy to remain restrictive. In other words, the FOMC intends to ensure that inflation continues to fall, and only after that will it begin to ease policy. However, according to her, the markets got ahead of themselves in their rate cut expectations, and it is a mistake to think that the FOMC will go along with them.

These statements did not have an impact on the dollar, but they ease the overall tension in the market associated with the dollar. Last week, it seemed like the U.S. currency was going to plummet. It was avoided thanks to Friday's market activity and the prudence of market participants who timely remembered that there are factors contributing to the dollar's fall.

Therefore, it follows that demand for the U.S. currency may start to rise in the near future, according to the current wave analysis. I still recommend considering short positions on the instruments. Certainly, news background can always cause the opposite effect, but I don't know the future, and no one does.

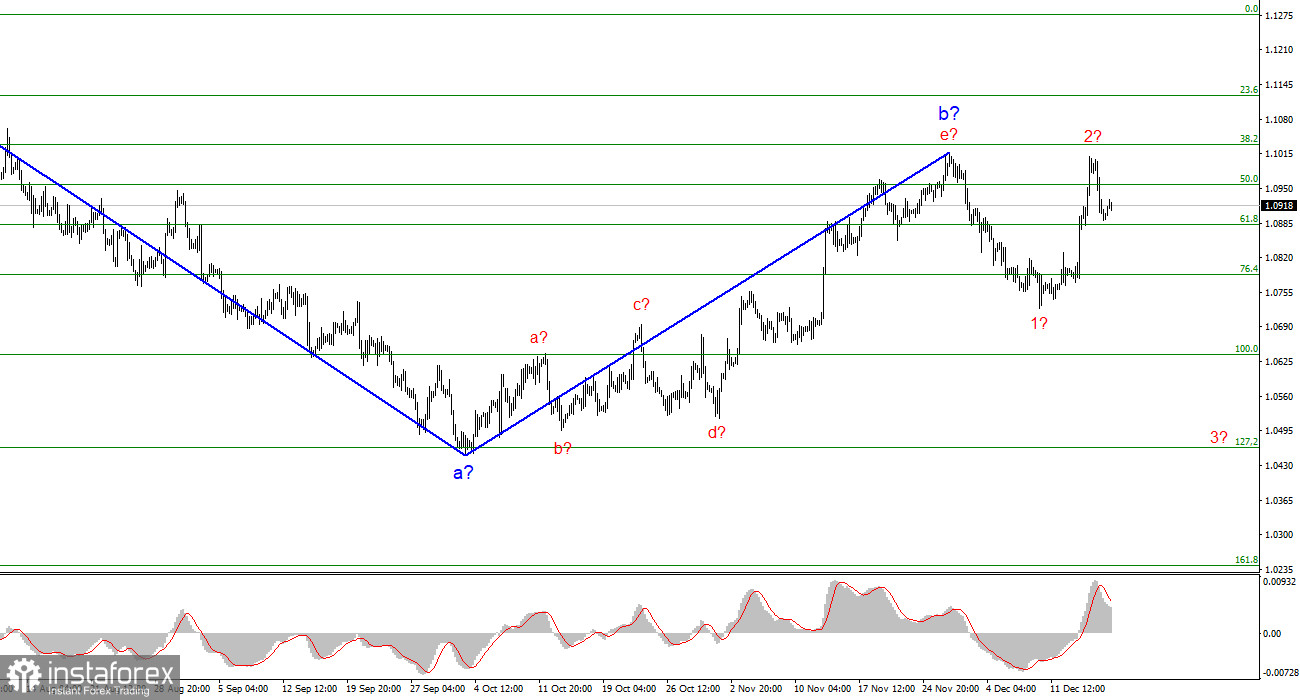

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

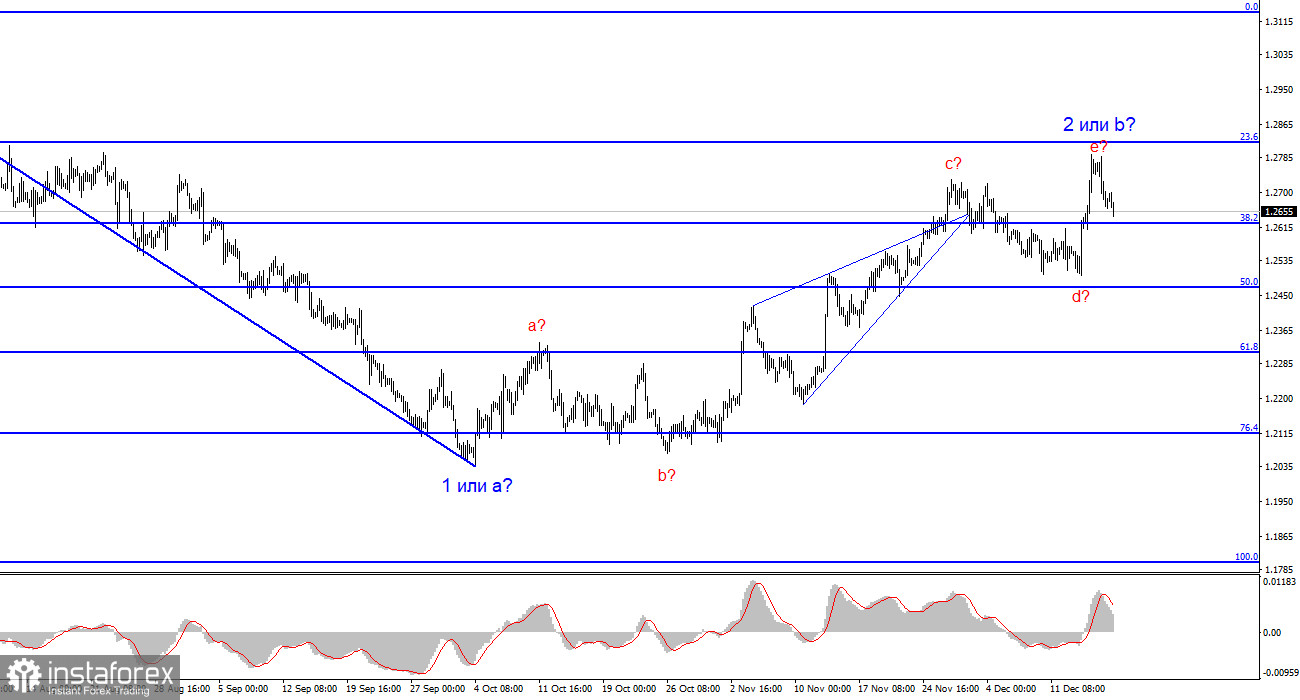

The wave pattern for the GBP/USD pair suggests a decline within the descending wave 3 or c. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b should end, and it could do so at any moment. The longer it takes, the stronger the fall. The peak of the assumed wave e in 2 or b can be used for short positions, and the order limiting possible losses on transactions can be placed above it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română