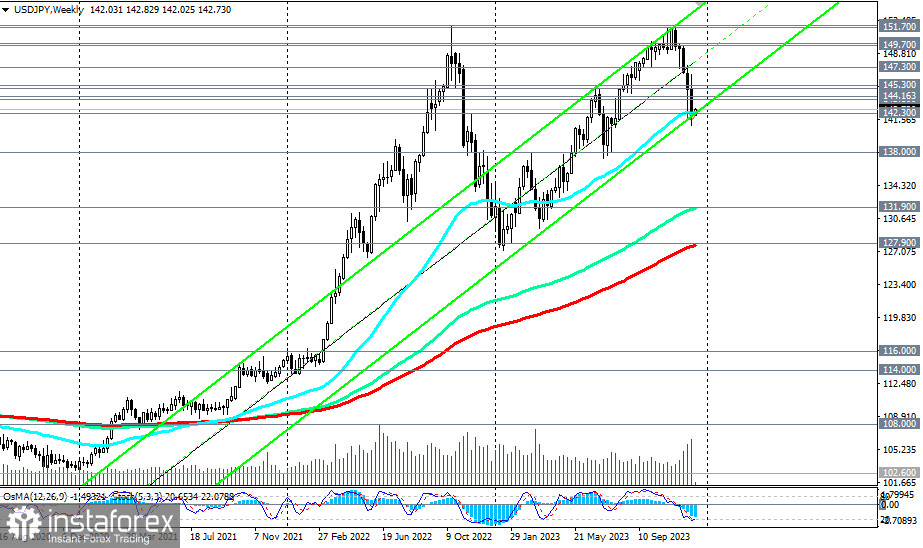

Despite approaching the record high of 151.95 reached in October 2022 in the middle of last month, USD/JPY subsequently shifted to a decline, actively responding to the weakening dollar and the revived hopes of yen buyers for the imminent conclusion of the Bank of Japan's ultra-loose monetary policy cycle.

At the beginning of this month, USD/JPY broke through the key support level of 143.80 (200 EMA on the daily chart), and last week, it reached the important support level of 142.30 (50 EMA on the weekly chart), which separates the medium-term bullish trend of the pair from the bearish trend.

As of this writing, the pair was near the 142.70 mark, attempting to develop a corrective rise after a sharp decline in the previous days.

Despite such a sharp decline (since the middle of last month), USD/JPY remains in a long-term and global bull market zone. To resume the upward dynamics, the price must return to the zone above the resistance levels of 144.00, 145.00, and 145.30 (144 EMA on the daily chart).

In an alternative scenario, a re-entry of the price below the mark of 141.00 and a breakdown of the local support level of 138.00 may provoke further decline in USD/JPY, confirming negative expectations for the pair. The first signal for increasing short positions may be a breakdown of the support at 142.30 and the local support level 142.00.

A breakdown of the key support levels 131.90 (144 EMA on the weekly chart), 127.90 (200 EMA on the weekly chart), and further decline will lead the pair into a long-term bear market zone.

Support levels: 142.30, 142.00, 141.00, 140.00, 138.00, 132.00, 131.00, 130.00, 128.00

Resistance levels: 143.80, 144.00, 144.16, 145.00, 145.30, 146.00, 147.30, 148.00, 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Trading Scenarios:

Main Scenario

Aggressively: Buy at the market. Stop Loss 142.20

Moderately: Buy Stop 143.10. Stop Loss 141.90

Targets 143.80, 144.00, 144.16, 145.00, 145.30, 146.00, 147.30, 148.00, 149.00, 149.70, 150.00, 151.00, 151.70, 151.95, 152.00, 153.00

Alternative Scenario

Aggressively: Sell Stop 142.20. Stop Loss 142.90

Moderately: Sell Stop 141.90. Stop Loss 143.10

Targets 141.00, 140.00, 138.00, 132.00, 131.00, 130.00, 128.00

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guide when planning and placing your trading positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română