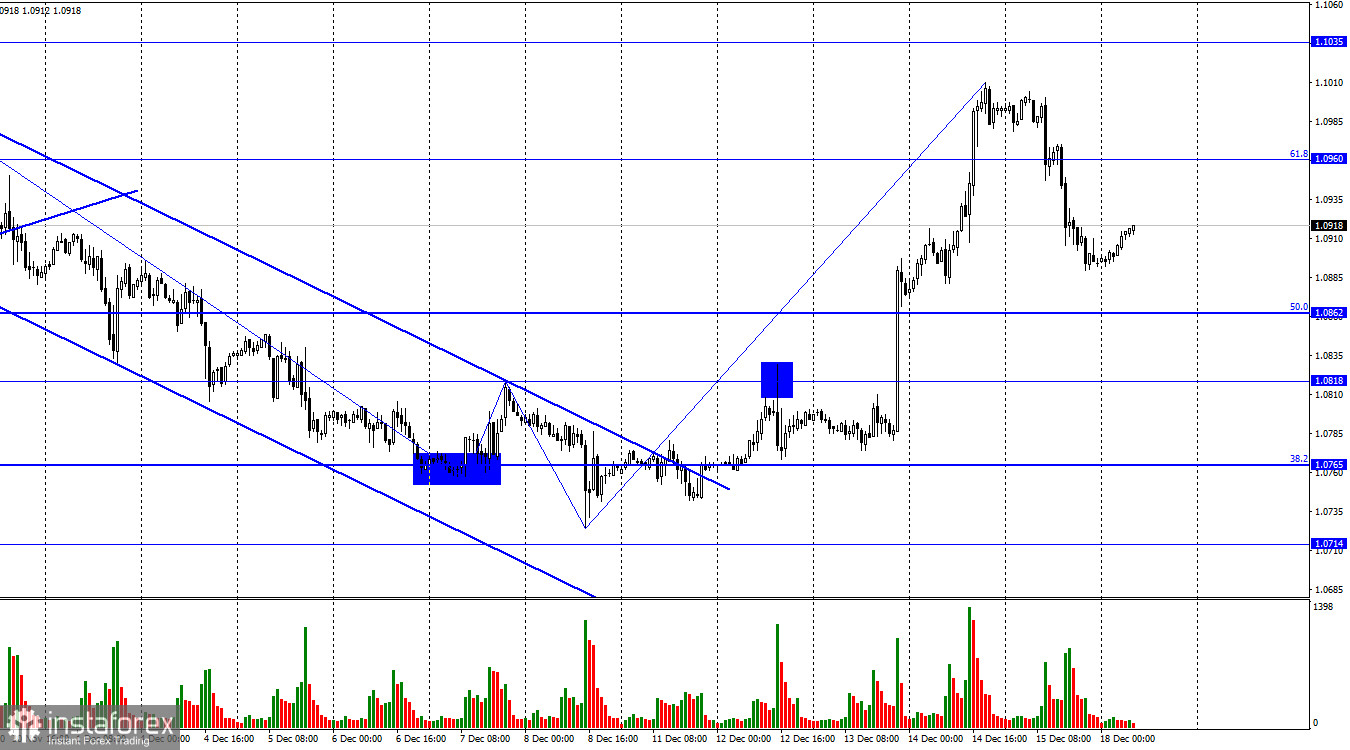

On Friday, the EUR/USD pair reversed in favor of the American currency and consolidated below the corrective level of 61.8% (1.0960). The quote decline continued throughout the day towards the next Fibo level of 50.0% (1.0862). A bounce in the pair's rate from this level would favor the European currency and resume growth towards the 1.0960 level. Closing below 1.0862 increases the probability of further decline towards the levels of 1.0818 and 1.0765.

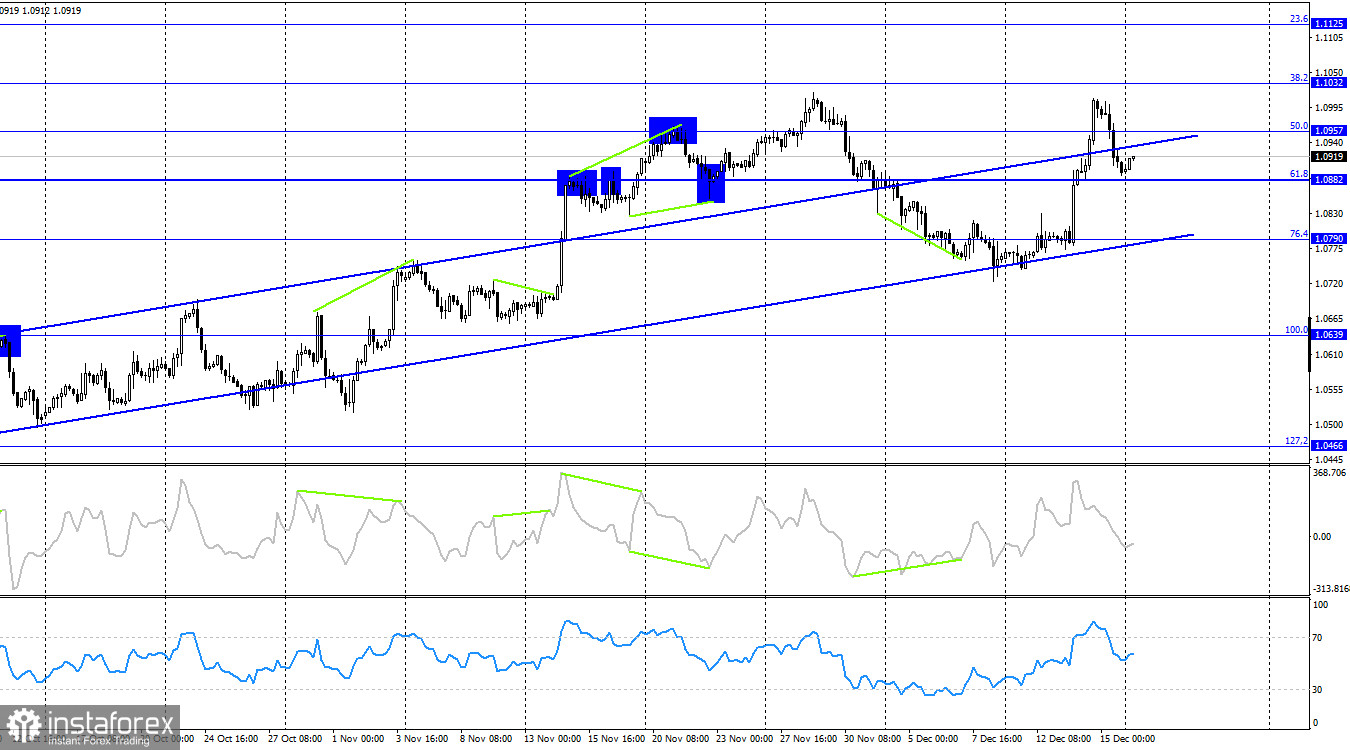

The wave situation has become not more complex but less attractive. The latest upward wave has overlapped all previous waves. The trend has changed to "bullish," but almost any downward wave cannot change it back to "bearish" now. The euro must decline by an additional 200-220 points to confirm the continuation of the "bearish" trend. Thus, the pair may continue falling for another 3-4 days (according to the average trader activity) and maintain the "bullish" trend.

On Friday, traders had to be content with the most ordinary business activity reports. Undoubtedly, these data are also important, and traders like to work with them, but in the previous two days, the information background was much stronger and more interesting. Recall that the outcomes of the ECB and Fed meetings caused a sharp decline in the US dollar, as the American regulator indicated that there might be several rate cuts next year. At the same time, the ECB maintained its "hawkish" rhetoric, although it is clear that the rate in the European Union will also decrease next year.

Regarding the prospects for the euro and the dollar, it cannot be said that the euro has a strong advantage. Friday's trading showed that the market is still being prepared to buy euros recklessly. At the moment, I expect a few more waves down. Today, the pair may experience a slight correction against Friday's decline and then continue to correct down against the rise on Wednesday and Thursday. There is no information background today - traders will rely solely on the chart pattern.

Business activity indices in the European Union released on Friday were slightly weaker than traders' expectations and contributed to the decline in the European currency. In Germany, two of three indices also turned out worse than expected. Thus, there were grounds for the euro's decline on Friday.

On the 4-hour chart, the pair reversed in favor of the US dollar and fell to the corrective level of 61.8% (1.0882). A bounce in the pair's rate from this level will allow traders to expect a continuation of the growth towards the Fibo level of 38.2% (1.1032). Consolidation below 1.0882 will increase the probability of a decline to the lower line of the ascending trend corridor, which still characterizes traders' sentiment as "bullish." I expect a significant decline in the euro only after consolidation below the corridor. There are no impending divergences observed in any indicator today.

Forecast for EUR/USD and trader advice:

What can be advised to traders in the current situation? A strong rise in the European currency is unlikely today. There is no information background today, and traders will find it difficult to find new reasons for buying. Thus, a resumption of the decline towards the 1.0862 level is more likely. Traders can continue to hold the sales opened after the consolidation below 1.0960. Purchases can be opened in case of a rebound from the 1.0862 level with a target of 1.0960.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română