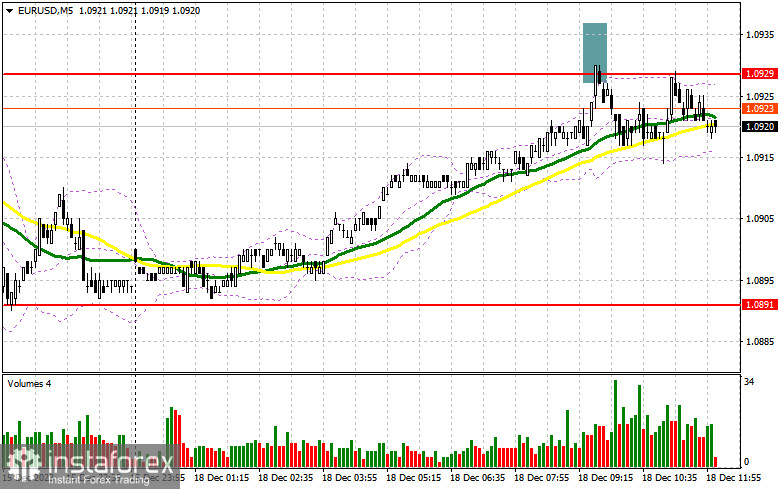

In the morning forecast, I emphasized the level of 1.0929 and recommended making entry decisions based on it. Let's examine the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout at this level provided an excellent selling signal in continuation of the bearish trend observed at the end of last week. However, a significant drop has yet to occur since writing this article. After a decline of 15-20 points, demand for the pair returned. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, the following is required:

The Eurozone data released indicated a sharp decline in IFO indices for Germany, limiting the further upward potential of the pair. However, it did not lead to a significant decrease, as envisioned in the Friday scenario. During the American session, nothing could negatively impact the euro, and the data on the NAHB Housing Market Index in the US is unlikely to influence market direction significantly. Therefore, I plan to act on buying after a decline and forming a false breakout around 1.0891. Only this would provide an entry point for long positions, counting on the recovery of EUR/USD and another test of the resistance at 1.0929, above which the moving averages, favoring sellers, are located. A breakout and a top-down update of this range, which was not achieved in the first half of the day, would signal a buying opportunity and a chance to develop an upward trend with the prospect of updating 1.0968. The ultimate target would be this month's high at 1.1007, where I would take a profit. In the scenario of a decline in EUR/USD and the absence of activity at 1.0891 during the American session, which is possible only in the case of very strong US data, pressure on the pair can be expected to return. In this case, I plan to enter the market only after forming a false breakout around 1.0857. I recommend opening long positions immediately on the rebound from 1.0827, with a target for an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, the following is required:

Sellers showed themselves during European trading, but a significant decline has yet to occur. This suggests that, with a high probability, buyers will attempt to break above 1.0929 again in the second half of the day. However, until trading is conducted above this range, the chances of a pair decline will persist. Another false breakout like the one discussed above would give a selling signal to update the nearest support at 1.0891, formed at the end of last Friday. Only after breaking and consolidating below this range, which may occur during the release of strong statistics and a reverse test from bottom to top, do I expect to receive another selling signal with an exit to 1.0857. The ultimate target would be the minimum of 1.0827, where I would take a profit. In the scenario of an upward movement in EUR/USD during the American session and the absence of bears at 1.0929, which is more likely, it is best to postpone selling until testing the next resistance at 1.0968. Selling is also possible there, but only after an unsuccessful consolidation. I recommend opening short positions immediately on the rebound from 1.1007 with a target for a downward correction of 30-35 points.

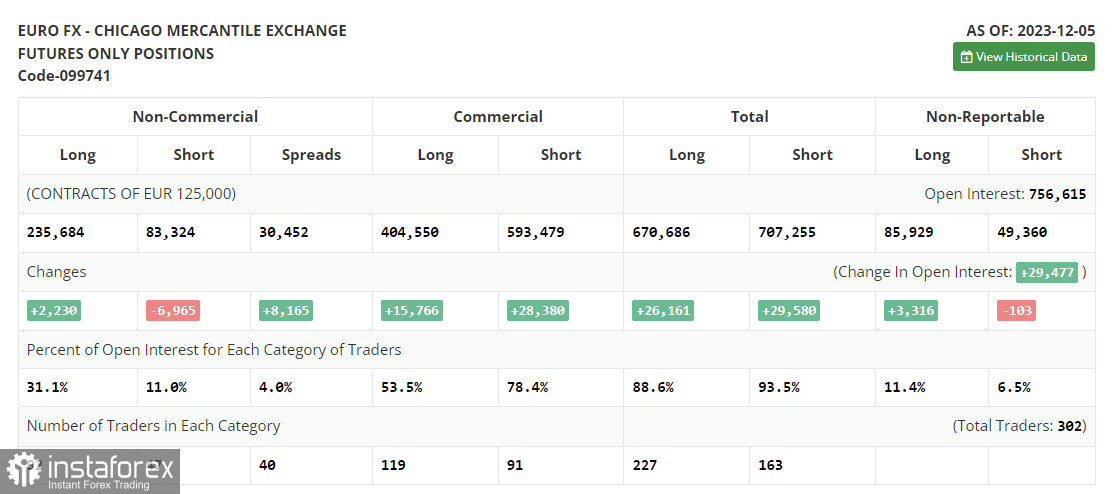

In the COT report (Commitment of Traders) for December 5, there was an increase in long positions and another significant reduction in shorts. The December meeting of the US Federal Reserve will be decisive for the dollar. After policymakers' statements, it will become clear in which direction the regulator is ready to move. A dovish stance on rates next year will lead to a turnaround in the bearish market for the euro and an increase in the pair. A hawkish position, with strong inflation, will keep demand for the dollar for some time but is unlikely to significantly impact the long-term balance of forces in favor of buyers of risky assets. The COT report indicates that non-commercial long positions increased by 2,230 to 235,684, while non-commercial short positions decreased by 6,965 to 83,324. As a result, the spread between long and short positions increased by 8,165.

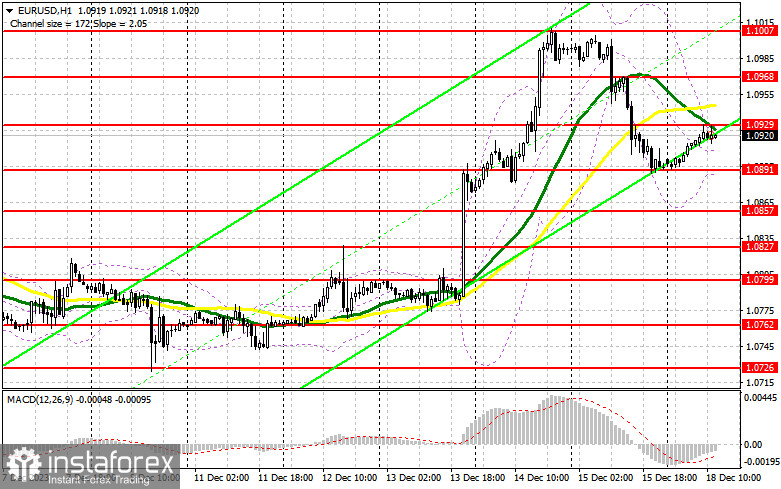

Indicator signals:

Moving Averages

Trading is carried out below the 30 and 50-day moving averages, indicating the maintenance of a downward correction.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator, around 1.0890, will act as support.

Description of Indicators:

- The moving average (50) is marked in yellow on the chart.

- The moving average (30) is marked in green on the chart.

- MACD Indicator (Fast EMA 12, Slow EMA 26, SMA 9)

- Bollinger Bands (Period 20)

- Non-commercial traders include speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions represent the total number of long open positions non-commercial traders hold.

- Short non-commercial positions represent the total number of short open positions that non-commercial traders hold.

- The total non-commercial net position differs from the short and long non-commercial positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română