If the Federal Reserve presented a dovish surprise to the markets, the Bank of England did not turn around at all. At its December meeting, it decided to maintain the repo rate at 5.25% and stated that the borrowing costs would remain at a plateau for an extended period and could be raised if necessary. Three out of nine members of the Monetary Policy Committee (MPC) support doing so now. The hawkish-minded central bank is a reason to buy GBP/USD.

Andrew Bailey noted that the BoE still has work to do to return inflation to the 2% target and that he is forced to be cautious since some elements of CPI are still very high. Clearly, he was referring to service prices, which increased by 6.6% in October, significantly higher than the 5.2% growth in the U.S. Additionally, a smaller labor force leads to faster wage growth in Britain than in the United States.

Inflation Dynamics in Britain, the U.S., and the Eurozone

Not surprisingly, after the announcement of the results of the meetings in Frankfurt and London, the urgent market assessed the repo rate reduction by 107 bps, the ECB deposit rates by 111 bps, and the federal funds rates by 148 bps. A day later, the balance of power changed. While the seventh consecutive month of European business activity being below the critical 50 mark signals a recession, things in the UK economy are much better.

The Purchasing Managers' Index (PMI) in the manufacturing sector of the UK rose to 51.7 in November, the best result since June. The services sector PMI did not lag behind, demonstrating the fastest dynamics in six months. Both indicators turned out better than Bloomberg experts' forecasts, and the trajectory of their movement proves that the UK economy has avoided a recession. The less reason to lower the repo rate, the better for GBP/USD.

However, the pound bulls retreated amid profit-taking from long positions due to comments from FOMC officials. New York Fed President John Williams asserts that lowering the federal funds rate in March is premature, and his colleague, Atlanta Fed President Raphael Bostic, believes it will not happen before the second half of 2024. Global risk appetite has somewhat diminished, causing GBP/USD to pull back.

According to Goldman Sachs research, the pound is sensitive to the positive dynamics of U.S. stock indices and rising commodity prices. It is not surprising since it is a pro-cyclical currency, and the recovery of the global economy creates a tailwind for it. On the other hand, during periods of mass monetary restrictions, GBP/USD quotes usually fall. Those times are over; central banks are on the verge of dovish pivots, allowing for a recovery in the upward trend.

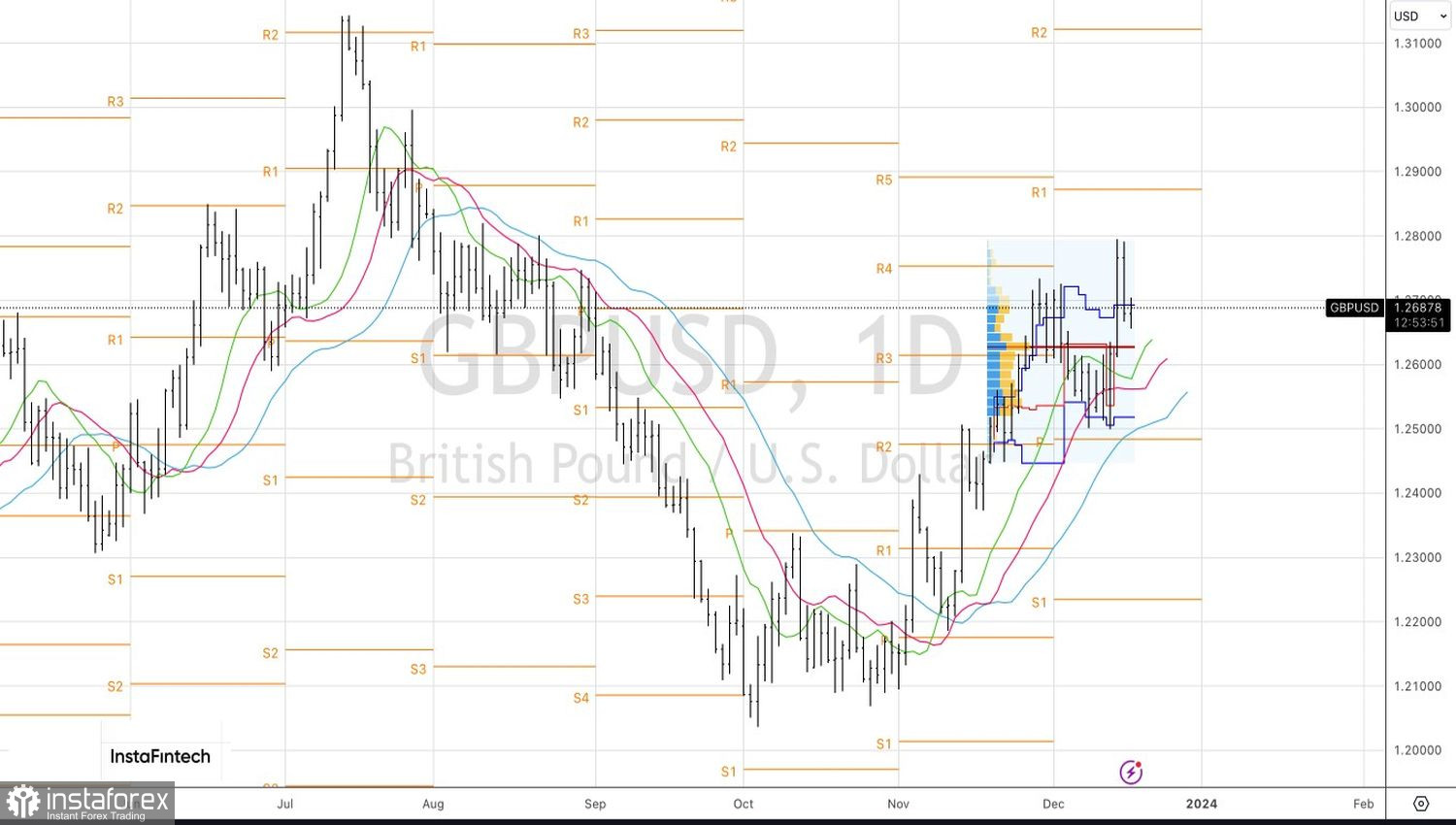

Technically, on the GBP/USD daily chart, an Anti-Turtles reversal pattern has formed. To activate it, a drop below the pivot level of 1.2615 is required. In this scenario, the pair should be sold. However, as long as it trades above the fair value of 1.263, we maintain an emphasis on buying.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română