The pound sterling reacted with a decline to Friday's statements from Federal Reserve representatives; however, the released data on economic activity in the United Kingdom has reignited discussions about the country teetering on the brink of recession.

Despite initial estimates showing zero growth in the UK's Gross Domestic Product (GDP) for the three months of the third quarter, retail sales have since proven to be lower than preliminary data. This might be enough to reduce growth by a few tenths of a percentage point when revised data is published this Friday. Even such a slight change could revive discussions about the onset of a technical recession, defined as two consecutive quarters of decline. This would be a bad sign for Prime Minister Rishi Sunak, who plans to seek re-election next year. It would also be a worrisome signal for the Bank of England, which will be compelled to consider interest rate cuts early next year despite political statements made last week that the policy will remain tight.

If industrial production is revised downward, the risk of GDP contraction in the third quarter will significantly increase. Data on retail sales, excluding fuel costs, will also be released. If they disappoint as well, do not be surprised if GDP is revised downward.

Optimism in business and consumer surveys contrasts with the gloomy picture painted by rising insolvencies, a halt in Christmas retail sales, and a warning of slowing demand from the Bank of England. Many economists note that next year's growth is likely to remain modest, meaning that significant deterioration in sentiment or economic conditions will not be required to plunge the UK into a recession.

At the moment, short-term prospects for the UK range from moderate growth to a slight recession. Friday's GDP report will determine whether a decline occurred in the third quarter or not. A more significant-than-expected contraction in October's data, published last week, also points to a poor start to the fourth quarter.

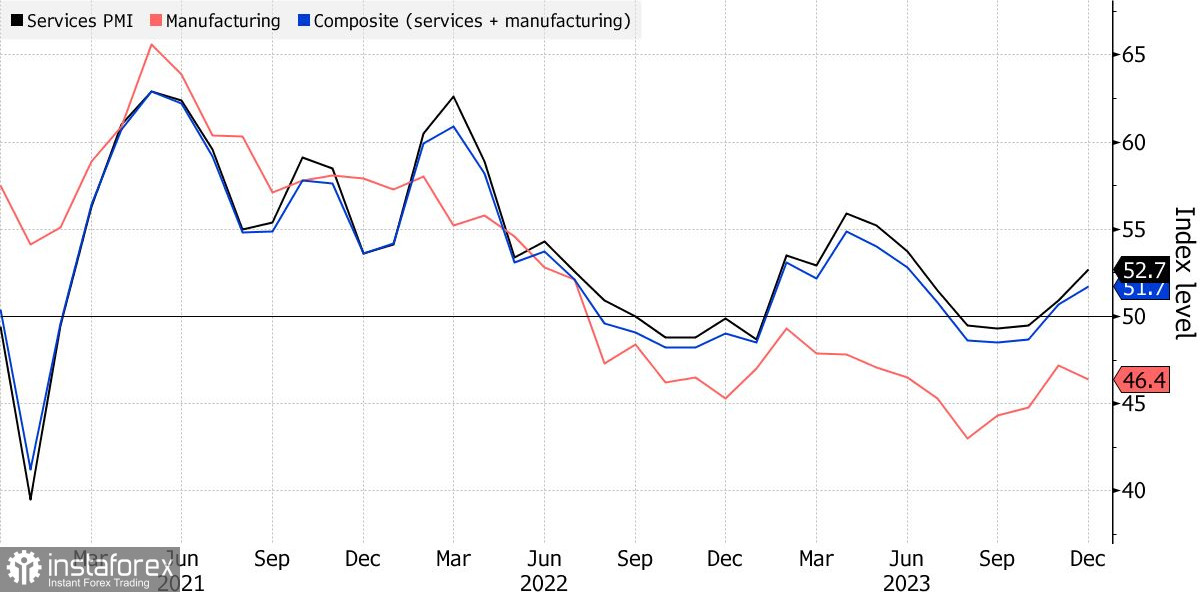

However, there are many signs that the UK will manage without a recession. Weakening inflation and the resumption of real wage growth for the first time in almost two years boost consumer and business confidence. Data on Friday showed that the Supply Managers' Index for the services sector, measuring private sector activity, jumped to a six-month high in December. Household confidence in the UK has also risen on the GfK scale. According to Halifax and Nationwide, the housing market continues to demonstrate remarkable resilience despite high borrowing costs. In November, prices increased compared to the previous month.

There are reasons to expect a gradual acceleration in the pace of UK economic growth, as the worst cost of living reduction is behind us, and household real incomes are now showing, albeit slight, growth. The dovish shift in market interest rates next year will undoubtedly add enthusiasm.

It is worth noting that at the end of last week, the Bank of England left rates unchanged, announcing a commitment to a tough stance on future interest rate policy, leading to an increase in the pound. However, on Friday, pressure on the pair resumed against the backdrop of weak economic activity statistics.

As for the prospects of the GBP/USD pair, despite the correction, the bull market persists. Consolidation above 1.2720 will strengthen the chance of further growth with a target of 1.2760, leaving room for a retest of the 1.2790 high. After that, there may be talks of a more pronounced surge in the pound towards 1.2820. In the case of a pair decline, bears will attempt to take control of 1.2650. If successful, breaking through this range will hit bullish positions and push GBP/USD toward the low of 1.2615 with the prospect of reaching 1.2590.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română