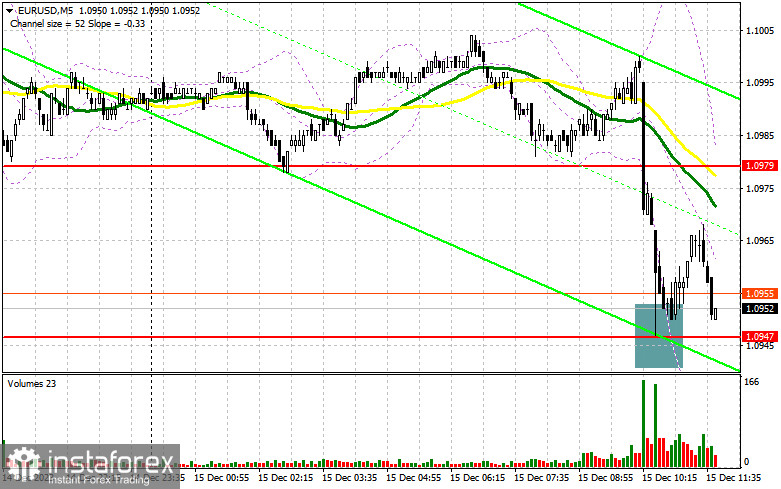

In my morning forecast, I pointed out the level of 1.0947 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout at this level provided an excellent buy signal for the continuation of the bullish trend. However, as of the time of writing this article, a significant upward movement had not materialized. After a 20-point recovery, pressure on the pair returned. The technical picture was reassessed for the second half of the day.

To open long positions on EUR/USD, it is required:

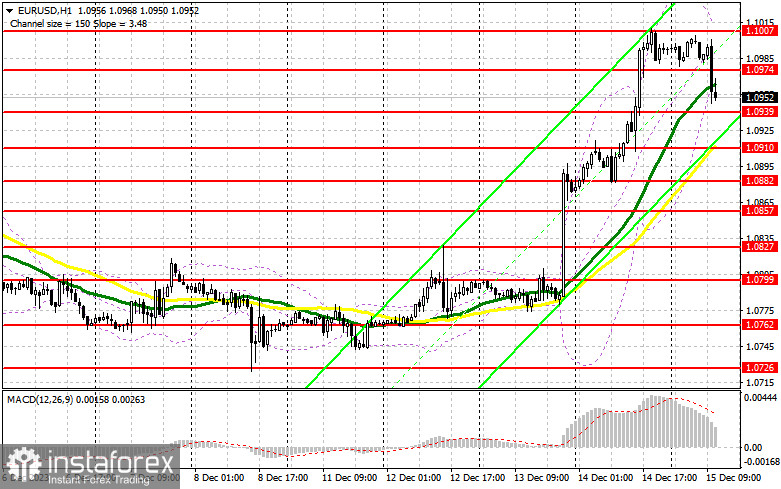

Earlier in the morning, I noted that weak data on activity in the Eurozone could lead to a significant correction in the euro, which did happen. In many Eurozone countries, PMI index activity continued to decline, indicating an economic downturn - the euro responded accordingly. In the second half of the day, we will see the figures for the Manufacturing Purchasing Managers' Index (PMI), the Services Business Activity Index, and the Composite PMI for the United States, as well as changes in industrial production. If the data turns out to be better than economists' forecasts, pressure on the euro will persist, leading to the reversal of most of yesterday's pair's gains. For this reason, I will not rush with purchases. Only a false breakout at 1.0939 will provide an entry point for long positions, counting on the recovery of EUR/USD and testing the resistance at 1.0974 formed by the end of today. Breaking through 1.0974 and updating from top to bottom, along with weak PMI indices, will lead to a buy signal and a chance to update 1.1007 - the monthly maximum. The ultimate target will be the area of 1.1058, where I will make a profit. In the case of a further decline in EUR/USD and the absence of activity at 1.0939 in the second half of the day, as well as strong statistics for the United States, one can count on another downward wave in the euro. In this case, I plan to enter the market only after the formation of a false breakout around 1.0910, where the moving averages intersect. I will consider opening long positions immediately on a rebound from 1.0882 with a target of an upward correction of 30-35 pips within the day.

To open short positions on EUR/USD, the following is required:

Sellers tried, and it turned out quite well. Thanks should be given to weak statistics for the Eurozone, which do not fit into the actions of the European Central Bank yesterday. However, the trend remains upward, and trading against such a market should be cautious. Only the formation of a false breakout around 1.0974 will confirm the correct entry point for sales and give a sell signal to update 1.0939 - the support formed by the end of yesterday. Only after breaking and consolidating below this range, as well as a reverse test from bottom to top, do I expect to get another sell signal with an exit at 1.0910. The ultimate target will be a minimum of 1.0882, where I will take a profit. In the case of an upward movement of EUR/USD during the American session, the absence of bears at 1.0974, as well as weak data on activity in the United States, buyers will regain the initiative. This will open the way to 1.1007, where you can also sell, but only after an unsuccessful consolidation. I will consider opening short positions immediately on a rebound from 1.1058 with a target of a downward correction of 30–35 points.

Indicator signals:

Moving averages:

Trading is conducted above the 30 and 50-day moving averages, indicating a bullish market.

Note: The author considers the periods and prices of moving averages on the hourly chart H1, which differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator at around 1.0950 will act as support.

Indicator Descriptions:

- Moving average (MA, determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving average (MA, determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD indicator (Moving Average Convergence/Divergence, determines the convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

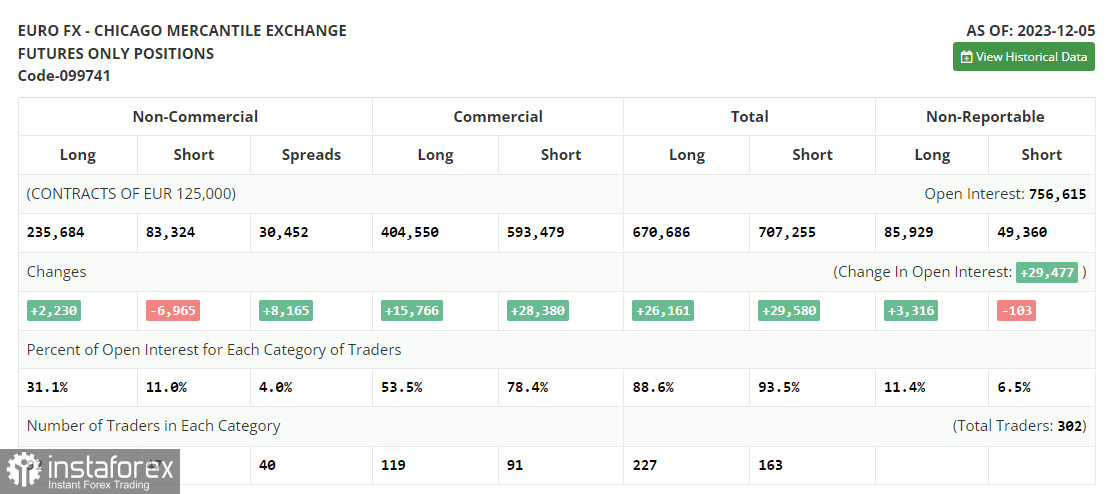

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română