The euro extends its advance following the European Central Bank meeting and ECB President Christine Lagarde's press conference. The whole point is that Lagarde did not mention anything about easing monetary policy. While she uttered the same words about the need to lower interest rates in the future, she accompanied them with a rather peculiar comment. It appears that she was referring to lowering the key rate only when the Bank meet its target of getting inflation back down to 2%. However, at the moment, inflation is still above this level. This implies that the ECB will start lowering interest rates after the Federal Reserve. This was already clear even without Lagarde's comments.

However, her words raised hopes that at some point, the level of interest rates in Europe would be higher than in the United States. This is why the euro surged. However, a brief look at inflation in Europe and the United States suggests that such dreams are unrealistic. Even if the ECB starts lowering its interest rates after the Fed, it will not wait too long. Considering that the level of interest rates in America is noticeably higher, European rates will only exceed them if Lagarde decides to destroy the eurozone economy.

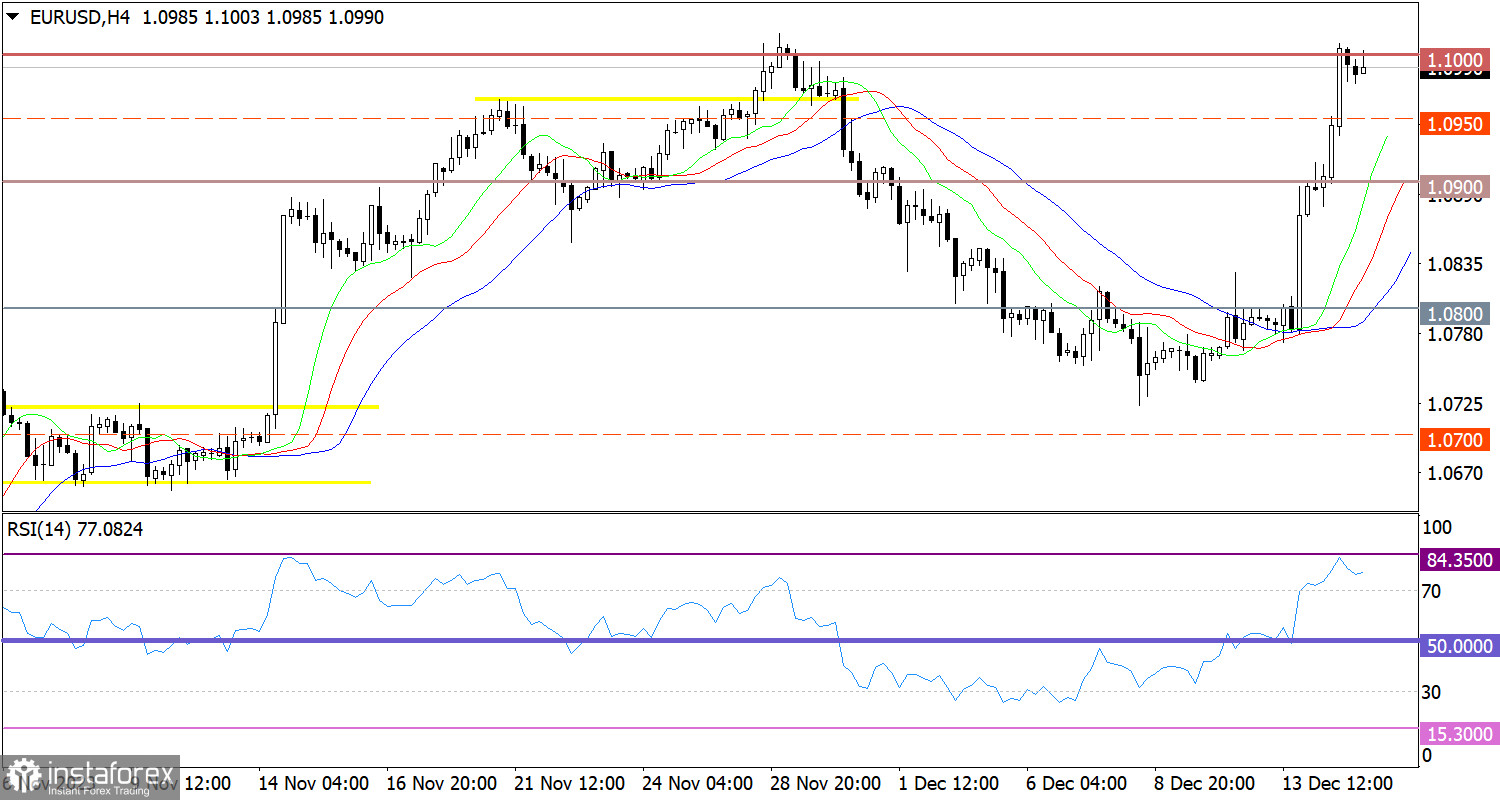

The EUR/USD pair is rapidly recovering previously lost ground. Since the beginning of the trading week, the exchange rate has strengthened by 2.5%, which is almost 100% of the recent correction. In fact, we already have technical signs of restoring the upward cycle.

On the 4-hour chart, the RSI indicator shows a signal of the euro's overbought conditions, as the asset's RSI exceeded the 70 mark.

On the same time frame, the Alligator's MAs are headed upwards, corresponding to an upward cycle.

Outlook

Keeping the price above the level of 1.1000 allows for further growth despite the technical signal of overbought conditions. In this case, it will extend the upward cycle. However, if the 1.1000 level serves as resistance, a local price rollback may take place.

The complex indicator analysis points to an upward signal in the short-term, medium-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română