EUR/USD

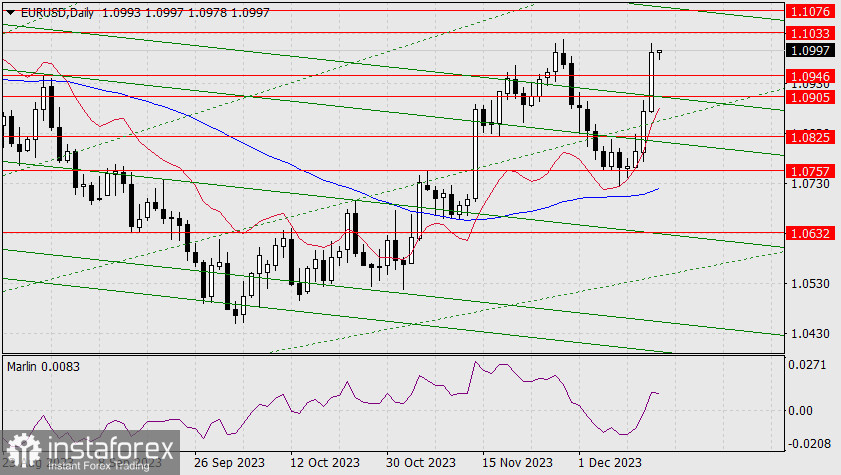

In light of the meetings of the Federal Reserve, the European Central Bank, and the Bank of England, investors saw divergences in central banks' approaches to interest rates. The US central bank is ready to start lowering them. The euro gained 118 pips on this, approaching the target level of 1.1033, above which is the upper band of the global descending price channel and the target level of 1.1076.

On the daily chart, the Marlin oscillator still has enough room for corrections and further growth before it reaches the overbought territory.

Once again, I would like to refer to yesterday's note about investors pricing in a sixfold rate cut by the Fed in 2024. A sevenfold rate cut occurred during the 2007/8 crisis, although at that time, there were cuts of both 0.50% and 0.75%. But there is still more ahead... Investors are anticipating a serious crisis, which may start closer to the summer of 2024 when stock markets set new record highs amid a declining economy and falling interest rates. The S&P 500 index has only 2.12% left to rise to reach the peak of January 2022. Perhaps the crisis will come sooner. For now, the markets are engrossed in the policies of the Fed and are leaving Argentina's financial crisis out of the spotlight.

On the 4-hour chart, the Marlin oscillator has reached the overbought territory and is turning to relieve tension. The price is also slightly turning. Once the correction ends, we expect the euro to rise towards the indicated targets: 1.1033 and 1.1076.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română