On Wednesday night, the FOMC summed up the results of the last meeting in 2023. At first glance, it may seem that the Federal Reserve did not make any crucial decisions, and did not announce anything significant. However, this is not the case. It can be said that all the most significant decisions were in the shadows. So, let's break down all the information.

First of all, I want to say that I fully support the market's actions, which sharply reduced demand for the US dollar. When the head of the Federal Reserve comes out and says that the rate will no longer rise but will decrease, these statements can only be interpreted as dovish. And dovish statements should exert pressure on the currency, which we saw on Wednesday. Another matter is the prospects for the dollar, as the wave patterns of both instruments suggest its growth. But, as I have already mentioned, the news background does not always align with wave analysis.

In addition to Fed Chair Jerome Powell's words, I will highlight the updated "dot-plot" chart. According to the new chart, 11 out of 19 FOMC members support a rate cut of 75 basis points in 2024. That is, three times. Another five support a cut of 100 basis points, which is four times. The median forecast for the rate at the end of 2024 is 4.6% (the current value is 5.5%). The median forecast for the rate at the end of 2025 is 3.6%. This suggests that the interest rate will not decrease rapidly. It's about a 100 basis point decrease per year. If so, it will take approximately 3-3.5 years to reach 2%.

In my opinion, such deliberation is due to the high risks of a new surge in inflation. However, at the same time, it is important to remember that this is just a forecast. Economic reports will change, and so will the forecasts. Everything will depend on inflation. The fact that Powell ruled out another rate hike played against the dollar, and other factors became less relevant.

Now, the bears need to recover quickly from the shock and return to the market. If this does not happen soon, Wave 2 or b for both instruments may take a completely unreadable form. And I have to remind you that it is advisable to play simple structures rather than complex ones. The more complex the wave structure, the higher the probability of incurring losses. Wave analysis is not a panacea; it is just one of the ways to forecast price movements.

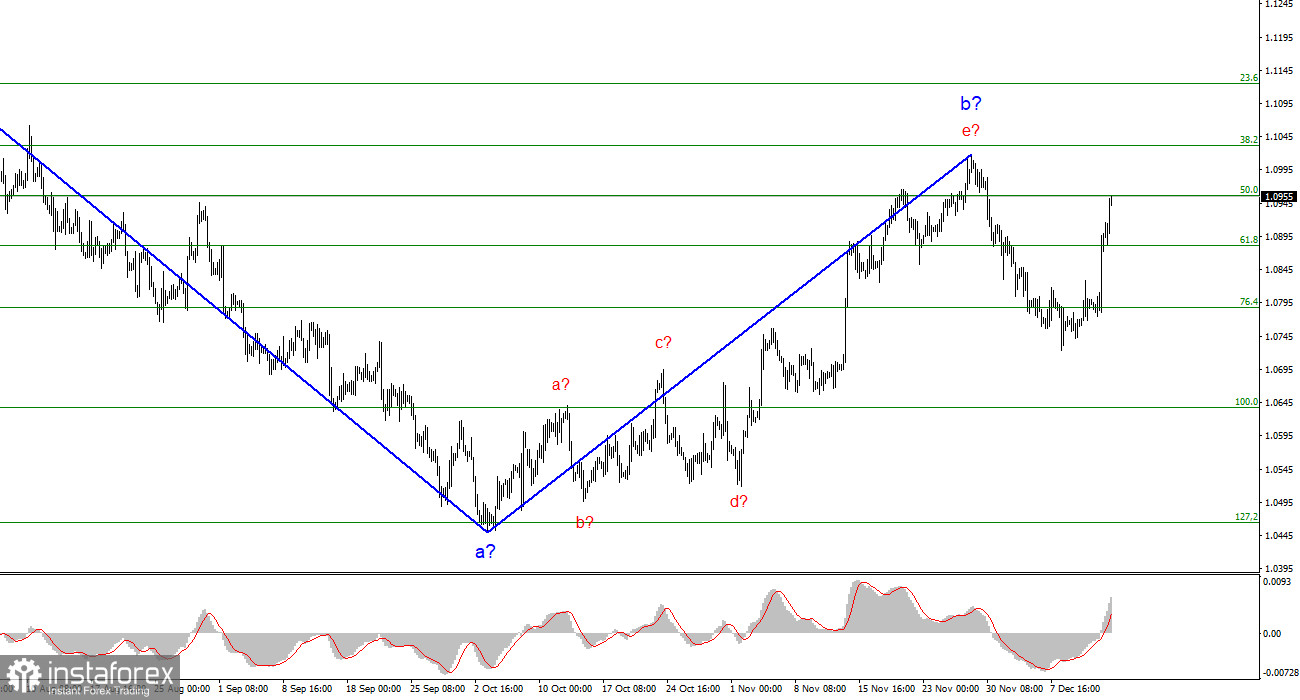

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

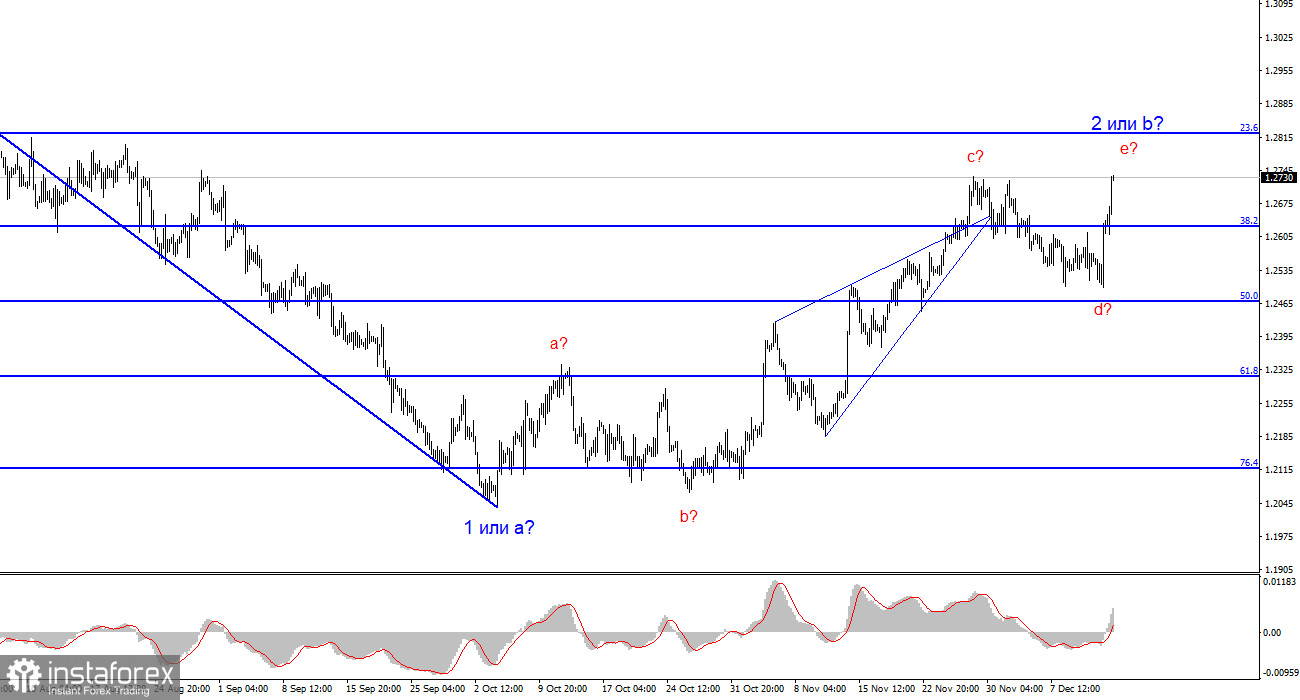

The wave pattern for the GBP/USD pair suggests a decline within the descending wave 3 or c. At this time, I can recommend selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and it could do so at any moment. The longer it takes, the stronger the fall. The peak of the assumed wave c in 2 or b can be used for short positions, and the order limiting possible losses on transactions can be placed above it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română