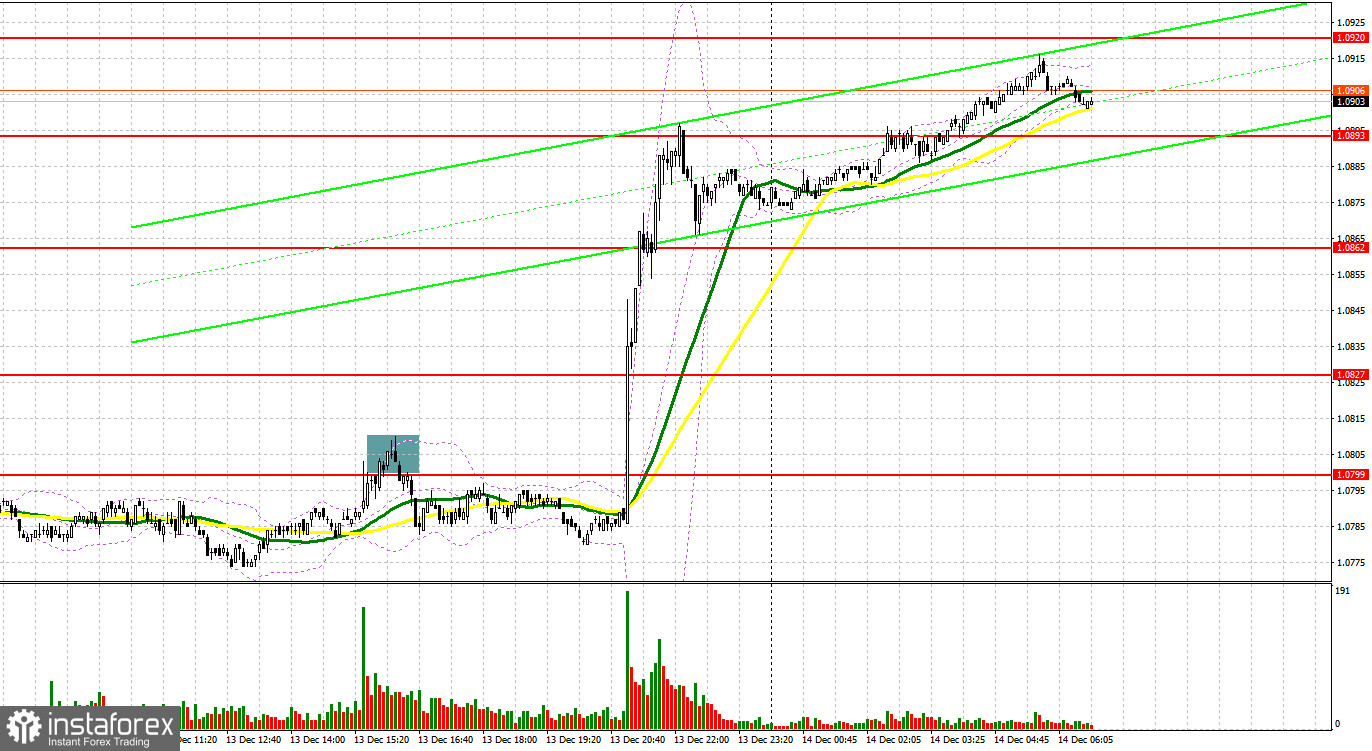

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0799 as a possible entry point. Due to very low volatility, which was just around 20 pips, it was not possible to test the levels I had mentioned, and accordingly, we did not get any good entry points either. In the afternoon, safeguarding 1.0799 generated a sell signal, which sent the pair down by 20 pips.

For long positions on EUR/USD:

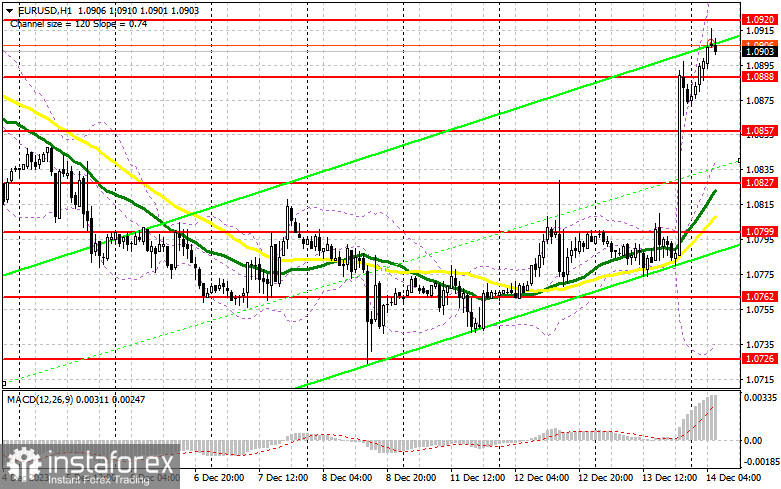

Yesterday afternoon, the dollar fell and the euro sharply increased as the Federal Reserve signaled it is ready to start its pivot towards lowering rates. Today, the pair's direction will depend on the outcome of the European Central Bank meeting. If the central bank follows the Fed, there's a possibility that the euro will lose some ground. If the ECB's position on rates is relatively firm, the single currency will continue to rise. It is best to act in favor of the new uptrend, but the best scenario would be to act on a decline after a false breakout near 1.0888. This will confirm the entry point for long positions, targeting a recovery and test of the resistance at 1.0920. A breakout and a downward test of this range will produce a buy signal and a chance to develop a new uptrend with the prospect of testing 1.0947. The furthest target would be the 1.0979 area, where I plan to take profits. If EUR/USD declines and there is no activity at 1.0888 in the first half of the day, which is possible in case the ECB shows a very soft stance regarding the future monetary policy, the currency pair may come under pressure. In such a case, it will be possible to enter the market after forming a false breakout near 1.0857. I will open long positions immediately on a rebound from 1.0827, bearing in mind an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

The sellers are facing problems and their last hope is the European Central Bank, which has recently been resisting talk of an imminent interest rate cut. You should be cautious when selling against the bull market. Forming a false breakout near 1.0920 will generate a sell signal with the goal of testing the nearest support at 1.0888. Only after a breakout and consolidation below this range, which may take place as a result of the ECB meeting, as well as an upward retest, do I expect another sell signal at 1.0857. The lowest target will be the low of 1.0827, where I will take profits. This is in line with the bearish moving averages. In case of an upward movement of EUR/USD during the European session, as well as the absence of the bears at 1.0920, which is where things are headed, I will postpone selling the pair until the price tests the resistance at 1.0947. There, selling is also possible but only after a failed consolidation. I will open short positions immediately on a rebound from 1.0979 aiming for a downward correction of 30-35 pips.

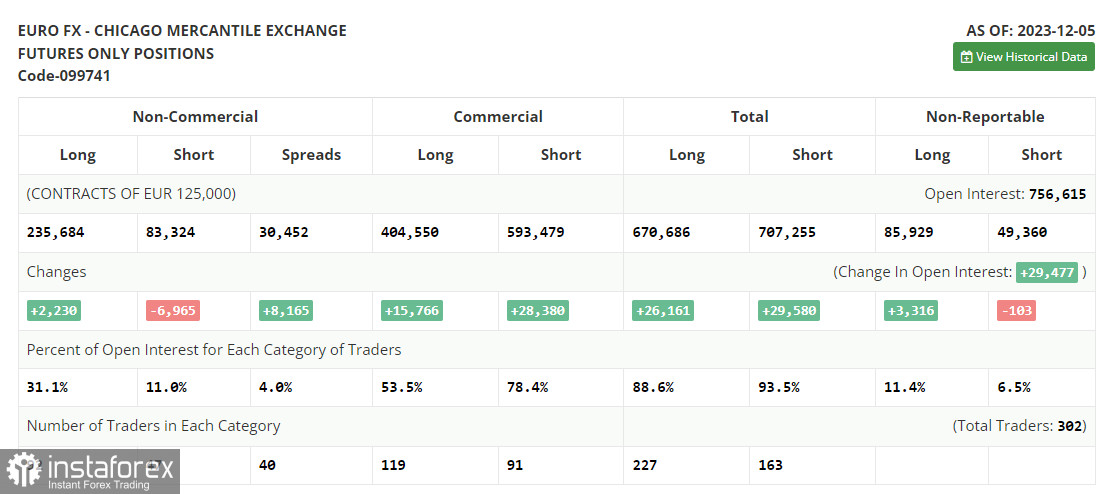

COT report:

In the COT report (Commitment of Traders) for December 5, there was an increase in long positions and a significant decline in short positions. Obviously, the Federal Reserve's December meeting will be decisive for the dollar, and after the statements of policymakers it will become clear in what direction the central bank is ready to move. A soft stance on rates next year will reverse the market and the pair will rise. A tough stance, with strong inflation, will maintain the demand for the dollar for some time, but is unlikely to significantly affect the long-term balance of power in favor of buyers of risky assets. The COT report indicated that long non-commercial positions grew by 2,230 to 235,684, while short non-commercial positions decreased by 6,965 to 83,324. As a result, the spread between long and short positions increased by 8,165.

Indicator signals:

Moving averages:

Trading above the 30- and 50-day moving averages indicates a possible uptrend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0760 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română