Analysis of transactions and tips for trading USD/JPY

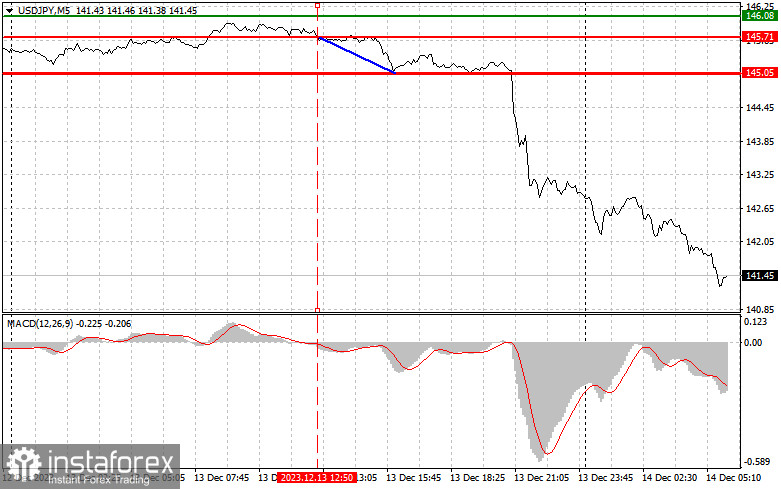

The test of 145.71, coinciding with the decline of the MACD line from zero, provoked a sell signal that led to a price decrease of around 60 pips.

Yen rose in price after the Fed announced a dovish stance on interest rates. Then, data on orders for machinery and equipment in Japan exceeded expectations, so yen increased further. Dollar may also continue to decline amid disappointing retail sales data from the US.

For long positions:

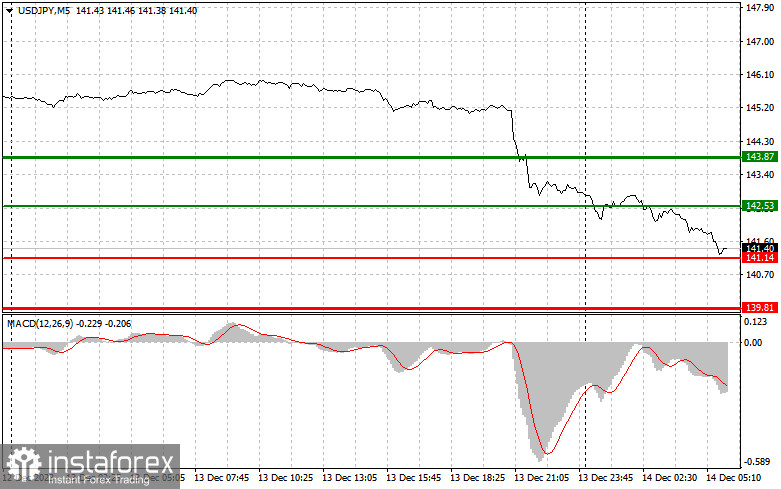

Buy when the price hits 142.53 (green line on the chart) and take profit at 143.87. Growth will occur only if the US releases very strong statistics.

When buying, ensure that the MACD line lies above zero or rises from it. Also consider buying USD/JPY after two consecutive price tests of 141.14, but the MACD line should be in the oversold area as only by that will the market reverse to 142.53 and 143.87.

For short positions:

Sell when the price reaches 141.14 (red line on the chart) and take profit at 139.81. Pressure will increase amid weak US data.

When selling, ensure that the MACD line lies below zero or drops down from it. Also consider selling USD/JPY after two consecutive price tests of 142.53, but the MACD line should be in the overbought area as only by that will the market reverse to 141.14 and 139.81.

What's on the chart:

Thin green line - entry price at which you can buy USD/JPY

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell USD/JPY

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română