If the train has been in motion for a month and a half, what's the point of standing in its way? The Federal Reserve is undoubtedly dissatisfied with the market pricing of a 100-125 basis points cut in the federal funds rate in 2024, but even Jerome Powell's attempts to pressure the S&P 500 won't yield results. This is the official stance of the bulls on the stock index, and it warms the ears of EUR/USD. However, in the Forex market, there is a different opinion. The campaign against the Federal Reserve's dovish policy is akin to suicide, and the central bank intends to prove it.

Since mid-October, the S&P 500 has grown by 13% thanks to expectations of the Fed's dovish pivot. Investors believe that in 2024, the regulator will provide the economy with significant monetary stimulus. The reason for this is both a recession and a soft landing. In the case of a rapid achievement of the 2% inflation target, the Federal Reserve will have no grounds to keep rates as high as they are now. The central bank clearly disagrees with this.

The latest statistics on the American labor market and inflation force it to stick to a policy of keeping borrowing costs flat for an extended period. Indeed, employment acceleration to 199,000 and a 0.4% MoM increase in wages, a reduction in unemployment to 3.7%, and stabilization of core inflation at 4% indicate that discussing a federal funds rate cut is premature.

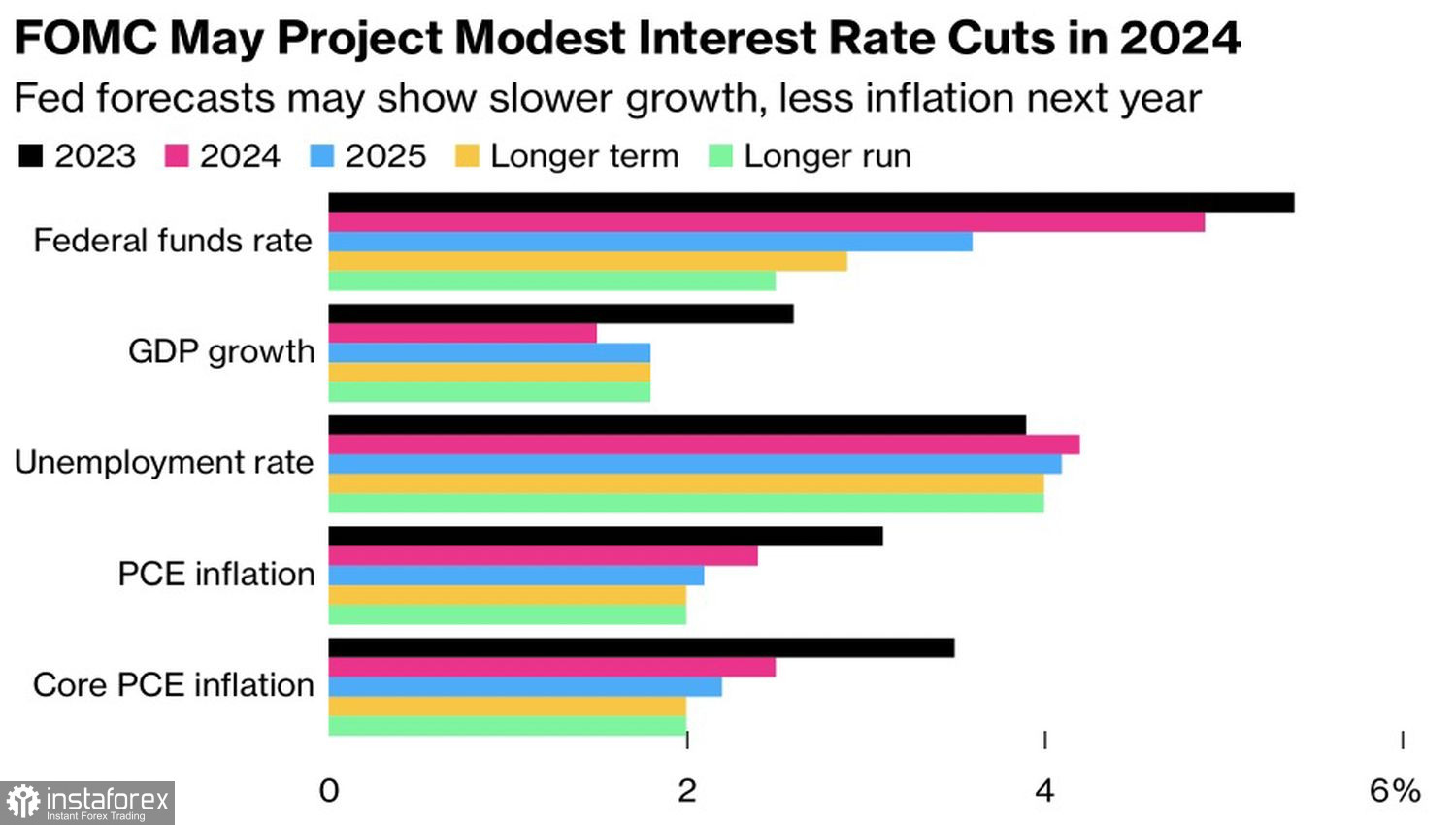

The consensus estimate of Bloomberg experts suggests that the updated FOMC forecasts will show two acts of monetary expansion in 2024 and five in 2025. Some specialists support the market's view of a 100 basis points reduction in borrowing costs to 4.5%, while others, on the contrary, see no cuts.

Consensus Estimates of Updated FOMC Forecasts

If we base the Federal Reserve's policy on data dependence, both benchmarks for raising and lowering the federal funds rate are high. The statistics call for a pause, and Powell will do everything possible to support the idea of a respite after a long journey. However, greed prevails in the markets, so the unconvincing arguments are fraught with the continuation of the S&P 500 rally and the rise of EUR/USD quotes.

Certainly, there are extreme scenarios. In the first, the Federal Reserve unexpectedly raises the cost of borrowing to 5.75%, as forecasted in September. The chances of this scenario unfolding are slim. Stock indices will sharply decline, yields on Treasury bonds and the U.S. dollar will spike. Financial conditions will tighten, but panic in financial markets is not needed by anyone.

On the contrary, if the updated FOMC forecasts include not two acts of monetary expansion in 2024, but three or more, the S&P 500 will get the green light. This is also not the best option for the Federal Reserve because, in such a scenario, financial conditions will become even easier, complicating the fight against inflation.

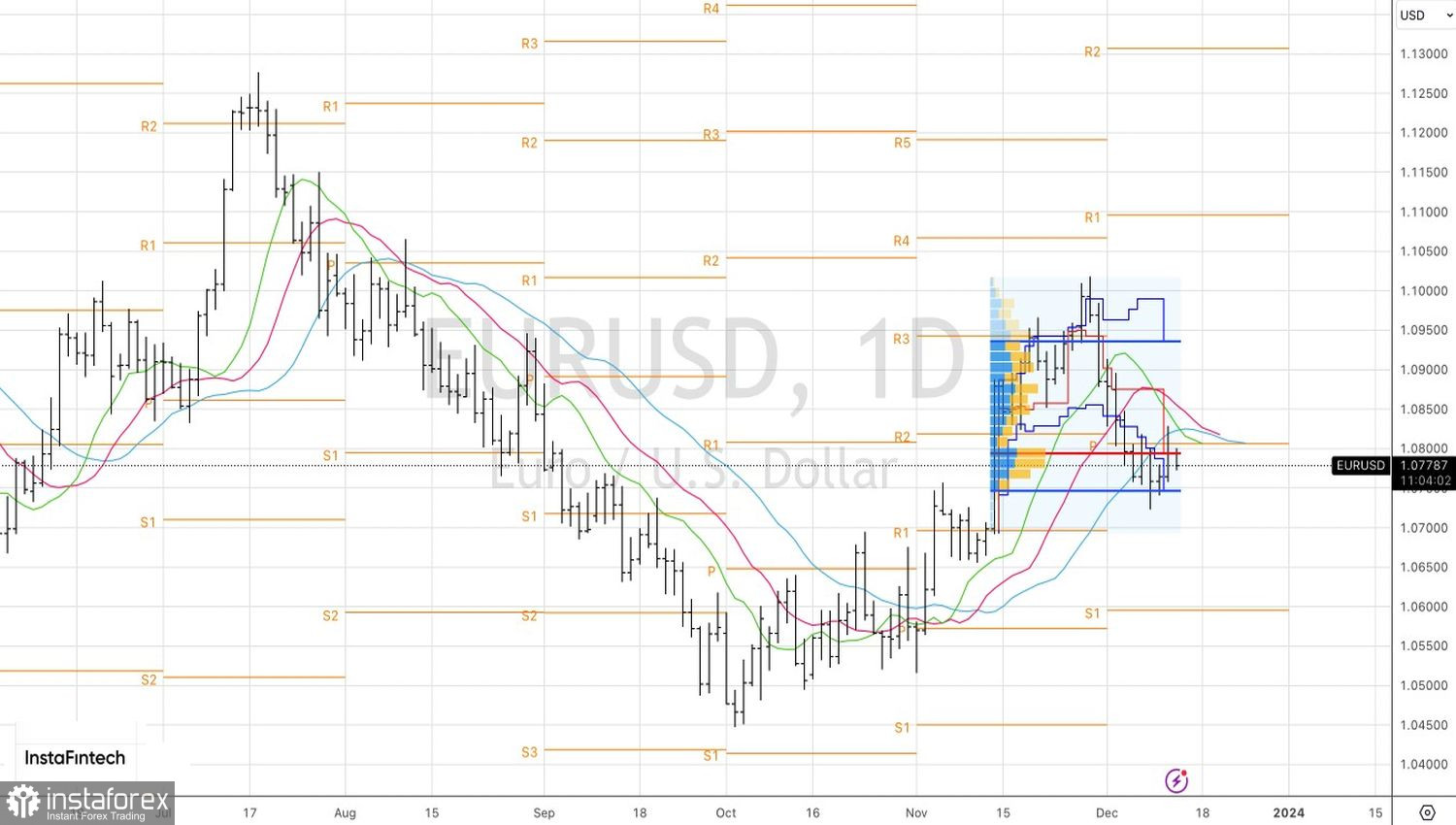

The technical inability of EUR/USD bulls to overcome resistance at 1.0815 indicates their weakness. Shorts formed from this level make sense to increase on the breakdown of support at 1.076 and 1.0745.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română