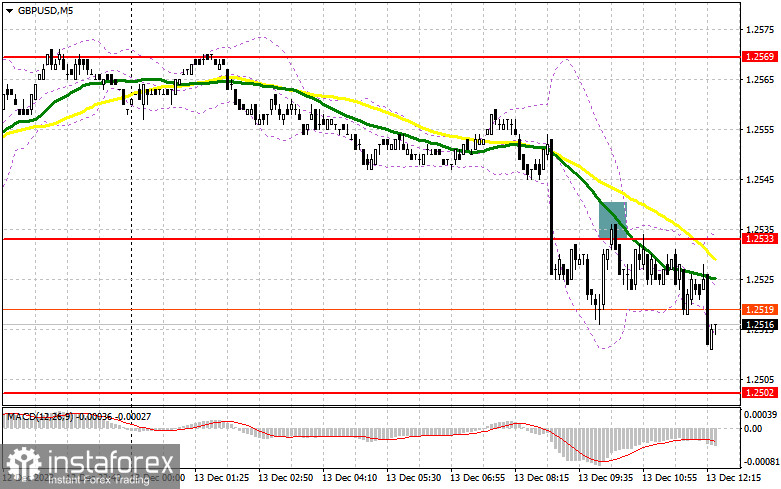

In my morning forecast, I drew attention to the level of 1.2533 and recommended making entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. The breakthrough and subsequent test of 1.2533, after very weak GDP data for the UK, led to an entry point for short positions, resulting in a drop of more than 25 points in the pair. The technical picture was slightly revised for the second half of the day.

To open long positions on GBP/USD, the following is required:

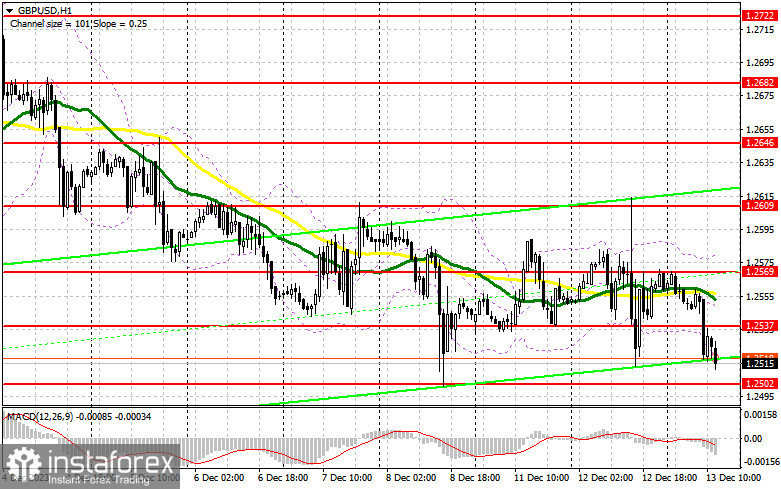

Considering the sharp decline in the UK GDP and several other reports indicating a slowdown in economic growth in the country, the pound reacted with a decline. Furthermore, the final Federal Reserve meeting is ahead of us, where a shift towards a more stringent policy in early next year will lead to even greater pressure on the pair and a breakout of monthly lows. For this reason, caution is needed with purchases. It would be good to wait for the formation of a false breakout around the minimum of 1.2502. Only this will provide an entry point for long positions with the target of GBP/USD recovery and updating the area of 1.2537, formed at the end of the European session. A breakout and consolidation above this range can only be expected in the case of a very dovish stance by the Federal Reserve, leading to stop-loss triggers and a sharper pound rise to around 1.2569, where the moving averages intersect. The ultimate target will be the area of 1.2609, where I will make profits. Testing this level can significantly reshape market sentiment in favor of buyers. In the scenario of a pair decline and the absence of bullish activity at 1.2502 in the second half of the day, attempts by bulls to stop the trend can be confidently abandoned. In this case, only a false breakout in the area of the next support at 1.2478 will signal the opening of long positions. I plan to buy GBP/USD immediately on the rebound only from 1.2451 to correct the pair downward by 30-35 points within the day.

To open short positions on GBP/USD, the following is required:

Sellers took advantage of another batch of weak statistics for the UK and continued to increase their presence. The Fed's decision in favor of maintaining a tough policy will be a good reason to increase short positions in the second half of the day. In the event of a pair spike upward before Powell's press conference, I expect bearish activity only around 1.2537 – resistance formed at the end of the first half of the day. Only the formation of a false breakout there will allow for a sell signal and a chance for another downward move to the monthly minimum of 1.2502. A breakout and bottom-up retest of this range will deal a more serious blow to bullish positions, leading to stop-loss triggers and opening the way to new support at 1.2478. The more distant target will be the area of 1.2451, where I will take profits. In the scenario of GBP/USD growth and the absence of activity at 1.2537 in the second half of the day, I will postpone sales until a false breakout at the level of 1.2569. However, it is crucial to see what Powell says. In the absence of downward movement, I will sell GBP/USD immediately on the rebound from 1.2609, but only with the expectation of a pair correction downward by 30-35 points within the day.

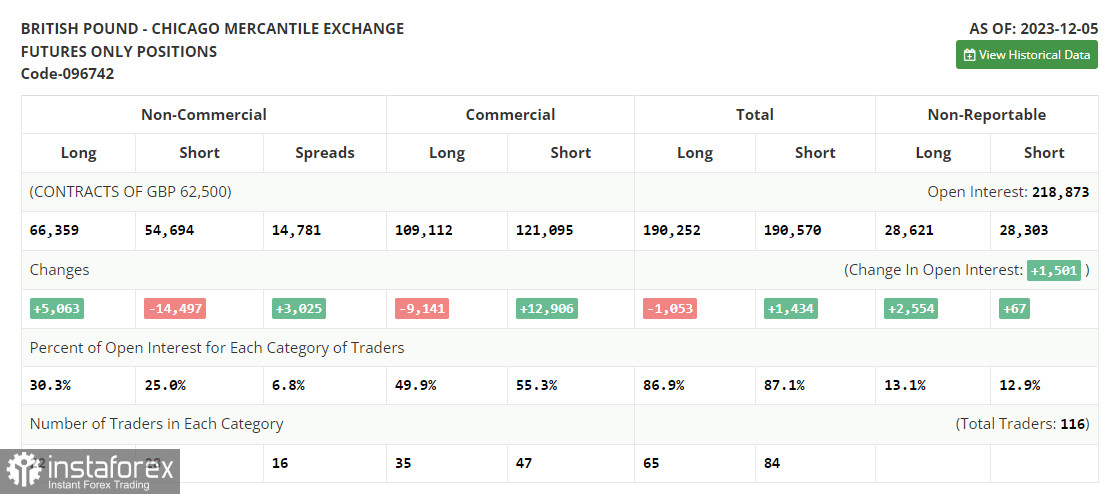

In the COT report (Commitment of Traders) for December 5, there was a sharp increase in long positions and a decrease in short positions. Demand for the pound is maintained, as evidenced by recent statements by Bank of England Governor Andrew Bailey and other Bank of England officials that the regulator, if not continuing to raise interest rates, will at least keep them at current highs and allow for buying the pair on every good downward movement. Ahead are meetings of the Federal Reserve and the Bank of England, which will be determining. The soft tone of American politicians will weaken the dollar's position. If the situation is the opposite, with the Fed stating that it is necessary to wait for a rate cut and the Bank of England starting to worry about the prospects of economic growth, a pound decline is inevitable. In the last COT report, it is stated that long non-commercial positions increased by 5,063 to the level of 66,359, while short non-commercial positions fell by 14,497 to the level of 54,694. As a result, the spread between long and short positions increased by 3,025.

Indicator Signals:

Moving Averages

Trading is conducted below the 30- and 50-day moving averages, indicating further pair declines.

Note: The author considers the period and prices of moving averages on the hourly chart (H1), which differs from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decline, the lower boundary of the indicator at 1.2513 will act as support.

Indicator Descriptions:

- The moving average (50-day) is marked on the chart in yellow.

- The moving average (30-day) is marked on the chart in green.

- MACD indicator (12-day fast EMA, 26-day slow EMA, and 9-day SMA) indicates the current trend.

- Bollinger Bands (20-day) help identify support and resistance levels.

- Non-commercial traders refer to speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română