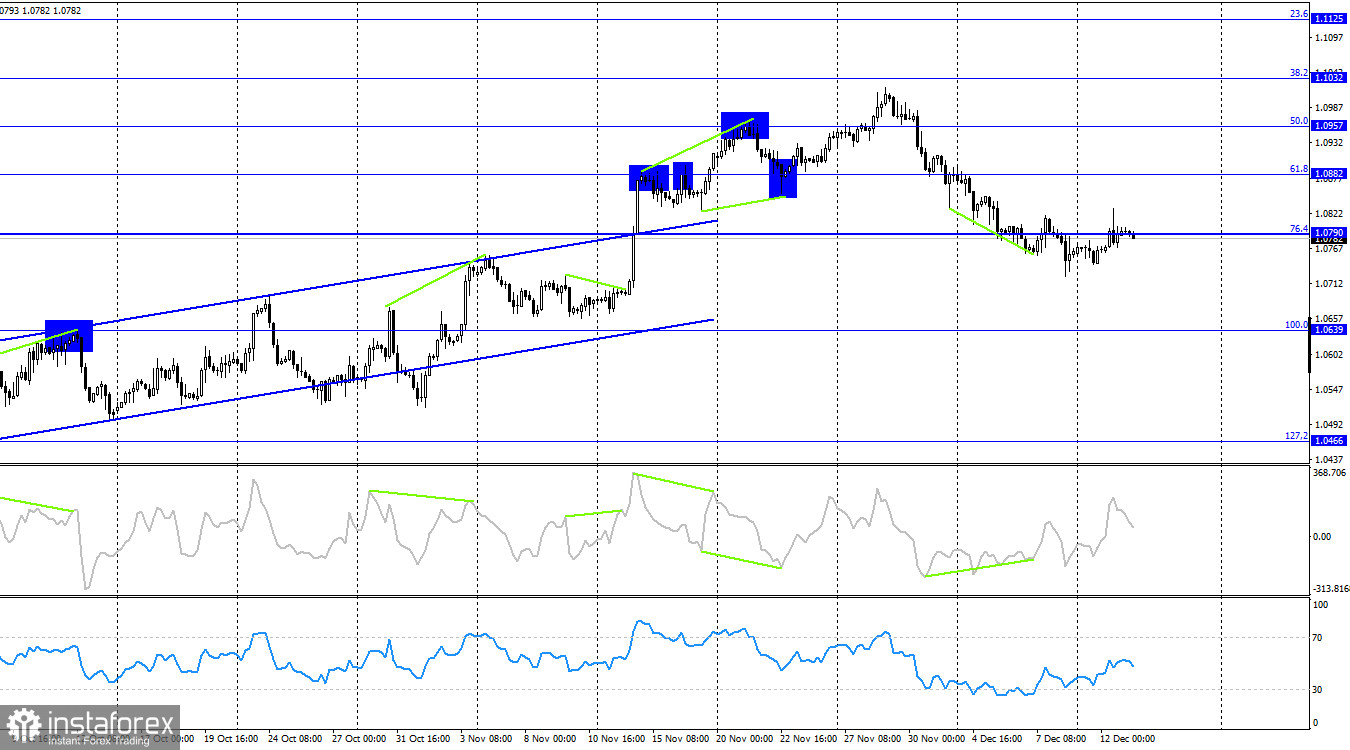

The EUR/USD pair executed an upward movement to the level of 1.0818 on Tuesday, rebounded from it, and returned to the corrective level of 38.2% (1.0765). At the moment, the pair is once again heading towards the level of 1.0765. A new bounce from this level will again work in favor of the European currency, leading to some growth towards the level of 1.0818. Consolidation of the pair's rate below 1.0765 increases the probability of a decline towards the level of 1.0714.

The wave situation has been slightly complicated over the past day. I warned that a confident breakthrough at the level of 1.0818 is needed to change the trend to "bullish." However, yesterday, the pair only broke it by a few points. Thus, I cannot consider the last upward wave to have surpassed the peak of the previous one. The last three waves indicate horizontal movement. A new downward wave may end near the low of the previous wave (1.0725). The probability of the pair being in a horizontal corridor for several more days is high.

On Tuesday, there was only one important report, and after it was released, it became clear that it wasn't as significant as expected. Traders anticipated a decline in inflation to 3.1%, and that's exactly what they got. Base inflation also did not surprise, remaining at 4%. Thus, no changes occurred, and traders did not see the need to react to an "empty" report. What is undoubtedly more interesting is not the market's reaction to this report but the Federal Reserve's (FRS) response. The results of the last meeting of the year will be announced tonight. Since there were no changes in inflation for November, I do not expect any changes in Jerome Powell's rhetoric. Interest rates are unlikely to change, significantly limiting traders' opportunities for active trading on Wednesday.

I believe that today there is a high probability that the pair will remain within the range of 1.0725–1.0818.

On the 4-hour chart, the pair executed a reversal in favor of the European currency and returned to the corrective level of 76.4% (1.0790). Consolidation above this level will allow counting on a continuation of the upward movement towards the next Fibonacci level of 61.8% (1.0882). A rebound from the level of 1.0790 will work in favor of the US currency, leading to a resumption of the decline toward the corrective level of 100.0% (1.0639). There are no imminent divergences observed in any of the indicators today.

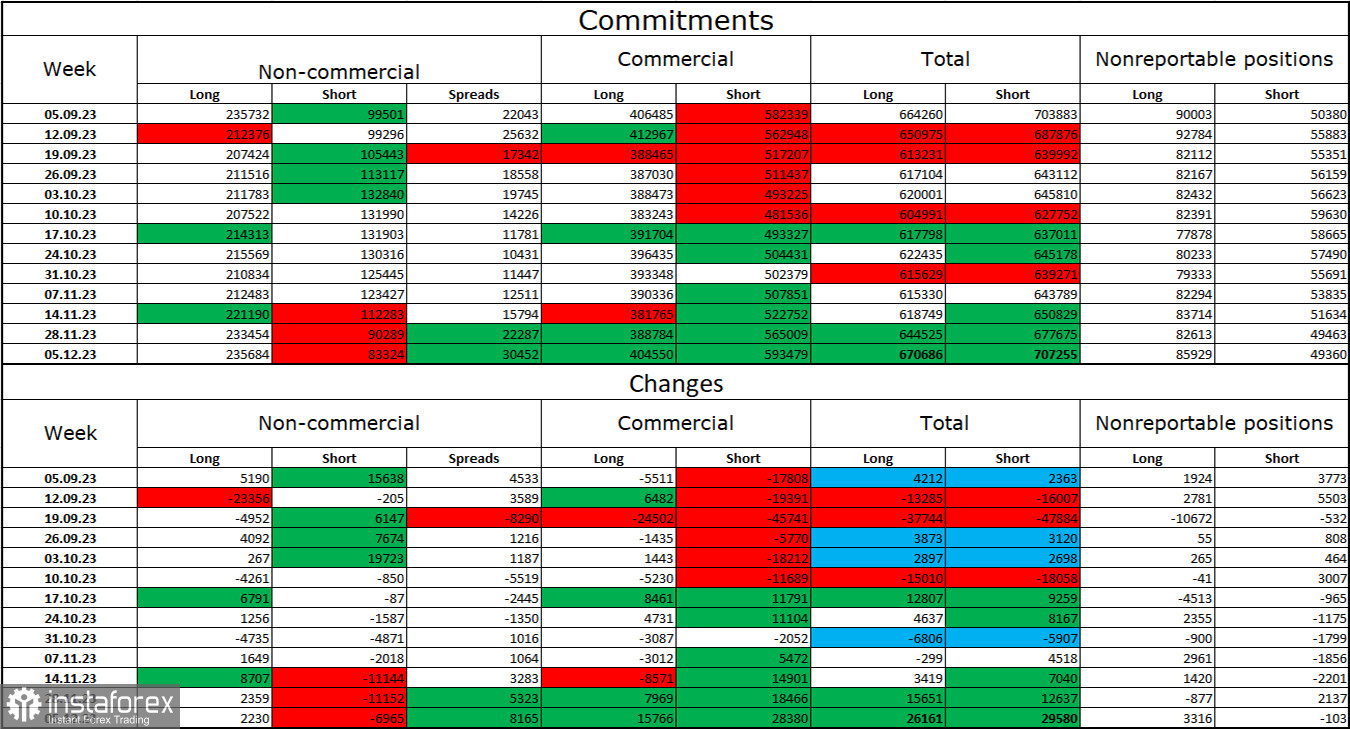

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 2230 long contracts and closed 6965 short contracts. The mood of major traders remains "bullish" and is intensifying again. The total number of long contracts held by speculators is now 235 thousand, while short contracts total only 83 thousand. The difference is once again threefold. However, I still believe that the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain the "bullish" trend. I don't see such a background at the moment, although the situation may change after the FRS and ECB meetings. Professional traders may resume closing long positions soon. I believe that the current figures allow for a resumption of the euro's decline in the coming months.

News Calendar for the US and the Eurozone:

Eurozone – Industrial Production (10:00 UTC).

US – Producer Price Index (13:30 UTC).

US – FOMC Rate Decision (19:00 UTC).

US – FOMC Statement (19:00 UTC).

US – FOMC Press Conference (19:30 UTC).

On December 13, the economic events calendar includes entries related to the FRS meeting. The impact of the information background on traders' sentiment today can be quite strong.

EUR/USD Forecast and Trader's Recommendations:

I recommended buying the pair yesterday when the quotes consolidated on the hourly chart above the descending corridor with targets at 1.0818 and 1.0862. The first target has been perfectly hit. New purchases are possible on the rebound from the level of 1.0765 with the same targets. Sales were possible on the rebound from the level of 1.0818, with targets at 1.0765 and 1.0714. These trades can still be kept open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română