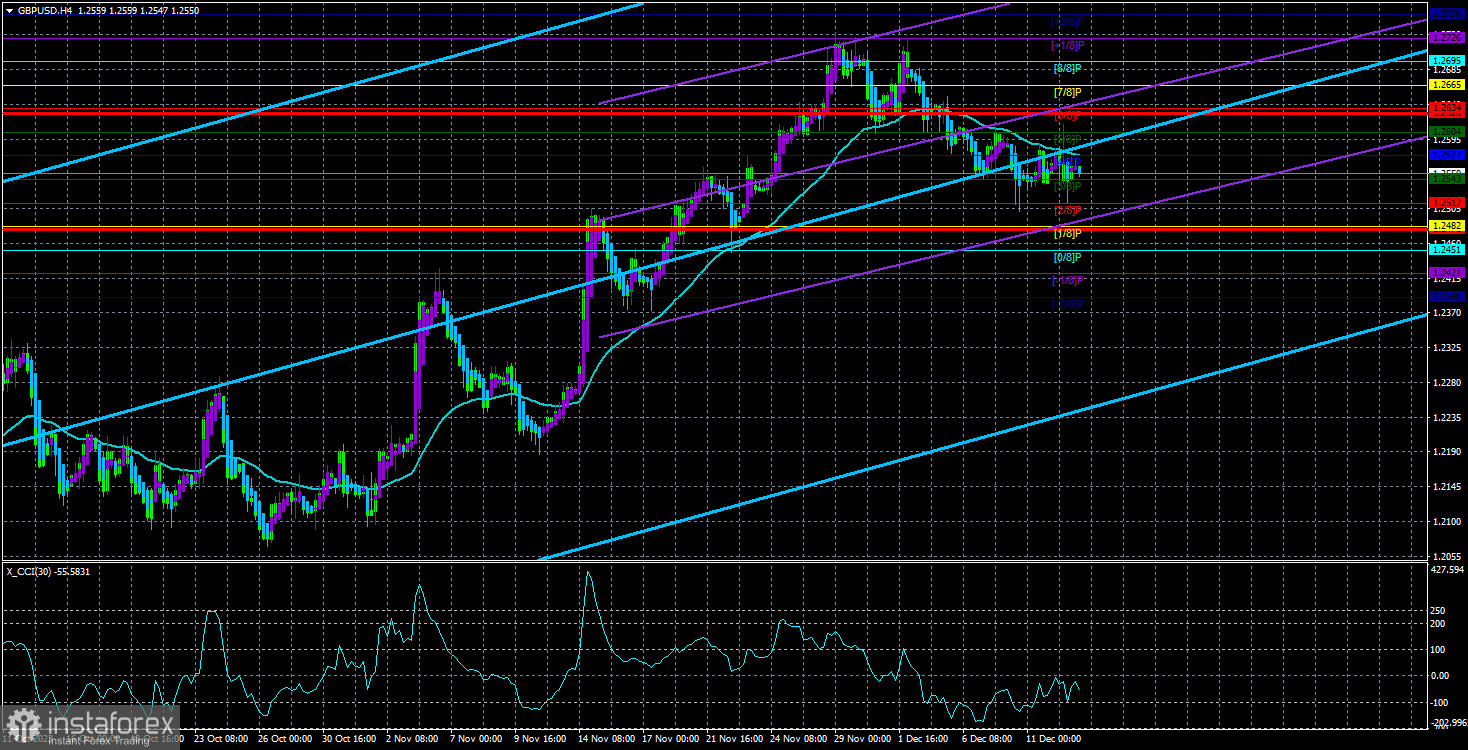

The GBP/USD currency pair also corrected towards the moving average on Tuesday. In the trading recommendations articles (links below), we mentioned that a fairly pronounced flat and sideways channel had formed for the pound. This flat is also clearly visible on the 4-hour TF. In other words, yesterday the pair not only corrected towards the moving average but rather stayed in the same place where it was. The US inflation report had no impact on the pair's movement.

In addition to the inflation report, "local" statistics were published in the UK in the morning. However, this data was just as bland as the American report. The unemployment level in the UK did not change, the number of unemployment benefit claims matched the forecast, and wages fell slightly more than expected. However, at the same time, the previous value of the indicator was revised to 8% (higher than the initial estimate). Therefore, the British pound did not find anything positive in this package of statistics.

As for the US inflation report, it did not provide any new food for thought. Market expectations remained unchanged, and the technical picture did not change. It still involves maintaining a downward trend with good prospects for further decline, as the price continues to be below the moving average. At the same time, the British pound is falling too slowly and too weakly to consider this movement as a new trend. We still believe that the pound has no grounds for growth. The CCI indicator did not enter the oversold zone, and the statistics from the UK are at best neutral and, at worst, weak. Neither the Bank of England nor the Fed is ready for additional tightening at the moment, and both will start lowering rates next year. Therefore, we do not currently see any advantages for either the dollar or the pound.

However, the British pound has risen quite strongly and without a solid foundation, so now expecting a decline from it is reasonable. On the 24-hour TF, it is visible that the recent upward movement looks a lot like a correction. If so, the downward trend will eventually resume, implying a drop in the pair below the 20th level.

The results of the Fed's meeting will be known tonight, and it can already be said that the key rate will remain unchanged, and Jerome Powell is unlikely to make "hawkish" or "dovish" statements. In essence, the most interesting indicator will be the dot plot, which will show the interest rates expected by the members of the monetary committee in 2024–2025. If the forecasts are lowered too much (stronger than the market expects), it may put pressure on the dollar, as market participants will believe in a faster shift to easing monetary policy in the US than in the EU or the UK.

Mr. Powell, of course, can also surprise the market, but what can he surprise with? The current inflation rate does not allow a shift to easing, and even talking about it is not allowed. There is also no reason to talk about raising the key rate now, as inflation is decreasing. It turns out that there is nothing to expect from the head of the Fed. But "surprises" are still possible, so we advise traders to be cautious tonight. For transactions, set a stop loss before announcing the results of the meeting; expect a sharp reversal and jump.

We believe that tonight we will see the same reaction as yesterday to the inflation report. The pair will "walk" in one direction, then in the other, and return to the starting positions. However, it should be remembered that the market can twist any of Powell's words in any direction, so tomorrow we will have to come up with reasons for this market reaction. This is the currency market, almost any movement is possible. We just try to outline the most likely scenarios.

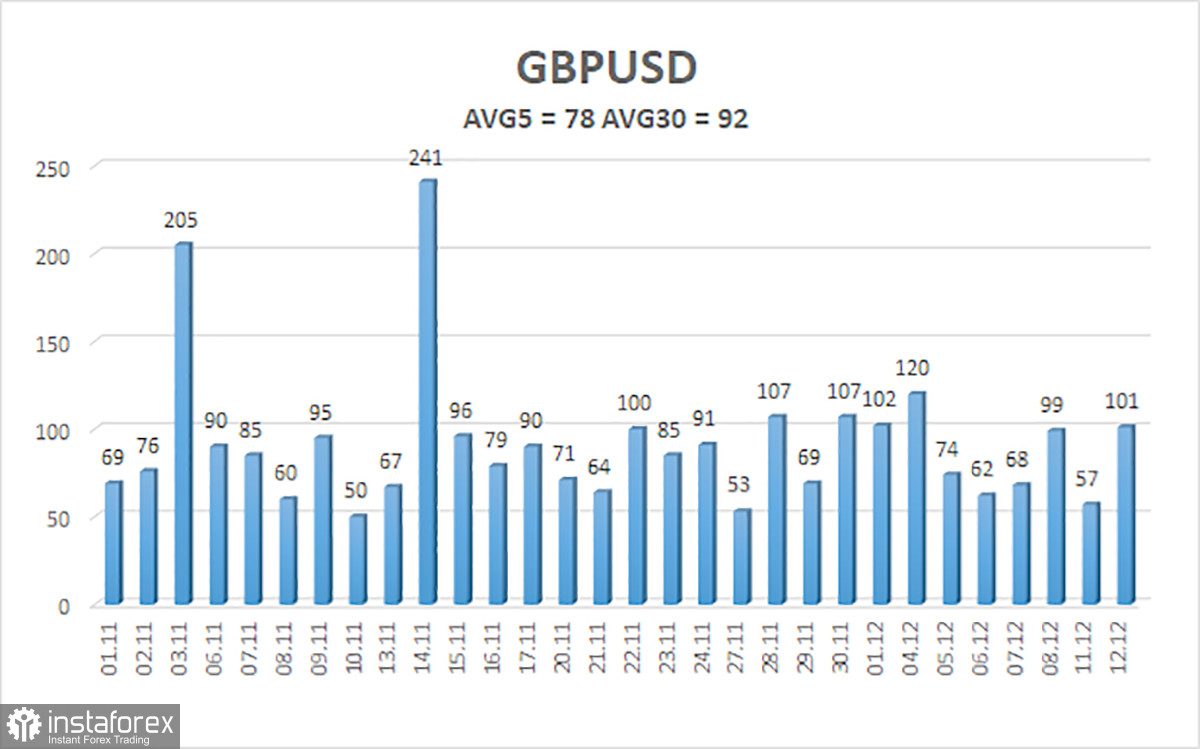

The average volatility of the GBP/USD pair over the last 5 trading days is 78 points. For the pound/dollar pair, this value is considered "average." Thus, on Wednesday, December 13, we expect movements within the range limited by the levels of 1.2478 and 1.2628. The reversal of the Heiken Ashi indicator back down will indicate the possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2543

S2 – 1.2512

S3 – 1.2482

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2604

R3 – 1.2634

Trading recommendations:

The GBP/USD pair remains below the moving average line. Thus, we can advise traders to stay in short positions with targets at 1.2482 and 1.2451 until they consolidate above the moving average. It will be reasonable to open purchases after consolidating above the moving average with targets at 1.2634 and 1.2665. We warn that a flat is highly likely now, which is very well seen on the hourly TF. Even the results of the Fed meeting and Powell's speech may leave the pair within a limited range.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) indicates that a trend reversal is approaching in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română