Analysis of GBP/USD 5M

GBP/USD also traded in a sideways channel on Tuesday. Take note that the pound's sideways channel is more convincing than that of the euro, with clear boundaries. Currently, the price is in the 1.2520-1.2605 range and has repeatedly bounced from the boundaries of this channel. Yesterday, traders were focused on the inflation data, which was supposed to set a new course for the pair, but in reality, we only saw a short-term surge of emotions in the currency market, and the price failed to break out of the sideways channel. But then again traders had little to react to. In the morning, the UK data turned out to be too bland, and the US inflation report matched expectations. Therefore, the market did not get an answer to the question of which way it should trade next.

Our opinion remains the same. Since the inflation data did not have much impact, we believe that the downtrend persists, and we expect the pound to fall further. It is quite possible that the general situation will not change today or tomorrow, as no one expects loud decisions and statements from the Federal Reserve and the Bank of England at the moment. Therefore, it is now necessary to trade within the sideways channel or wait for the pair to leave it.

There were many trading signals on Tuesday, but most of them were false signals. Since the pair is already in a sideways channel, the Kijun-sen line has lost its strength, and most signals were formed around it. Since the European session, we already had the impression that only false signals would be formed around the critical line. The first two signals turned out to be false, and all subsequent ones should not have been executed. However, at the beginning of the US session, the price rebounded precisely from the level of 1.2605, so traders had the opportunity to open a short position. Subsequently, the price dropped to the level of 1.2520, where profit should have been taken. The profit from this trade covered the loss from the first two. And even the rebound from the level of 1.2520 could be executed; this long position also brought several tens of pips of profit.

COT report:

COT reports on the British pound also align perfectly with what's happening in the market. According to the latest report on GBP/USD, the non-commercial group opened 5,000 long positions and closed 14,500 short ones. Thus, the net position of non-commercial traders increased by another 19,500 contracts in a week. The net position indicator has been steadily rising over the past 12 months, but it has been firmly decreasing since August. In recent weeks, the pound has traded higher, and large players are gradually increasing their long positions. However, we still believe that the pound will no longer rally.

The "non-commercial" group currently has a total of 66,300 long positions and 54,600 short ones. In general, the bulls and the bears have reached a balance. Since the COT reports cannot make an accurate forecast of the market's behavior at the moment, and the fundamentals are practically the same for both currencies, we can only consider the technical picture and economic reports. The technical analysis allows us to expect a strong downtrend, and the economic reports have been significantly stronger in the United States than in the United Kingdom. There are many factors influencing the pair's movement right now, and not all of them can answer the question of what to expect next.

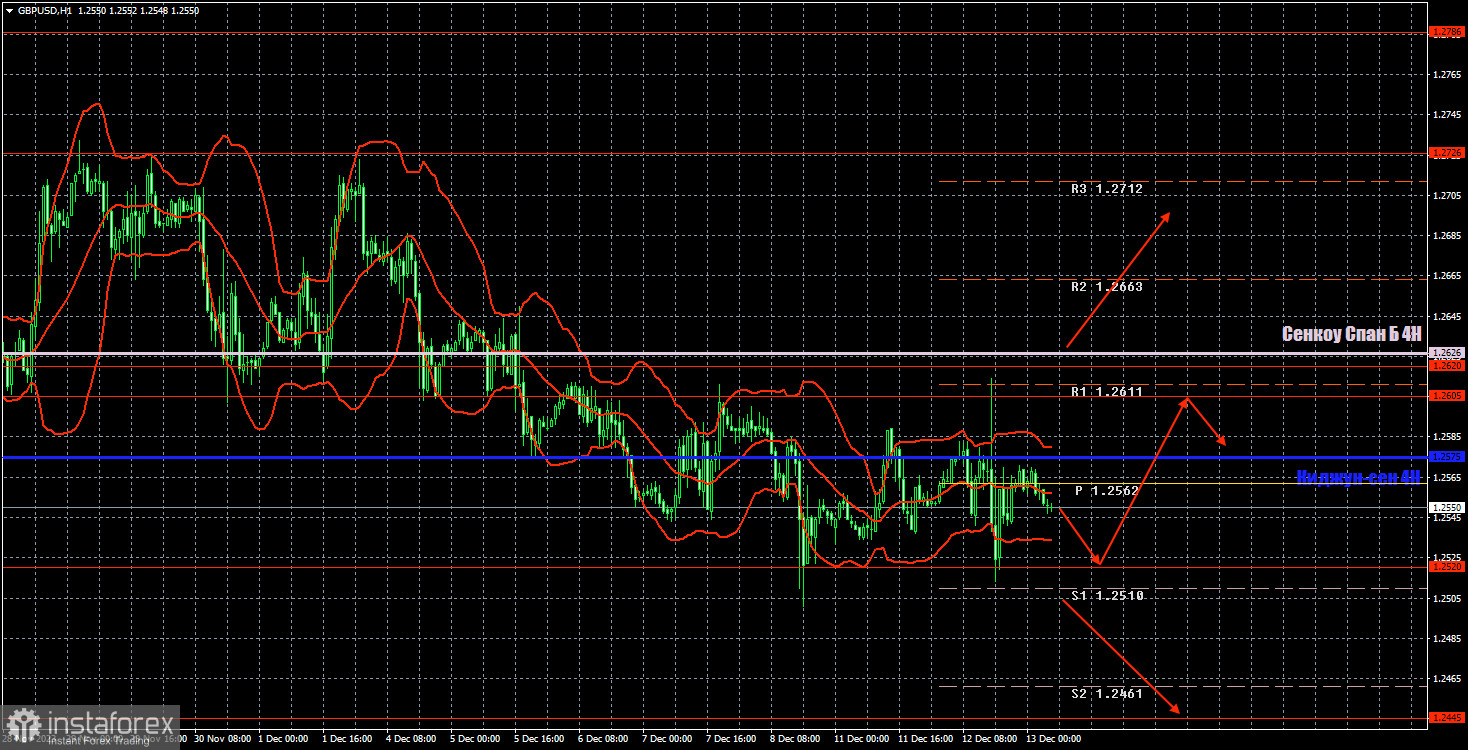

Analysis of GBP/USD 1H

On the 1H chart, a rather weak downtrend persists and the pair has simultaneously entered a sideways channel. We still expect the pound to fall and consider it excessive and illogical for the pair to continue its upward movement. The pound remains overbought, but the market is not in a rush to sell at the moment.

Today, we believe that the price will stay between the levels of 1.2520-1.2605 until the evening. Even the Federal Reserve's meeting may not be able to take the pair out of this range. Therefore, we recommend trading on rebounds from the boundaries of this channel, ignoring the Kijun-sen line. A breakout from the channel will make it possible for us to open corresponding positions.

As of December 13, we highlight the following important levels: 1.1927-1.1965, 1.2052, 1.2109, 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2726, 1.2786, 1.2863. The Senkou Span B (1.2626) and Kijun-sen (1.2575) lines can also be sources of signals. Signals can be "bounces" and "breakouts" of these levels and lines. It is recommended to set the Stop Loss level to break-even when the price moves in the right direction by 20 pips. The Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The illustration also includes support and resistance levels that can be used to lock in profits from trades.

On Wednesday, UK reports on industrial production and GDP may garner investor interest, but the reaction to them may be as weak as it was to yesterday's reports. In the US, the Producer Price Index and the FOMC meeting may offer fresh impetus. The FOMC meeting and its results will be in focus.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română