The slowdown in U.S. inflation from 3.2% to 3.1% did not leave a significant impression for several reasons. First of all, the data matched forecasts. Second, the pace of the slowdown is quite insignificant. Thirdly, and most importantly, investors are much more concerned about the outcome of today's Federal Open Market Committee (FOMC) meeting. Especially since the dynamics of inflation hint at the most likely outcome. However, no one can guarantee that the Federal Reserve will finally announce the start of a gradual easing of its monetary policy. Of course, this does not involve a direct interest rate cut right away. It is more likely to happen in the spring of 2024. However, the problem is that as early as June, inflation was already slowing down to 3.0%, after which it sharply rebounded. There is a risk of a similar scenario repeating, although it is highly unlikely. Nevertheless, the existence of such a risk could prompt Fed Chair Jerome Powell to be somewhat more restrained during the press conference. If he does not announce an imminent easing of monetary policy, the dollar will likely strengthen. However, the most probable scenario is the announcement of an upcoming interest rate cut, even without specifying specific timelines, which, in any case, will lead to the dollar's weakness. And, of course, interest rates will remain unchanged today.

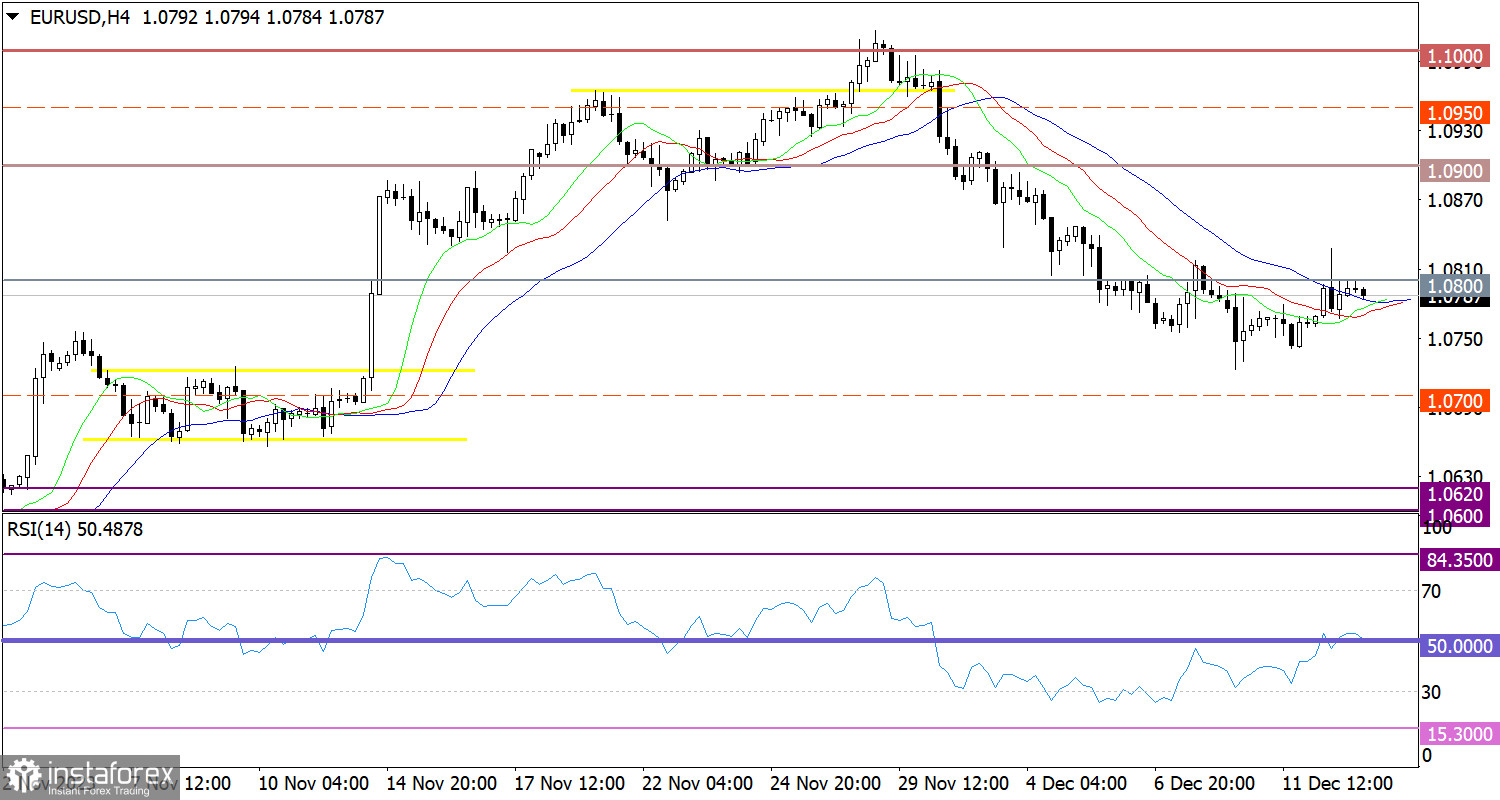

The decrease in the volume of short positions on the EUR/USD pair eventually pushed the pair to the 1.0800 level. There are no crucial changes at this time, and the movement fits within the structure of a corrective trend.

On the 4-hour chart, if we look at the RSI (Relative Strength Index), we can see initial signs of an increase in the volume of long positions on the euro, as the RSI upwardly crossed the 50 middle line.

Meanwhile, the Alligator's MAs are intertwined in the 4-hour chart, indicating a slowdown in the corrective trend.

Outlook

In this situation, traders consider the bullish scenario as part of a recovery phase in case the price settles above the 1.0800 level. The bearish scenario considers the possibility of extending the corrective phase if the price stays below the 1.0750 level.

The complex indicator analysis points to an upward signal in the short-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română